- United States

- /

- Pharma

- /

- NasdaqGS:RPRX

Will Royalty Pharma's (RPRX) Governance Shift Sharpen Its Edge in Life Sciences Investment?

Reviewed by Sasha Jovanovic

- Royalty Pharma plc recently announced that Dr. Ted W. Love, an independent director since 2020, was unanimously appointed Lead Independent Director, with Dr. Love continuing to Chair the Nominating and Corporate Governance Committee.

- Dr. Love's extensive leadership across major biopharmaceutical companies and industry associations brings additional expertise and perspective to Royalty Pharma's governance as it seeks to accelerate innovation in life sciences.

- We'll examine how the acquisition of a royalty interest in Amgen’s Imdelltra shapes Royalty Pharma's future investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Royalty Pharma Investment Narrative Recap

To be a shareholder in Royalty Pharma, you need to believe in its ability to consistently secure high-value royalty streams from breakthrough biopharma assets, supported by a disciplined, expert-driven board. The recent appointment of Dr. Ted W. Love as Lead Independent Director adds governance strength but does not have a material impact on the near-term catalyst, the integration and revenue potential from the Imdelltra royalty acquisition, or the ongoing Alyftrek royalty rate dispute, which remains the key risk.

Royalty Pharma's acquisition of a royalty interest in Amgen’s Imdelltra is the most relevant recent announcement, as it speaks directly to the company's core growth strategy of backing promising, high-impact therapies. The scale of this purchase reinforces its focus on oncology, while also raising questions about competitive dynamics and pricing power for future deals as peers intensify their activity.

But investors should be aware that, despite evolving board expertise, the unresolved Alyftrek royalty dispute could...

Read the full narrative on Royalty Pharma (it's free!)

Royalty Pharma's outlook forecasts $4.0 billion in revenue and $922.7 million in earnings by 2028. This is based on an assumed annual revenue growth rate of 20.0% and reflects a decrease of $77.3 million in earnings from the current $1.0 billion.

Uncover how Royalty Pharma's forecasts yield a $44.86 fair value, a 23% upside to its current price.

Exploring Other Perspectives

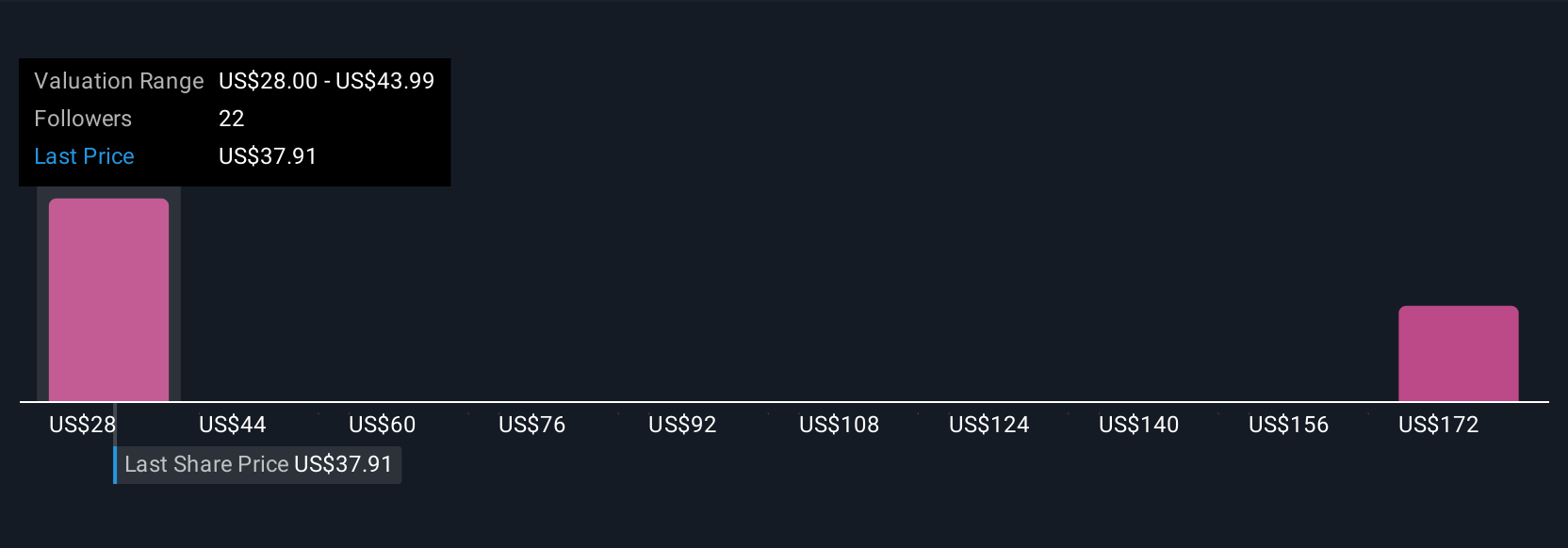

Simply Wall St Community members have published six fair value estimates for Royalty Pharma, ranging from US$39.10 to US$181.04 per share. While opinions vary, many are watching the impact of competitive pressures on future deal sourcing and returns, explore these different perspectives to understand how investor outlooks can diverge.

Explore 6 other fair value estimates on Royalty Pharma - why the stock might be worth over 4x more than the current price!

Build Your Own Royalty Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royalty Pharma research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Royalty Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royalty Pharma's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RPRX

Royalty Pharma

Operates as a buyer of biopharmaceutical royalties and a funder of innovation in the biopharmaceutical industry in the United States.

Very undervalued with proven track record.

Market Insights

Community Narratives