- United States

- /

- Biotech

- /

- NasdaqCM:SLNO

Is There Still Opportunity in Soleno Therapeutics After Its 13% Drop This Week?

Reviewed by Bailey Pemberton

If you are deciding what to do with Soleno Therapeutics stock, you are in some good company. With so much of Wall Street focused on biotech movers, it is easy to understand why Soleno has caught investors' attention. The share price tells a story filled with wild swings, growing optimism, and big questions about what comes next.

Just in the last week, Soleno’s stock dipped by 13.5%. That sharp move caught some traders by surprise, especially after a long run higher this year. Despite a tough week and a 16.2% slide over the past month, the stock is still up by a hefty 27.9% since the start of the year. Looking back even further adds more context. The stock is up more than 4100% over the last three years, and it is almost a different company now, at least in the market's eyes. Even over five years, gains have accumulated to nearly 98%.

Some of these moves trace back to growing hope around the company’s rare disease pipeline. While there have been a few general market jolts along the way, recent market trends in biotech and increased focus on innovation have played a role in shifting sentiment. The stock has moved up and occasionally down as investors gauge the risk and potential rewards.

So, is Soleno Therapeutics undervalued after all this action? By standard valuation checks, the company scores well on 3 out of 6 measures, giving it a valuation score of 3. Of course, numbers only tell part of the story. Next, I will break down each valuation approach in detail, and at the end, we will look for a smarter way to value Soleno that may provide more insight than a simple scorecard.

Approach 1: Soleno Therapeutics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model evaluates how much cash a company can generate in the future and then determines what those future dollars are worth in today's terms. For Soleno Therapeutics, the DCF approach involves projecting future Free Cash Flow (FCF) and discounting that stream back to the present to estimate the company's intrinsic value.

Soleno's current Free Cash Flow stands at -$84.52 Million, reflecting its ongoing investments in research and development. Analysts provide detailed cash flow estimates for the next five years and project a significant turnaround. For example, by 2029, Soleno is expected to generate $719.67 Million in annual Free Cash Flow, with further upward extrapolations for subsequent years. All projections are provided in dollars and remain well below $1 Billion, representing ambitious yet plausible growth expectations based on industry trends.

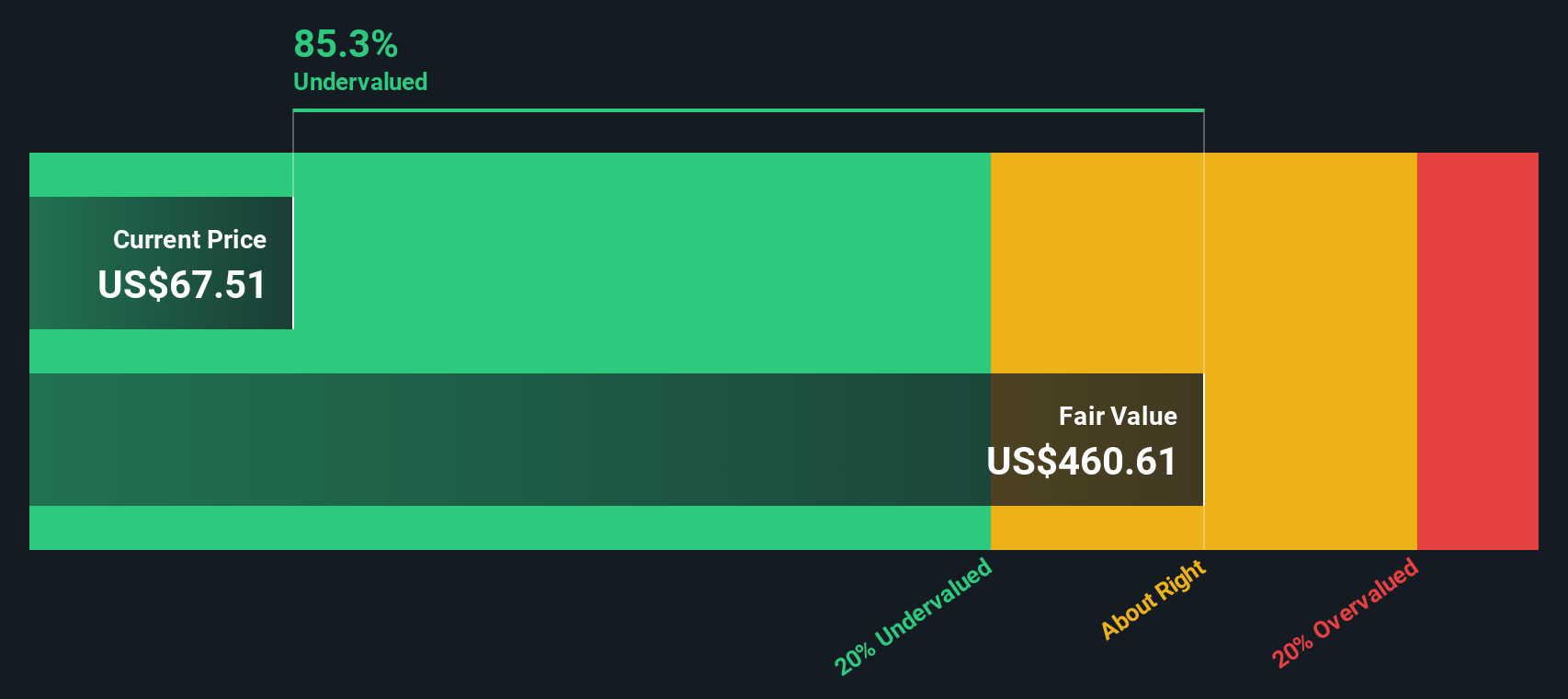

When these future figures are discounted back to the present, the DCF valuation for Soleno is $468.53 per share. Compared to the current market price, this implies the stock is trading at an 87.5% discount to its intrinsic value. In other words, the DCF model suggests Soleno Therapeutics may be undervalued at today's prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Soleno Therapeutics is undervalued by 87.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Soleno Therapeutics Price vs Book

The Price-to-Book (PB) ratio is often used to value biotech companies because many are still in early growth phases where profits are limited but their asset base, such as intellectual property and cash, can still be robust. For companies like Soleno Therapeutics, which are not yet profitable, the PB ratio can provide a more meaningful gauge of value than earnings-based metrics.

A company’s PB ratio is shaped by expectations for future growth and the perceived risks in its business model. Higher growth or lower risk typically justifies paying a higher PB ratio, while higher risks or stagnating assets suggest a lower valuation is appropriate. Investors use industry averages and peer multiples as crude benchmarks, but the specifics of each business are key.

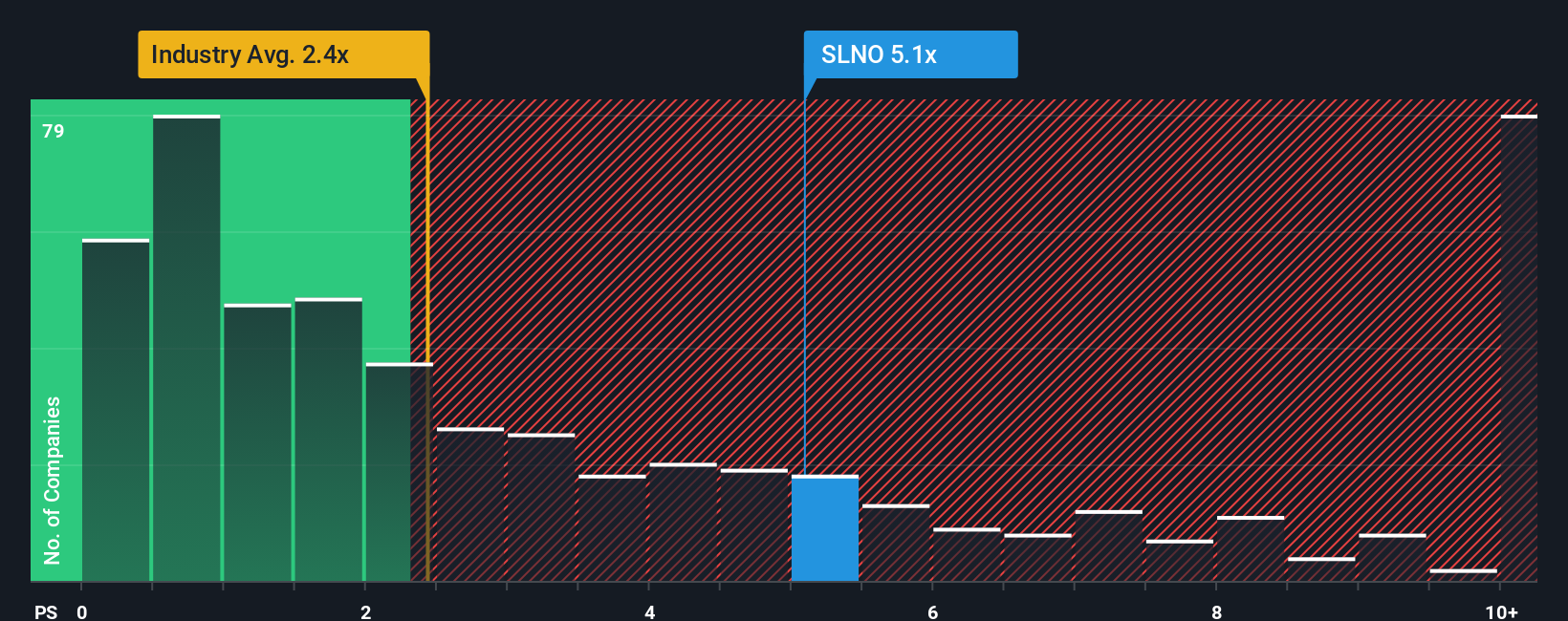

Soleno currently trades at a PB ratio of 12.94x. This is substantially higher than the biotech industry average of 2.50x, and it is also above the average of its peer group at 10.43x. At first glance, this steep premium might suggest overvaluation, but fair value often depends on more than just comparisons to averages.

Simply Wall St’s Fair Ratio metric refines this picture by factoring in Soleno’s projected growth, unique risks, profit margins, and its place in the market. Unlike simple industry and peer comparisons, the Fair Ratio provides a tailored benchmark that reflects the company’s fundamentals.

However, since the Fair Ratio for Soleno is not currently available, we can only rely on an evaluation of its current PB ratio compared to sector norms. The high PB multiple signals that the market is pricing in strong future execution, but it may also raise caution for valuation-driven investors.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Soleno Therapeutics Narrative

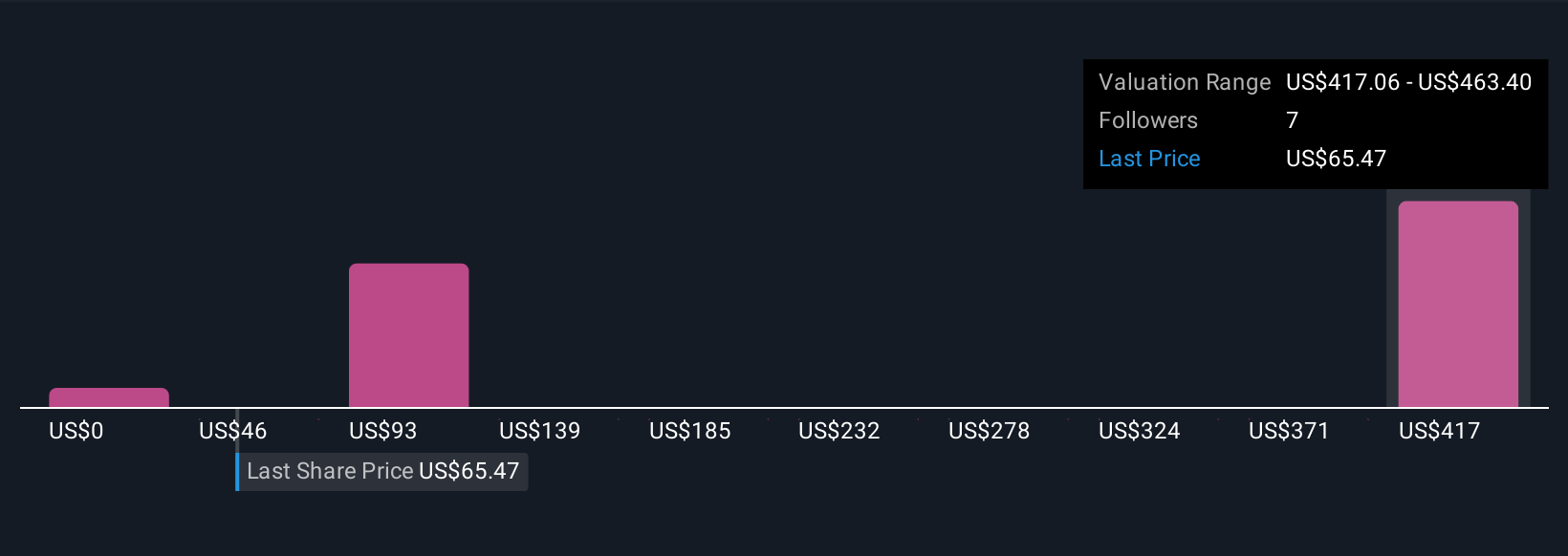

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple, intuitive tool that helps you tell the story behind Soleno Therapeutics by connecting your assumptions about its future, such as revenue growth and profit margins, to a projected fair value.

Instead of relying only on ratios or rigid models, Narratives let you map out your own perspective on the company's future and see what that means for its share price. This approach can make tricky investment decisions more accessible, and it is available right now in the Community section on Simply Wall St, used by millions of investors worldwide.

With Narratives, you can visually compare your calculated Fair Value to the current market price, making it easier to decide when to buy or sell. Plus, as new information emerges from news or earnings updates, your Narrative and its forecast refresh automatically, helping your outlook stay current and relevant.

For Soleno Therapeutics, you will find that some investors see massive future upside and assign a high fair value, while others, more cautious, estimate a much lower figure. This demonstrates just how much personal Narrative can influence your investment strategy.

Do you think there's more to the story for Soleno Therapeutics? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SLNO

Soleno Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development and commercialization of novel therapeutics for the treatment of rare diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives