Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Revance Therapeutics, Inc. (NASDAQ:RVNC) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Revance Therapeutics

What Is Revance Therapeutics's Debt?

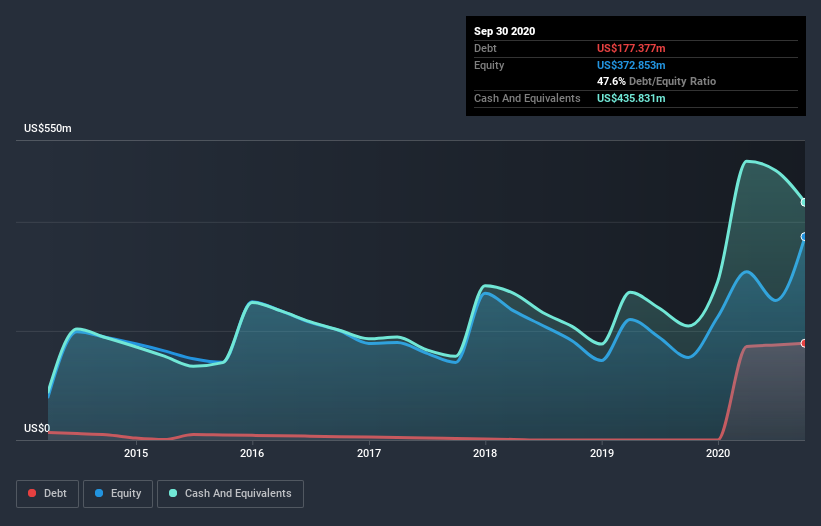

The image below, which you can click on for greater detail, shows that at September 2020 Revance Therapeutics had debt of US$177.4m, up from none in one year. But it also has US$435.8m in cash to offset that, meaning it has US$258.5m net cash.

How Healthy Is Revance Therapeutics' Balance Sheet?

The latest balance sheet data shows that Revance Therapeutics had liabilities of US$63.7m due within a year, and liabilities of US$275.6m falling due after that. Offsetting these obligations, it had cash of US$435.8m as well as receivables valued at US$2.59m due within 12 months. So it actually has US$99.1m more liquid assets than total liabilities.

This surplus suggests that Revance Therapeutics has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Revance Therapeutics boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Revance Therapeutics can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Revance Therapeutics reported revenue of US$4.3m, which is a gain of 431%, although it did not report any earnings before interest and tax. When it comes to revenue growth, that's like nailing the game winning 3-pointer!

So How Risky Is Revance Therapeutics?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year Revance Therapeutics had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of US$152m and booked a US$249m accounting loss. But the saving grace is the US$258.5m on the balance sheet. That means it could keep spending at its current rate for more than two years. Importantly, Revance Therapeutics's revenue growth is hot to trot. While unprofitable companies can be risky, they can also grow hard and fast in those pre-profit years. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Revance Therapeutics , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Revance Therapeutics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:RVNC

Revance Therapeutics

A biotechnology company, engages in the development, manufacture, and commercialization of neuromodulators for various aesthetic and therapeutic indications in the United States and internationally.

Undervalued moderate.

Similar Companies

Market Insights

Community Narratives