- United States

- /

- Pharma

- /

- NasdaqGS:SCPH

scPharmaceuticals Inc. (NASDAQ:SCPH) Stocks Shoot Up 26% But Its P/S Still Looks Reasonable

scPharmaceuticals Inc. (NASDAQ:SCPH) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 57% share price decline over the last year.

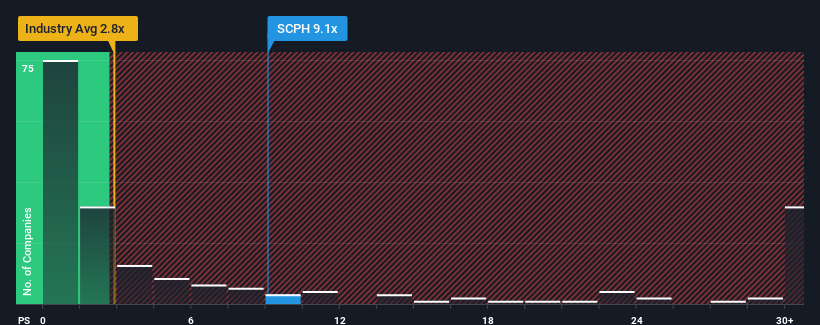

After such a large jump in price, scPharmaceuticals may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 9.1x, since almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios under 2.8x and even P/S lower than 0.8x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for scPharmaceuticals

How scPharmaceuticals Has Been Performing

scPharmaceuticals certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think scPharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.How Is scPharmaceuticals' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as scPharmaceuticals' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an explosive gain to the company's top line. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 128% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 17% per annum, which is noticeably less attractive.

With this in mind, it's not hard to understand why scPharmaceuticals' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does scPharmaceuticals' P/S Mean For Investors?

Shares in scPharmaceuticals have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that scPharmaceuticals maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Pharmaceuticals industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you settle on your opinion, we've discovered 2 warning signs for scPharmaceuticals that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SCPH

scPharmaceuticals

A pharmaceutical company, focuses on developing and commercializing products to optimize the delivery of infused therapies and patient care.

High growth potential and good value.

Market Insights

Community Narratives