- United States

- /

- Pharma

- /

- NasdaqGM:RVNC

The Revance Therapeutics (NASDAQ:RVNC) Share Price Has Gained 64% And Shareholders Are Hoping For More

Revance Therapeutics, Inc. (NASDAQ:RVNC) shareholders might be concerned after seeing the share price drop 22% in the last quarter. But that doesn't change the reality that over twelve months the stock has done really well. To wit, it had solidly beat the market, up 64%.

View our latest analysis for Revance Therapeutics

Given that Revance Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last twelve months, Revance Therapeutics' revenue grew by 431%. That's well above most other pre-profit companies. The solid 64% share price gain goes down pretty well, but it's not necessarily as good as you might expect given the top notch revenue growth. If that's the case, now might be the time to take a close look at Revance Therapeutics. Since we evolved from monkeys, we think in linear terms by nature. So if growth goes exponential, opportunity may exist for the enlightened.

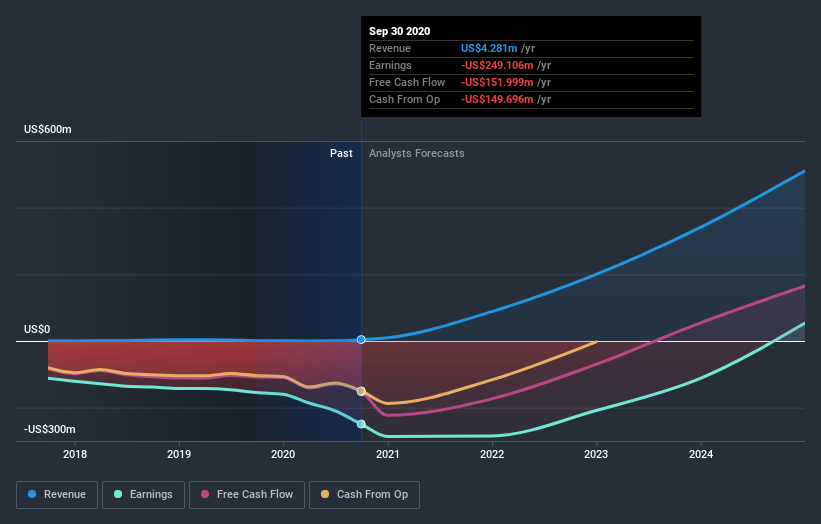

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Revance Therapeutics is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

We're pleased to report that Revance Therapeutics shareholders have received a total shareholder return of 64% over one year. That certainly beats the loss of about 5% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 4 warning signs for Revance Therapeutics that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Revance Therapeutics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGM:RVNC

Revance Therapeutics

A biotechnology company, engages in the development, manufacture, and commercialization of neuromodulators for various aesthetic and therapeutic indications in the United States and internationally.

Undervalued moderate.

Similar Companies

Market Insights

Community Narratives