- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Recursion Pharmaceuticals (RXRX): Valuation Insights Following New Partnerships and Better-Than-Expected Quarterly Results

Reviewed by Simply Wall St

Recursion Pharmaceuticals (RXRX) drew attention after announcing the registration for resale of shares issued to Tempus AI and securing significant partnership funding from Roche and Genentech. The company also reported better-than-expected quarterly results. Investors are closely watching these developments for their impact on future growth.

See our latest analysis for Recursion Pharmaceuticals.

Recursion’s recent quarterly beat and its strategic funding wins have sparked some short-term optimism, reflected in a 4.99% 1-day share price return and a 6.93% gain over the past week. Still, momentum remains challenged in the bigger picture. A 1-year total shareholder return of -38.92% reminds investors that long-term performance has lagged, even as partnerships and a solid cash position point to potential upside.

If news of these biotech partnerships has you curious about what else is happening in innovative medicine, it’s a great time to check out See the full list for free.

With shares trading at a sizable discount to analyst price targets and new partnerships fueling potential future growth, investors may wonder whether RXRX is undervalued or if all this good news is already reflected in the current share price.

Most Popular Narrative: 26.9% Undervalued

The most followed narrative estimates Recursion Pharmaceuticals' fair value at $6.33, notably above its last close of $4.63. This signals that narrative followers see considerable upside driven by ambitious internal and industry shifts.

Rapid integration and iterative improvement of the Recursion OS 2.0 platform, incorporating advanced AI and ML tools (such as Boltz-2 and causal AI for clinical trial design), are expected to drive faster, more cost-effective drug discovery and development. This may improve R&D efficiency and support long-term margin expansion.

Want to know the bold projections that back this valuation jump? The secret sauce is a mix of massive innovation and expectations for margins biotech rarely sees. Behind this number? Surprising growth rates and a profit reversal you need to see to believe. Click to uncover what’s really driving the case for an even higher price.

Result: Fair Value of $6.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on pharma partners or delays in advancing internal drug candidates could undermine Recursion’s projected upside and challenge the optimistic valuation case.

Find out about the key risks to this Recursion Pharmaceuticals narrative.

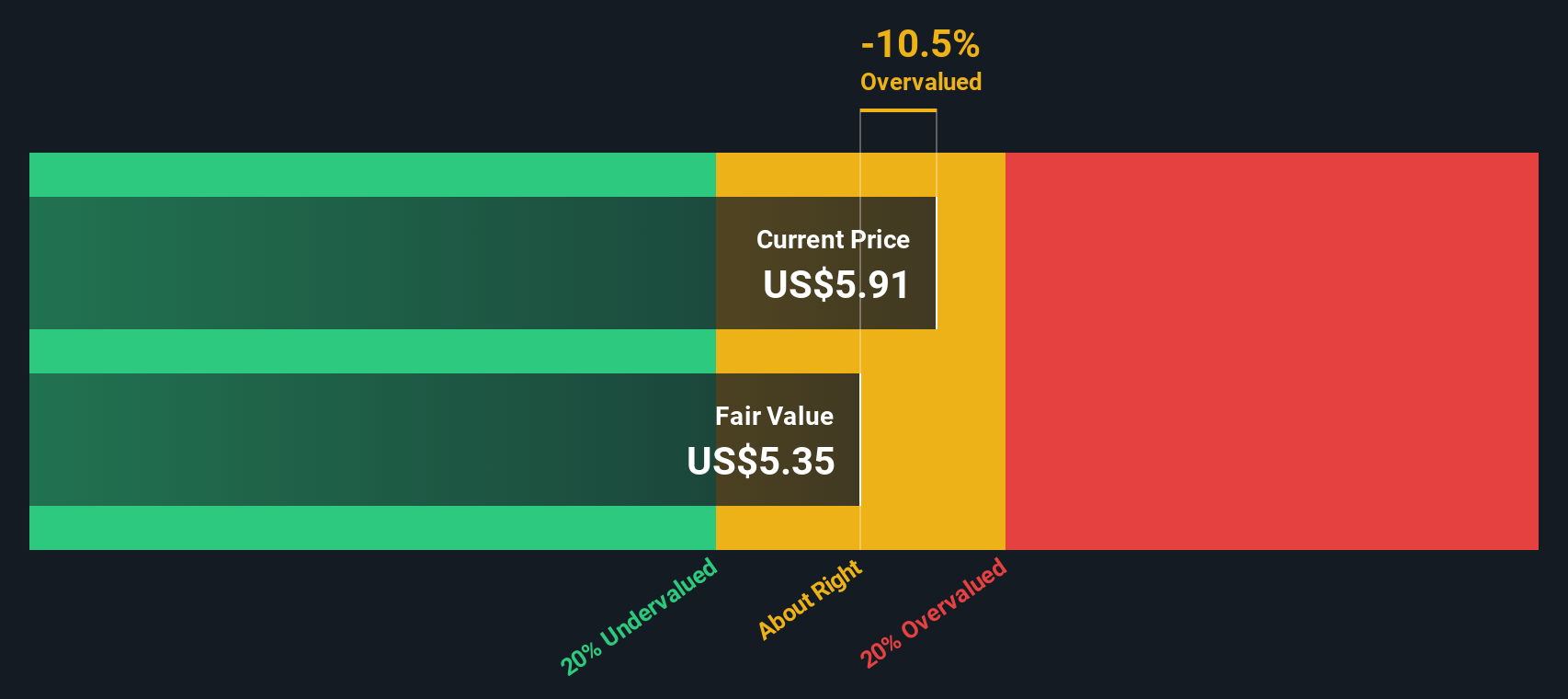

Another View: SWS DCF Model Tells a Different Story

While narrative-driven valuations see RXRX as undervalued, the SWS DCF model puts the fair value at $4.34, slightly below today’s share price of $4.63. This suggests the recent optimism may already be priced in. The DCF’s caution could signal a reality check ahead.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Recursion Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Recursion Pharmaceuticals Narrative

If you see the story differently or want to run the numbers yourself, you can shape your own view in just a few minutes. Do it your way

A great starting point for your Recursion Pharmaceuticals research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunities pass you by. Expand your investment search and spot the next winners before others do. Use the Simply Wall Street Screener to streamline your strategy and focus on what matters most.

- Capitalize on robust yields by reviewing these 15 dividend stocks with yields > 3% and see which companies offer consistently strong dividend income for your portfolio.

- Tap into cutting-edge breakthroughs by tracking these 25 AI penny stocks and get ahead with businesses at the forefront of artificial intelligence innovation.

- Strengthen your exposure to high growth and value by targeting these 916 undervalued stocks based on cash flows that are trading below their intrinsic worth this season.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026