- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Recursion Pharmaceuticals, Inc. (NASDAQ:RXRX) Just Reported Third-Quarter Earnings And Analysts Are Lifting Their Estimates

It's been a mediocre week for Recursion Pharmaceuticals, Inc. (NASDAQ:RXRX) shareholders, with the stock dropping 18% to US$4.62 in the week since its latest quarterly results. Statutory results overall were mixed, with revenues coming in 73% lower than the analysts predicted. What's really surprising is that losses of US$0.36 per share were pretty much in line with forecasts, despite the revenue miss. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

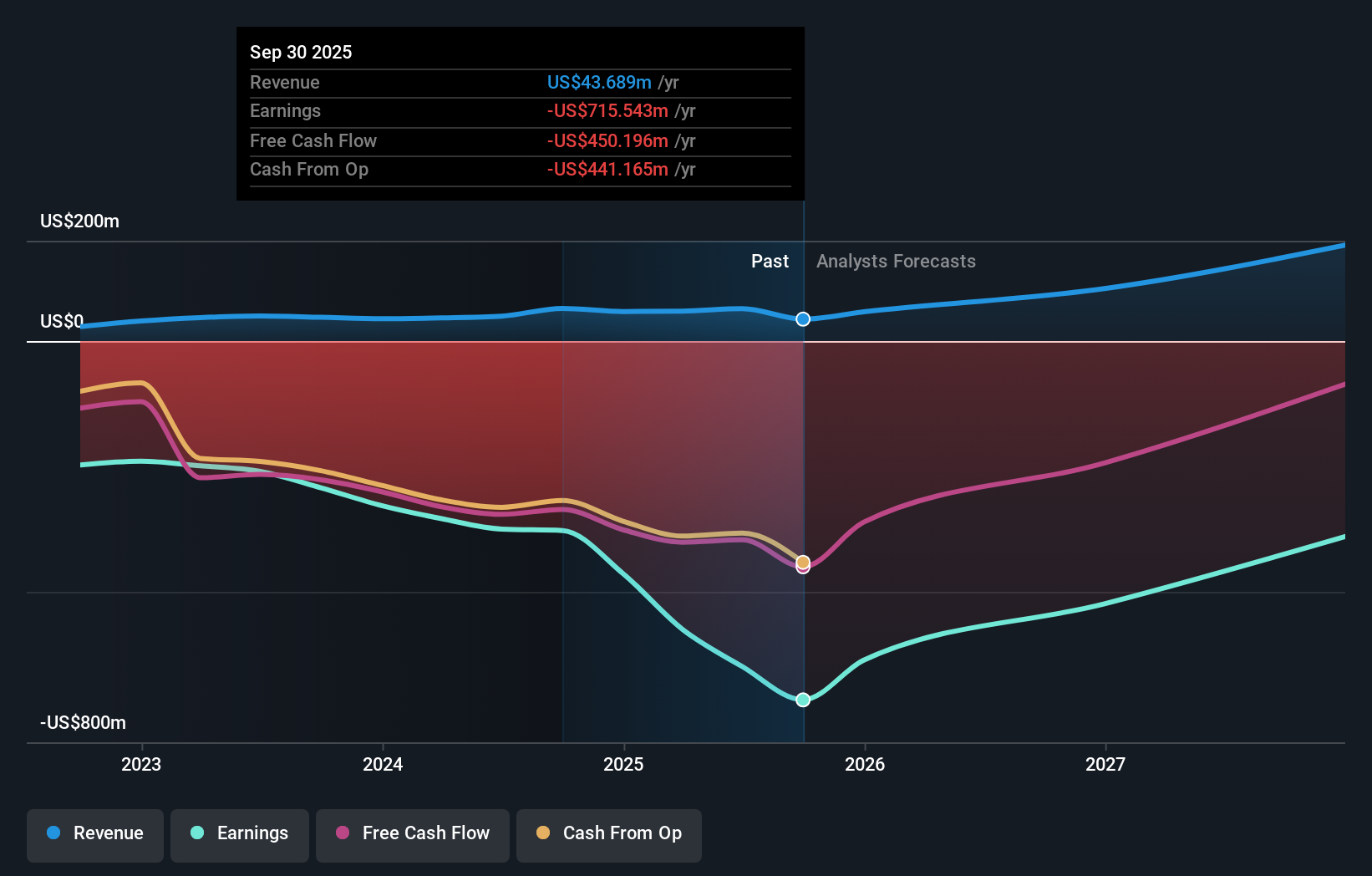

Taking into account the latest results, the most recent consensus for Recursion Pharmaceuticals from eight analysts is for revenues of US$104.6m in 2026. If met, it would imply a huge 139% increase on its revenue over the past 12 months. Losses are predicted to fall substantially, shrinking 23% to US$1.26. Before this latest report, the consensus had been expecting revenues of US$97.3m and US$1.22 per share in losses. Overall it looks as though the analysts were a bit mixed on the latest consensus updates. Although there was a nice uplift to revenue, the consensus also made a pronounced increase to its losses per share forecasts.

See our latest analysis for Recursion Pharmaceuticals

There was no major change to the consensus price target of US$6.30, with growing revenues seemingly enough to offset the concern of growing losses. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Recursion Pharmaceuticals analyst has a price target of US$10.00 per share, while the most pessimistic values it at US$3.00. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how analysts think this business will perform. With this in mind, we wouldn't rely too heavily the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's clear from the latest estimates that Recursion Pharmaceuticals' rate of growth is expected to accelerate meaningfully, with the forecast 101% annualised revenue growth to the end of 2026 noticeably faster than its historical growth of 37% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 21% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Recursion Pharmaceuticals is expected to grow much faster than its industry.

The Bottom Line

The most important thing to note is the forecast of increased losses next year, suggesting all may not be well at Recursion Pharmaceuticals. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. The consensus price target held steady at US$6.30, with the latest estimates not enough to have an impact on their price targets.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple Recursion Pharmaceuticals analysts - going out to 2027, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Recursion Pharmaceuticals (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Goldman Sachs Group (GS) The Titan Reclaims Its Crown: Return to Core Excellence

Parker-Hannifin (PH) The Industrial Alchemist: Transforming Motion into Margin

Monolithic Power Systems (MPWR) Powering the Hyperscale Era: The Efficiency Moat

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion