- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Revenues Not Telling The Story For Recursion Pharmaceuticals, Inc. (NASDAQ:RXRX) After Shares Rise 25%

Those holding Recursion Pharmaceuticals, Inc. (NASDAQ:RXRX) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, despite the strong performance over the last month, the full year gain of 6.2% isn't as attractive.

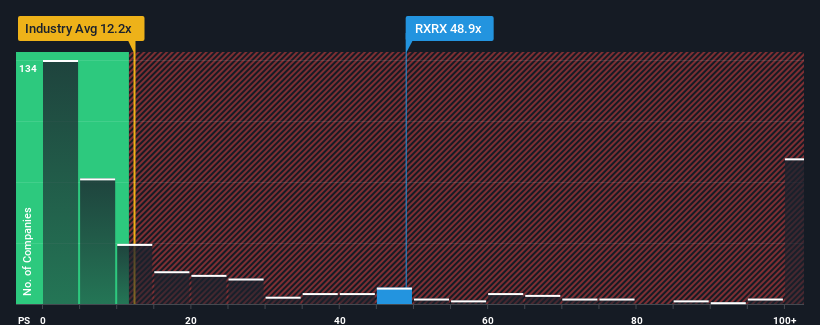

After such a large jump in price, Recursion Pharmaceuticals may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 48.9x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios under 12.2x and even P/S lower than 4x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Recursion Pharmaceuticals

What Does Recursion Pharmaceuticals' P/S Mean For Shareholders?

Recursion Pharmaceuticals could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Recursion Pharmaceuticals will help you uncover what's on the horizon.How Is Recursion Pharmaceuticals' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Recursion Pharmaceuticals' to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, even though the last 12 months were nothing to write home about. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Turning to the outlook, the next year should generate growth of 30% as estimated by the seven analysts watching the company. With the industry predicted to deliver 333% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Recursion Pharmaceuticals' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Recursion Pharmaceuticals' P/S?

The strong share price surge has lead to Recursion Pharmaceuticals' P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see Recursion Pharmaceuticals trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 5 warning signs for Recursion Pharmaceuticals (2 can't be ignored!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026