- United States

- /

- Interactive Media and Services

- /

- NYSE:YALA

US Market's 3 Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq reach new all-time highs, driven by lower-than-expected PPI data and strong demand in sectors like artificial intelligence, investors are closely watching small-cap stocks for potential opportunities. In this dynamic market environment, identifying stocks with robust fundamentals and growth potential can be key to uncovering undiscovered gems that may thrive amid broader economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 75.89% | 1.93% | -1.42% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| FineMark Holdings | 115.14% | 2.22% | -28.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Pioneer Bancorp (PBFS)

Simply Wall St Value Rating: ★★★★★★

Overview: Pioneer Bancorp, Inc. is a holding company for Pioneer Bank, National Association, offering a range of banking products and services in New York with a market capitalization of $326.79 million.

Operations: Pioneer Bancorp generates revenue primarily from its banking segment, which amounts to $91.37 million. The company has a market capitalization of $326.79 million.

Pioneer Bancorp, with total assets of US$2.1 billion and equity of US$314.2 million, is navigating the financial landscape with a net interest margin of 3.8%. Its low-risk funding structure is underscored by 98% customer deposits, while its allowance for bad loans stands at a comfortable 0.7% of total loans. Earnings surged by 49%, outpacing the industry’s growth rate significantly. Recently, Pioneer expanded into HR consulting under Miriam Dushane's leadership to diversify its offerings beyond traditional banking services, showcasing adaptability in meeting market demands while continuing share repurchases worth US$9 million over the past year.

- Click here and access our complete health analysis report to understand the dynamics of Pioneer Bancorp.

Examine Pioneer Bancorp's past performance report to understand how it has performed in the past.

SIGA Technologies (SIGA)

Simply Wall St Value Rating: ★★★★★★

Overview: SIGA Technologies, Inc. is a commercial-stage pharmaceutical company that specializes in the health security market within the United States, with a market capitalization of $627.27 million.

Operations: The company generates revenue primarily from its pharmaceuticals segment, totaling $179.64 million.

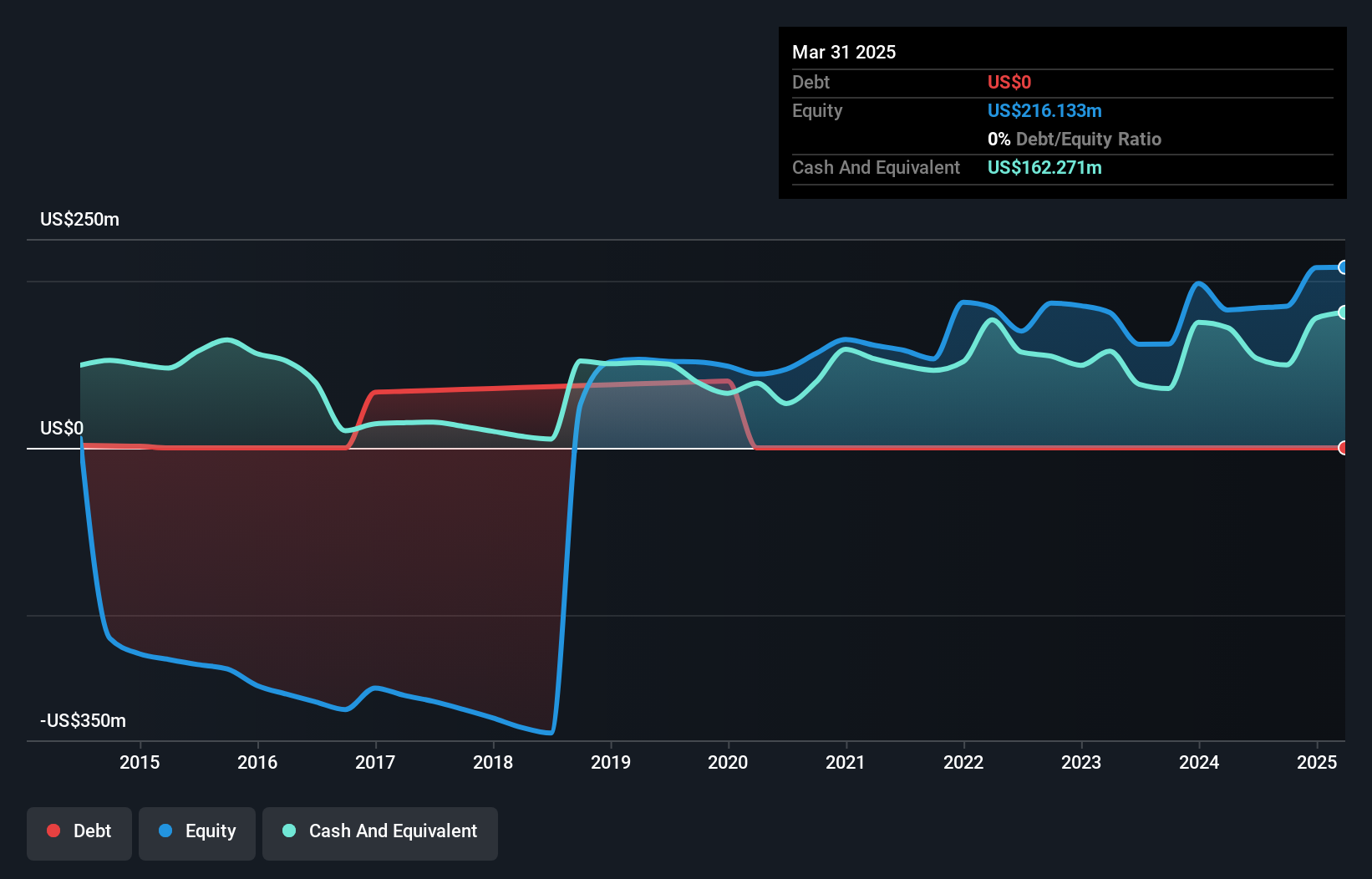

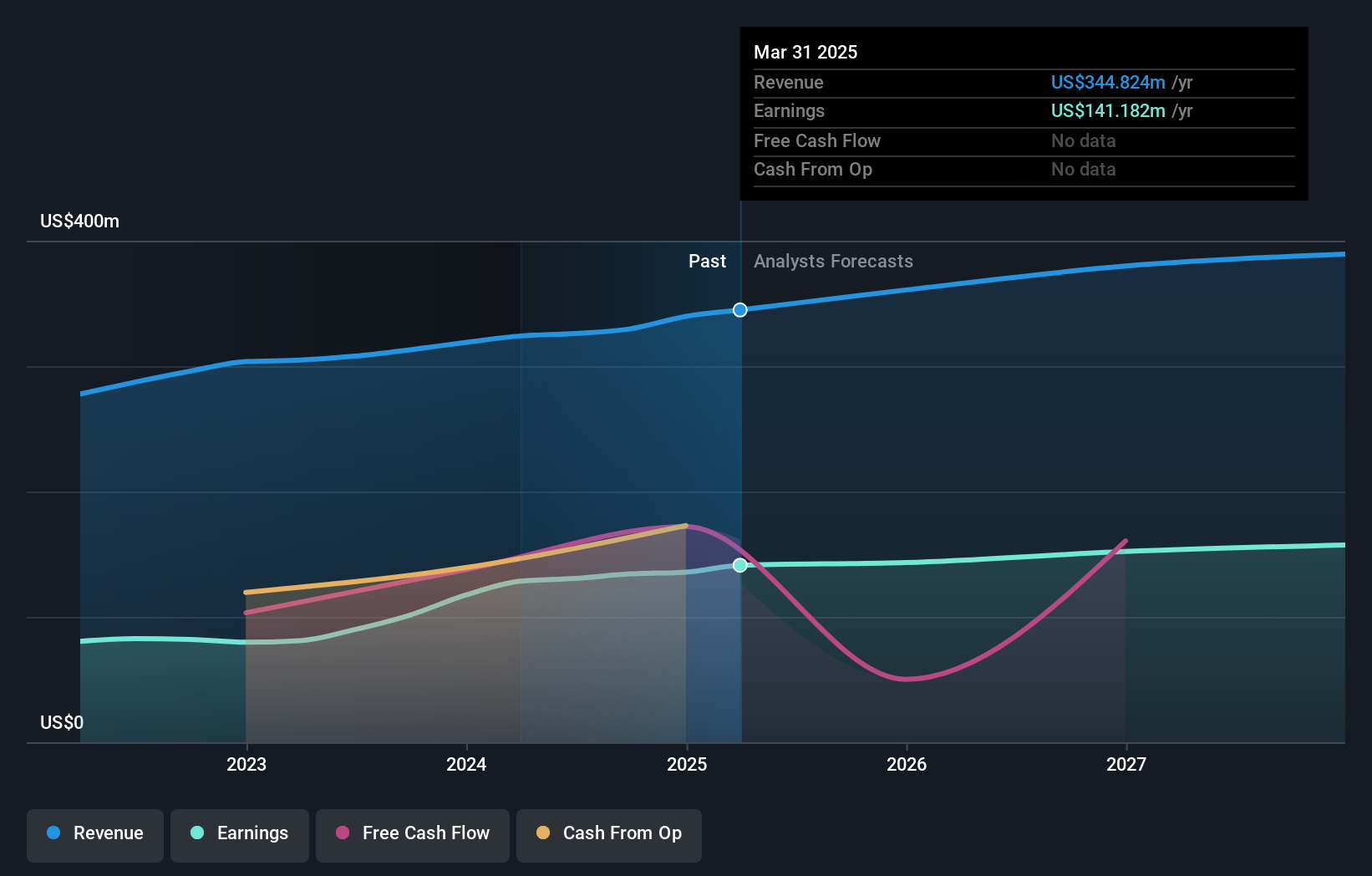

SIGA Technologies, with its recent earnings report, has shown significant growth in revenue, reaching US$81.12 million for Q2 2025 compared to US$21.81 million the previous year. Net income also surged to US$35.48 million from US$1.83 million a year ago, reflecting strong performance in its niche market. Despite negative earnings growth of -2.1% over the past year, SIGA is debt-free and trades at a compelling value—91% below estimated fair value—making it an intriguing option for investors seeking opportunities outside mainstream picks while maintaining high-quality earnings and positive free cash flow status.

- Delve into the full analysis health report here for a deeper understanding of SIGA Technologies.

Evaluate SIGA Technologies' historical performance by accessing our past performance report.

Yalla Group (YALA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yalla Group Limited, along with its subsidiaries, operates a social networking and gaming platform in the Middle East and North Africa region, with a market capitalization of approximately $1.21 billion.

Operations: Yalla Group generates revenue primarily from its social networking and entertainment platform, which contributed $348.19 million. The company's cost structure is not detailed in the provided information, but its focus on a digital platform suggests technology and development expenses could be significant.

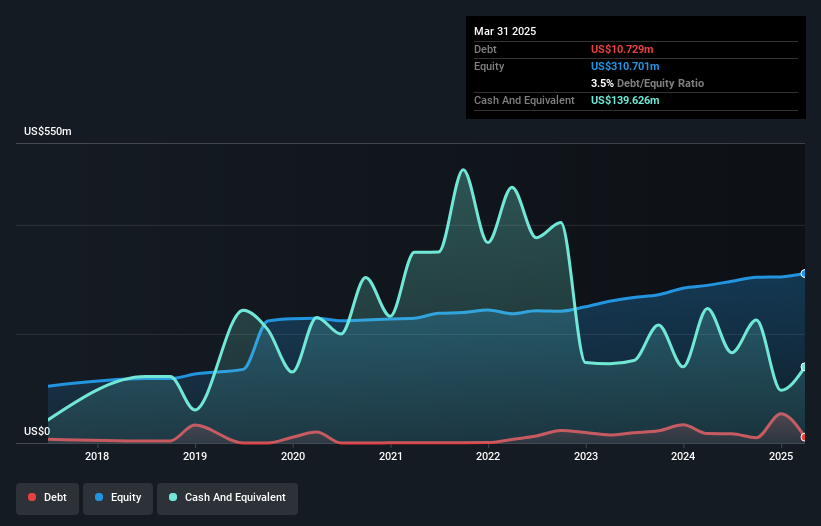

Operating in the MENA region, Yalla Group is making waves with its social networking and gaming platform. The company has shown a consistent earnings growth of 36% annually over the past five years, highlighting its strong performance. With no debt on its books for five years, Yalla's financial health appears robust. Recent buybacks saw 5.41 million shares repurchased for $35.6 million between April and June 2025, indicating confidence in future prospects. Despite facing competition and regional reliance risks, analysts have set a price target of $9.27 per share, suggesting potential upside from the current price of $7.60 as they anticipate modest revenue growth ahead.

Key Takeaways

- Get an in-depth perspective on all 280 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YALA

Yalla Group

Operates a social networking and gaming platform in the Middle East and North Africa region.

Very undervalued with flawless balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026