- United States

- /

- Life Sciences

- /

- NasdaqGS:SHC

Investors Still Aren't Entirely Convinced By Sotera Health Company's (NASDAQ:SHC) Revenues Despite 26% Price Jump

Sotera Health Company (NASDAQ:SHC) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The annual gain comes to 109% following the latest surge, making investors sit up and take notice.

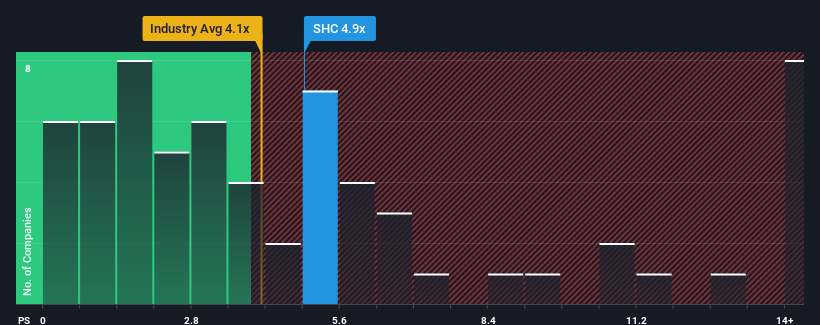

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Sotera Health's P/S ratio of 4.9x, since the median price-to-sales (or "P/S") ratio for the Life Sciences industry in the United States is also close to 4.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Sotera Health

How Has Sotera Health Performed Recently?

Sotera Health's negative revenue growth of late has neither been better nor worse than most other companies. The P/S ratio is probably moderate because investors think the company's revenue trend will continue to follow the rest of the industry. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues tracking the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sotera Health.How Is Sotera Health's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sotera Health's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Fortunately, a few good years before that means that it was still able to grow revenue by 25% in total over the last three years. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 9.3% during the coming year according to the five analysts following the company. That would be an excellent outcome when the industry is expected to decline by 2.1%.

With this in mind, we find it intriguing that Sotera Health's P/S trades in-line with its industry peers. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Key Takeaway

Sotera Health's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We note that even though Sotera Health trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. The market could be pricing in the event that tough industry conditions will impact future revenues. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Sotera Health with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SHC

Sotera Health

Provides sterilization, lab testing, and advisory services for the healthcare industry in the United States, Canada, Europe, and internationally.

Reasonable growth potential and fair value.