- United States

- /

- Pharma

- /

- NasdaqGM:SIGA

Introducing SIGA Technologies (NASDAQ:SIGA), The Stock That Soared 880% In The Last Five Years

It hasn't been the best quarter for SIGA Technologies, Inc. (NASDAQ:SIGA) shareholders, since the share price has fallen 12% in that time. But over five years returns have been remarkably great. In that time, the share price has soared some 880% higher! So it might be that some shareholders are taking profits after good performance. But the real question is whether the business fundamentals can improve over the long term.

Anyone who held for that rewarding ride would probably be keen to talk about it.

View our latest analysis for SIGA Technologies

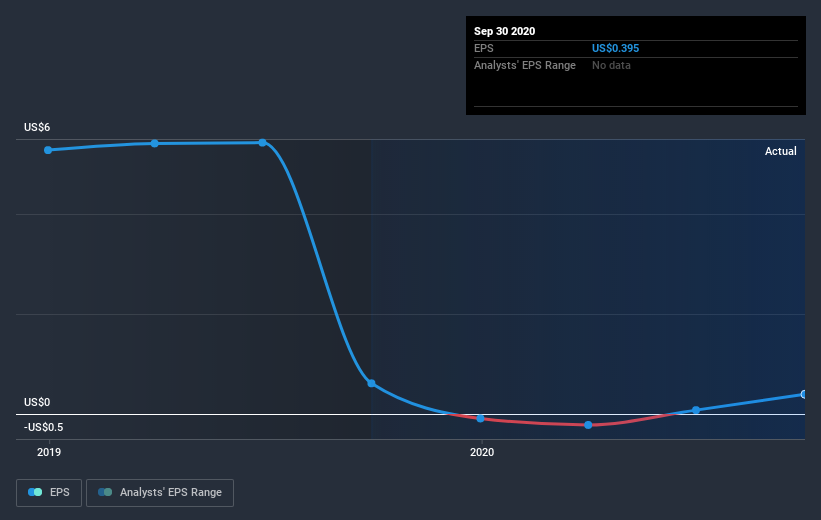

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years of share price growth, SIGA Technologies moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into SIGA Technologies' key metrics by checking this interactive graph of SIGA Technologies's earnings, revenue and cash flow.

A Different Perspective

SIGA Technologies' TSR for the year was broadly in line with the market average, at 35%. It has to be noted that the recent return falls short of the 58% shareholders have gained each year, over half a decade. Although the share price growth has slowed, the longer term story points to a business well worth watching. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for SIGA Technologies (of which 1 is concerning!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade SIGA Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:SIGA

SIGA Technologies

A commercial-stage pharmaceutical company, focuses on the health security market in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives