- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Recursion Pharmaceuticals (RXRX): Evaluating Valuation After AI Collaborations, Exscientia Deal, and Industry Leadership Moves

Reviewed by Kshitija Bhandaru

Recursion Pharmaceuticals (RXRX) caught Wall Street’s attention again this week as a wave of new AI-driven partnerships and technology upgrades put its platform in the spotlight. The company’s leadership presence at high-profile conferences is also adding to the buzz.

See our latest analysis for Recursion Pharmaceuticals.

Following several AI-driven collaborations and high-profile conference appearances, Recursion’s 30-day share price return has surged by 19.35%, even as its year-to-date price return remains down nearly 19%. While momentum has picked up in the short term, the one-year total shareholder return sits at -13%. Recursion’s recent run suggests that investor sentiment is warming, but the market is still waiting to see sustained execution on its ambitious drug discovery platform.

If the latest biotech breakthroughs have you searching for more opportunities, check out our Healthcare Stocks Screener to discover other innovators making waves. See the full list for free.

But with the recent rally and growing optimism around AI in biotech, is Recursion Pharmaceuticals trading at a discount considering its long-term promise, or are investors already factoring in the next phase of growth?

Most Popular Narrative: 9.4% Undervalued

The most widely followed narrative sees Recursion Pharmaceuticals priced below its fair value, with the last close at $5.86 and a calculated fair value of $6.47. Investors are watching closely to see whether ambitious AI-driven growth can translate to sustainable financial results in a volatile biotech landscape.

Rapid integration and iterative improvement of the Recursion OS 2.0 platform, incorporating advanced AI and ML tools (such as Boltz-2 and causal AI for clinical trial design), are expected to drive faster, more cost-effective drug discovery and development. This could improve R&D efficiency and support long-term margin expansion.

Curious which financial forecasts and bold pipeline milestones give Recursion its edge in this valuation narrative? The story behind this fair value involves aggressive assumptions around revenue jumps, margin turnaround, and industry-beating growth rates. Ready to see the numbers the market is missing?

Result: Fair Value of $6.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on pharma partners and the early-stage status of Recursion’s pipeline remain risks that could shift this optimistic valuation narrative quickly.

Find out about the key risks to this Recursion Pharmaceuticals narrative.

Another View: Caution from Sales-Based Valuation

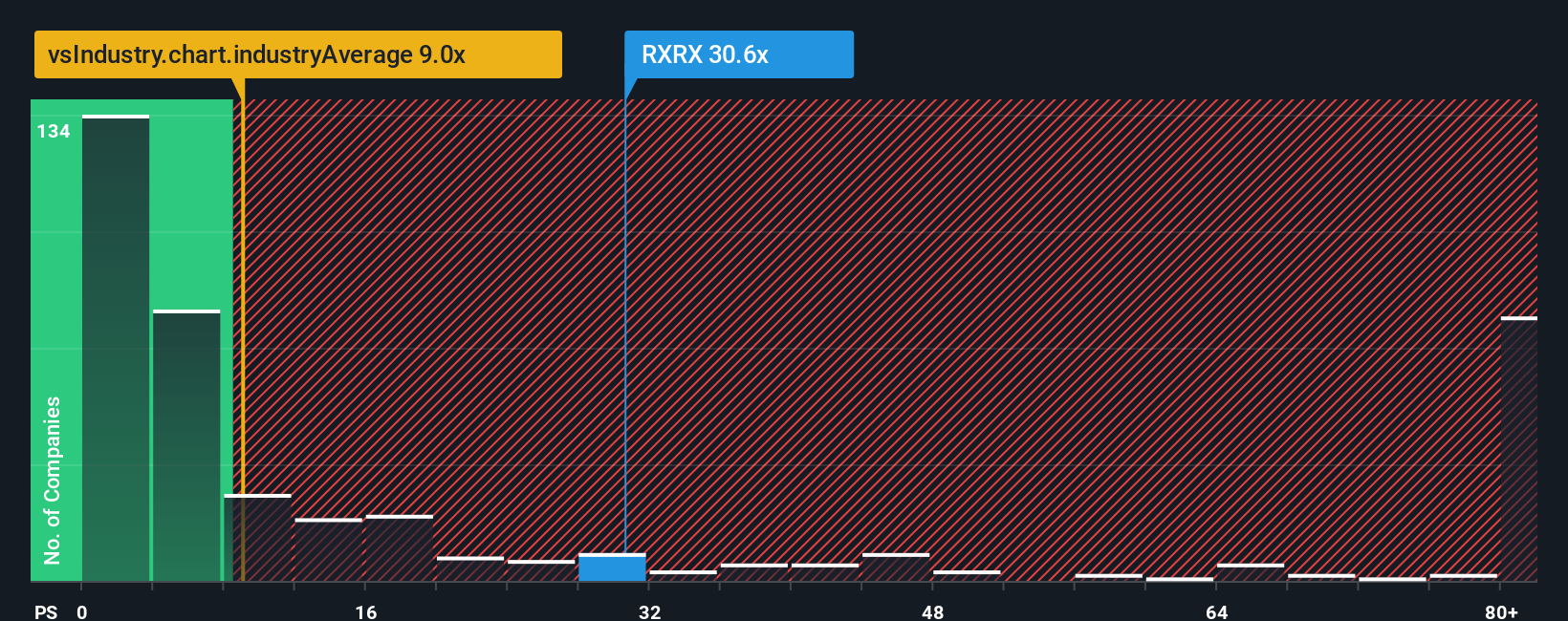

Looking beyond fair value estimates, Recursion’s price-to-sales ratio stands out. At 39.6x, it is priced much higher than the US Biotech industry’s average of 11.3x and its peer average of 15x. Compared to the fair ratio, the current figure signals meaningful valuation risk unless future growth exceeds expectations.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Recursion Pharmaceuticals Narrative

If you’d rather draw your own conclusions than follow the crowd, you can dive into the numbers yourself and shape a fresh perspective in under three minutes. Do it your way

A great starting point for your Recursion Pharmaceuticals research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your portfolio with actionable investment themes tailored to today’s market. Don’t let tomorrow’s top opportunities pass you by. Make your move now!

- Capture long-term income potential by checking out these 18 dividend stocks with yields > 3% with attractive yields and stable dividend histories.

- Get ahead of the tech curve and seize growth in emerging automation when you review these 24 AI penny stocks shaping tomorrow’s industries.

- Secure an edge on value by browsing these 868 undervalued stocks based on cash flows that the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success