- United States

- /

- Biotech

- /

- NasdaqGM:SLN

Some Shareholders Feeling Restless Over Silence Therapeutics plc's (NASDAQ:SLN) P/S Ratio

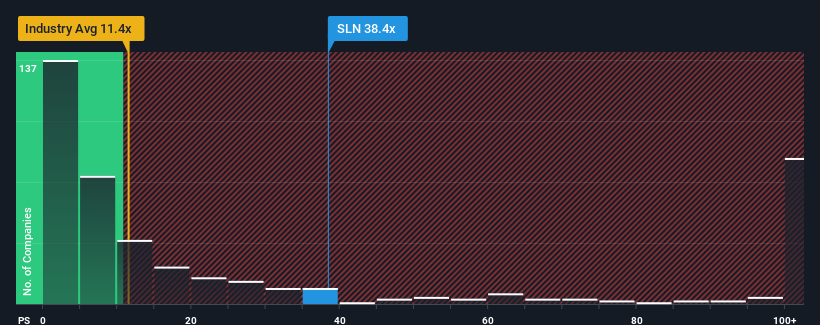

You may think that with a price-to-sales (or "P/S") ratio of 38.4x Silence Therapeutics plc (NASDAQ:SLN) is a stock to avoid completely, seeing as almost half of all the Biotechs companies in the United States have P/S ratios under 11.4x and even P/S lower than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Silence Therapeutics

What Does Silence Therapeutics' Recent Performance Look Like?

Silence Therapeutics hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Silence Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.How Is Silence Therapeutics' Revenue Growth Trending?

In order to justify its P/S ratio, Silence Therapeutics would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 37% decrease to the company's top line. Still, the latest three year period has seen an excellent 76% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 14% per year as estimated by the six analysts watching the company. That's shaping up to be materially lower than the 147% per annum growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Silence Therapeutics' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Silence Therapeutics' P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Silence Therapeutics, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Silence Therapeutics (1 makes us a bit uncomfortable!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Silence Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:SLN

Silence Therapeutics

A biotechnology company, engages in the discovery and development novel molecules incorporating short interfering ribonucleic acid (siRNA) to inhibit the expression of specific target genes in hematology, cardiovascular, and rare diseases.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives