- United States

- /

- Biotech

- /

- NasdaqGM:RYTM

Rhythm Pharmaceuticals (RYTM): Assessing Valuation Following Phase 3 Setmelanotide Results and Pipeline Advances

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 14.6% Undervalued

The prevailing narrative suggests that Rhythm Pharmaceuticals is currently undervalued by a notable margin, despite recent share price momentum and high growth expectations.

Extension of intellectual property protection to 2034 for the lead asset and to 2040 and beyond for next-generation compounds, along with orphan drug exclusivity incentives in the U.S. and EU, create a multi-year window of strong pricing power and high net margins. These protections shield earnings from generic and biosimilar erosion.

How does Rhythm’s growth story stack up against analyst models? The narrative imagines a future where surging revenues, a radically different profit outlook, and premium valuation multiples converge. Want to see what drives such a bullish fair value? Find out which quantitative leaps underpin these high expectations for earnings and margins.

Result: Fair Value of $112.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent operating losses and a heavy reliance on setmelanotide could create challenges for Rhythm’s path to profitability and dampen future optimism.

Find out about the key risks to this Rhythm Pharmaceuticals narrative.Another View: Looking Beyond Analyst Targets

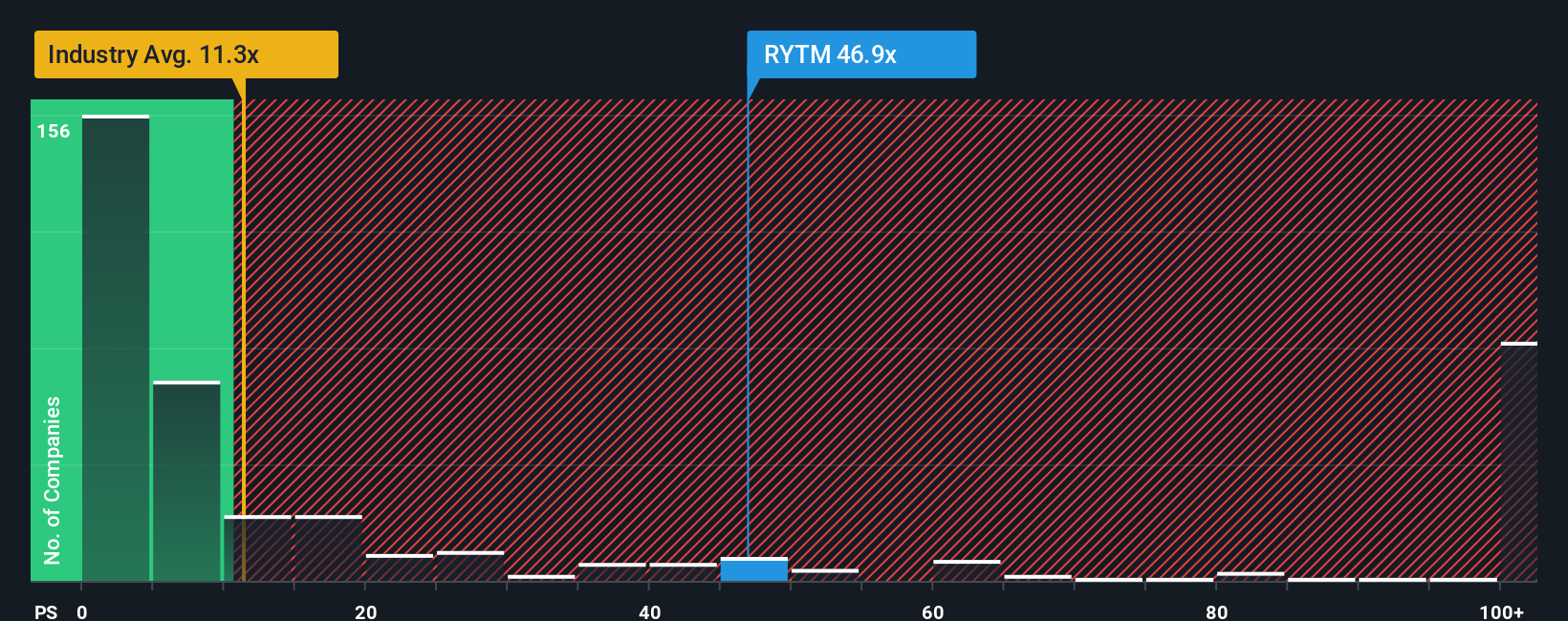

A different angle comes from comparing Rhythm’s price-to-sales ratio with the average for US biotechs. This suggests the stock trades at a rich premium versus its industry. Does this signal investors may be getting ahead of themselves?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Rhythm Pharmaceuticals to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Rhythm Pharmaceuticals Narrative

If you see the story playing out differently or want to dig deeper on your own, you can shape your own view in just a few minutes with Do it your way.

A great starting point for your Rhythm Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want to step up your portfolio strategy, jump into fresh opportunities that others may be overlooking. Simply Wall Street’s expert-curated screens make it easy to find tomorrow’s winners today. Start now and you’ll never wonder what you missed.

- Amplify your growth potential by targeting small-cap gems with strong financials using our penny stocks with strong financials screen.

- Unlock the future of tech by tapping into the next wave of innovation leaders through our handpicked quantum computing stocks.

- Accelerate your search for real value by pinpointing promising companies the market has overlooked with the help of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RYTM

Rhythm Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the rare neuroendocrine diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives