- United States

- /

- Biotech

- /

- NasdaqGS:RVMD

Is Revolution Medicines’ Recent 17.5% Surge Justified After Pipeline Progress Update?

Reviewed by Bailey Pemberton

Deciding whether to buy, hold, or sell Revolution Medicines right now means you are definitely not alone. The stock’s recent journey has sparked growing curiosity from investors who see both risk and reward reflected in this chart. In the last week alone, Revolution Medicines gained 6.4%, and its 30-day return is a strong 17.5%. That is a noticeable turnaround for a company that, despite being down 1.3% over the last year, has increased by 153.9% over the past three years. What is behind those sharp moves? Many analysts point to optimism in the biotech sector and increased attention on the company’s drug development pipeline, which have changed investors’ appetite for risk. Even taking a five-year view, Revolution Medicines is up 17.2%, underlining an underlying resilience in its business story.

As interest rises, so does debate over whether the current stock price offers a genuine opportunity. Looking at basic valuation checks, Revolution Medicines scores 4 out of 6 on our scale for being undervalued, a strong mark that places it ahead of many sector peers. But that number alone does not tell the whole story, and you are probably wondering how those valuation checks actually work. Next, let’s break down what goes into assessing a company’s valuation using different approaches, and stay tuned, because at the end, we will explore an even more insightful way to judge whether Revolution Medicines really is a buy at today’s price.

Why Revolution Medicines is lagging behind its peers

Approach 1: Revolution Medicines Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach aims to estimate a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollar value. This method gives investors a forward-looking perspective, drawing on assumptions about how Revolution Medicines might perform over the next decade.

Currently, Revolution Medicines reports a Free Cash Flow (FCF) of approximately negative $700 million, meaning it is still burning cash as it funds research and development. Analysts project a major turnaround, with FCF expected to reach positive territory in several years. By 2029, estimates suggest FCF will total $1.06 billion, and projections for the following years show continued strong growth, hitting over $6 billion by 2035 (though it is important to note those long-term numbers are extrapolated and not based on direct analyst forecasts).

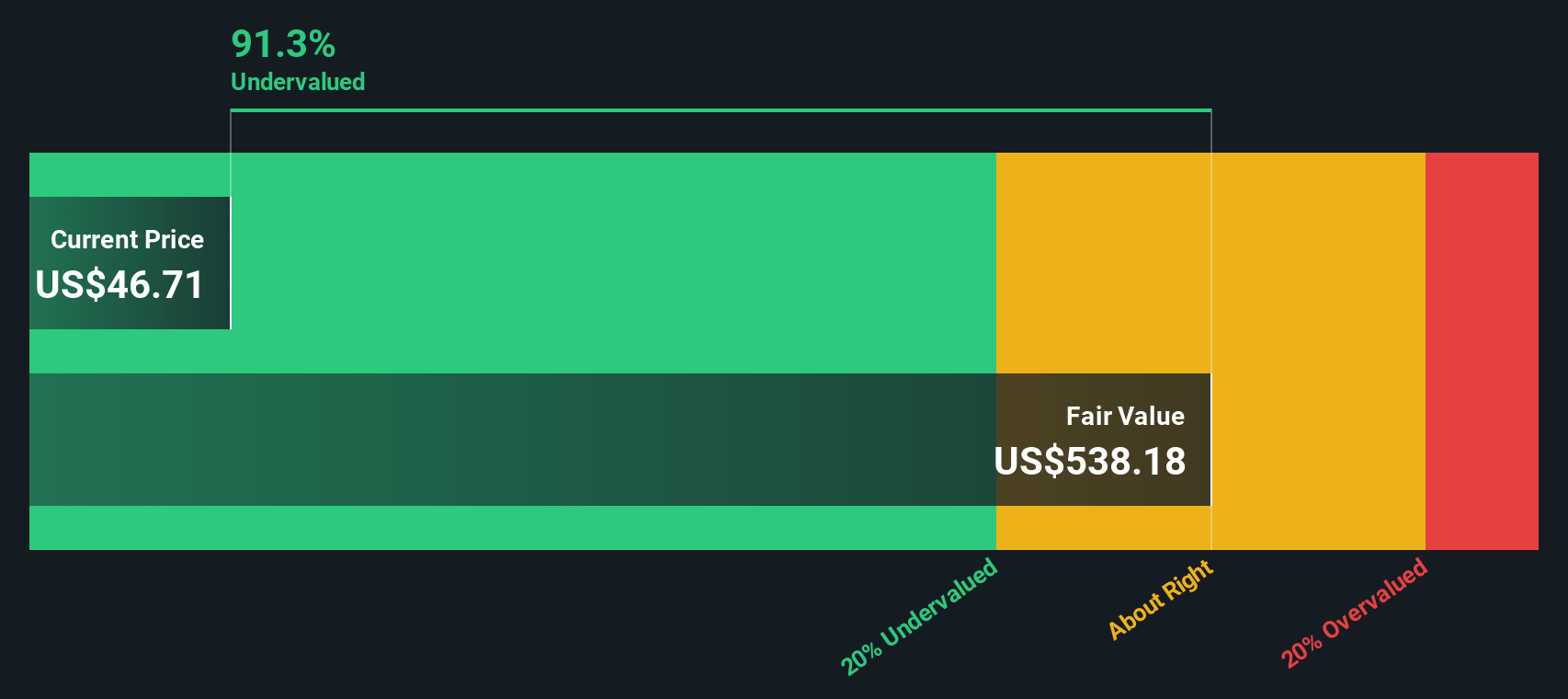

When all these cash flows are factored into the DCF model and discounted at an appropriate rate, the resulting intrinsic value for Revolution Medicines is about $539.58 per share. This valuation implies the stock is trading at a 91.3% discount to its fair value, meaning it could be significantly undervalued right now based on these long-term cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Revolution Medicines is undervalued by 91.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Revolution Medicines Price vs Book

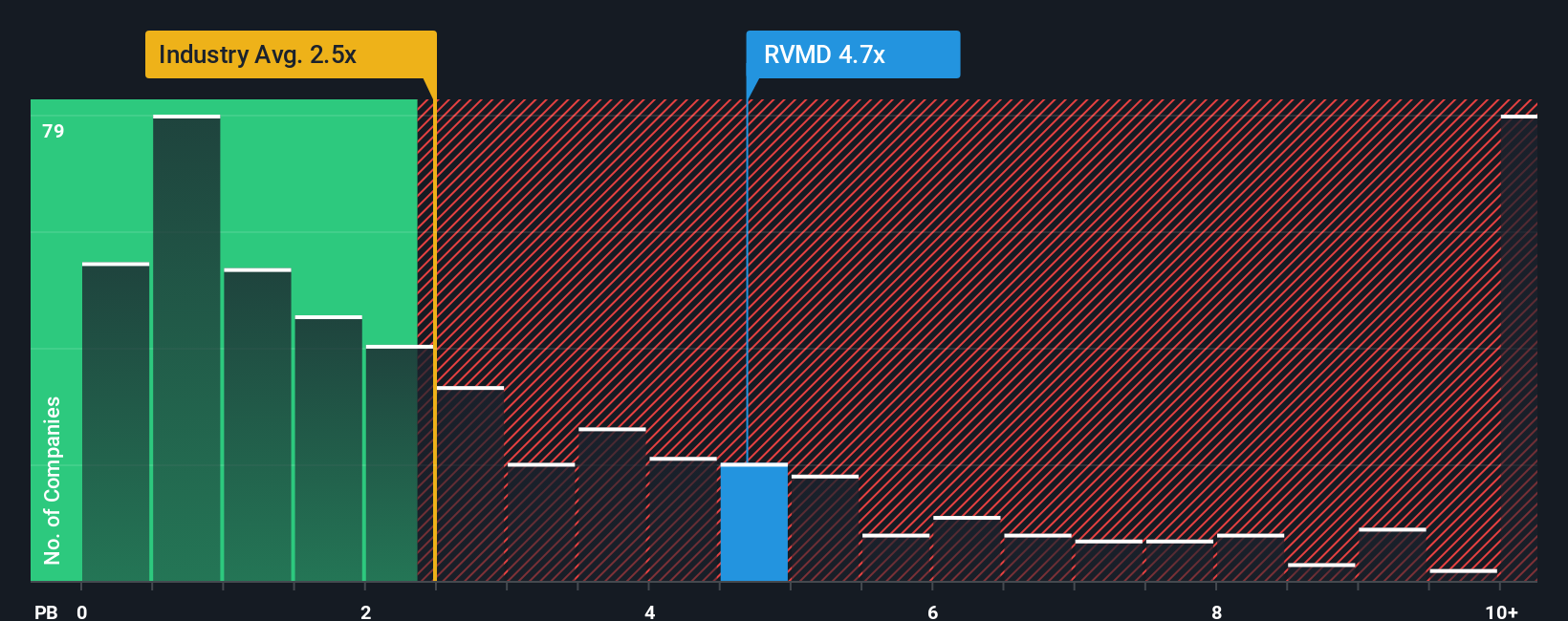

The Price-to-Book (P/B) ratio is often used as a valuation metric for companies that are not yet profitable, like Revolution Medicines, because it provides insight into how the market values the business relative to its net assets. In the biotech sector, where many companies are still developing their product portfolios and may not have positive earnings, the P/B ratio helps investors assess whether they are paying a reasonable price for the underlying assets and future potential.

Growth prospects and risk levels play a significant role in shaping what is considered a "normal" or "fair" P/B ratio. Companies expected to grow rapidly or that have lower risk profiles often command higher P/B multiples. Slower-growing or riskier firms tend to trade at a discount.

Currently, Revolution Medicines trades at a P/B ratio of 4.68x. This is well above the Biotechs industry average of 2.47x and lower than the peer average of 17.13x, suggesting the stock is priced at a premium to the industry but appears more reasonable relative to direct peers. However, Simply Wall St’s proprietary "Fair Ratio" provides a more tailored benchmark. It takes into account Revolution Medicines' unique growth trajectory, risk profile, profit margins, and its position within the market, rather than just relying on broad averages. This makes the Fair Ratio a more holistic tool for valuation analysis.

Comparing the Fair Ratio to the actual P/B, the difference is less than 0.10x, indicating that Revolution Medicines’ current valuation is closely aligned with what would be expected given its specific fundamentals.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Revolution Medicines Narrative

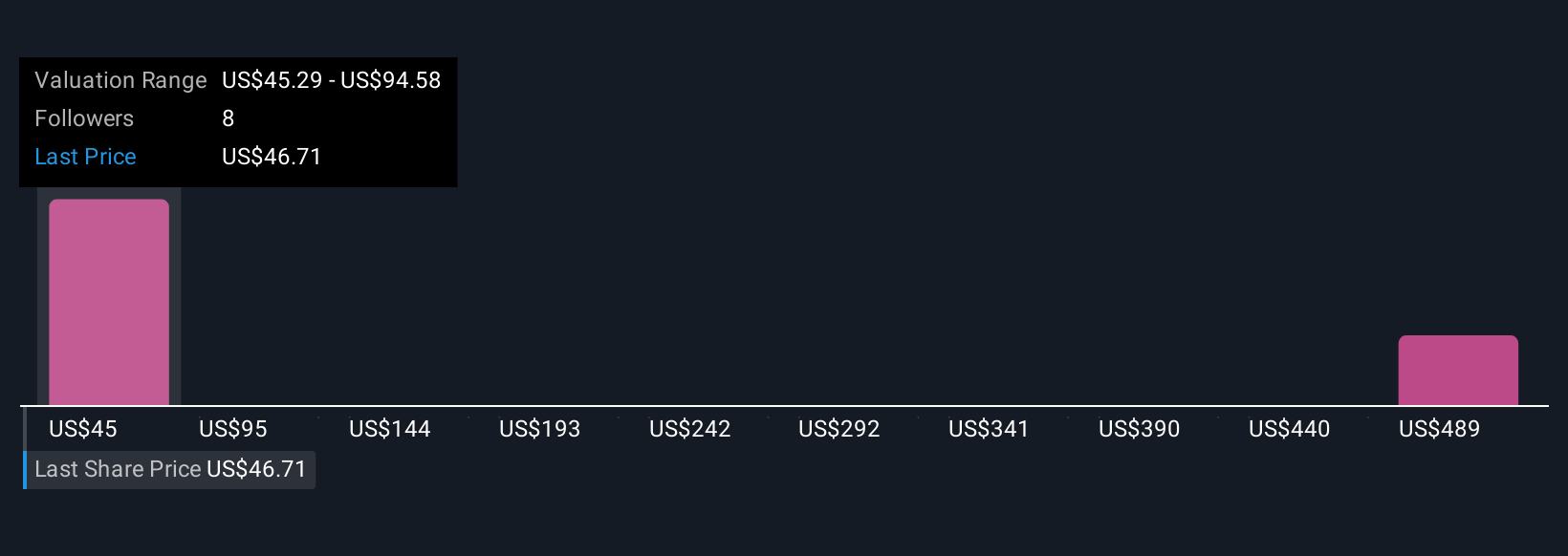

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple and approachable way to give a company’s story—your personal perspective—behind the numbers, combining your assumptions for fair value, expected revenue, earnings, and margins with a holistic financial forecast. Narratives link what you believe about Revolution Medicines’ business to a dynamic projection of its future, helping you see how your view impacts its fair value and whether it is a buy or sell at current prices.

Accessible to everyone on Simply Wall St’s Community page, Narratives make investment insights easy to use by millions of investors. When events like earnings releases or news updates happen, Narratives are updated automatically, so your investment outlook always reflects the latest information. If you think Revolution Medicines will achieve breakthrough growth and profitability, your Narrative may show a much higher fair value than someone who takes a conservative, risk-focused view. This shows that each investor’s story can lead to very different price targets. Narratives turn complex decisions into personalized, data-driven choices that evolve as the company’s story unfolds.

Do you think there's more to the story for Revolution Medicines? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RVMD

Revolution Medicines

A clinical-stage precision oncology company, develops novel targeted therapies for RAS-addicted cancers.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives