- United States

- /

- Biotech

- /

- NasdaqGS:ROIV

How Investors May Respond To Roivant Sciences (ROIV) Positive Phase 3 Results for Brepocitinib in Dermatomyositis

Reviewed by Sasha Jovanovic

- Earlier this month, Roivant Sciences and Priovant Therapeutics announced positive Phase 3 results for brepocitinib in dermatomyositis, showing significant improvements on primary and secondary endpoints in the VALOR study and consistent safety at the optimal 30 mg dose, with plans for an NDA filing in the first half of 2026.

- This pivotal clinical advance could expand Roivant's late-stage pipeline opportunities and accelerate its potential move toward new regulatory approvals in rare autoimmune diseases.

- We’ll examine how these VALOR study results for brepocitinib may shape Roivant’s investment case and future pipeline outlook.

The latest GPUs need a type of rare earth metal called Terbium and there are only 31 companies in the world exploring or producing it. Find the list for free.

Roivant Sciences Investment Narrative Recap

To be a shareholder in Roivant Sciences, you need to believe in its ability to deliver successful late-stage clinical results and move innovative therapies to market, especially in rare autoimmune diseases. The recent positive brepocitinib Phase 3 readout supports short term optimism for regulatory progress, a key near-term catalyst; however, continued execution in other ongoing trials and R&D spending remain significant risks and the overall impact of this news does not reduce these. Recent company conference presentations, including Roivant’s focused discussion on brepocitinib’s Phase 3 outcome at its September 17 special call, reflect the central importance of clinical milestones as investor catalysts, especially given the company’s current lack of profitability and revenue growth targets. However, investors should be aware that offsetting these clinical successes, Roivant’s high ongoing R&D expenses and persistent net losses may continue to weigh on long term returns...

Read the full narrative on Roivant Sciences (it's free!)

Roivant Sciences’ outlook anticipates $520.7 million in revenue and $83.8 million in earnings by 2028. This scenario assumes a 59.2% annual revenue growth rate but projects a considerable earnings decrease of $4.5 billion from current earnings of $4.6 billion.

Uncover how Roivant Sciences' forecasts yield a $18.30 fair value, a 21% upside to its current price.

Exploring Other Perspectives

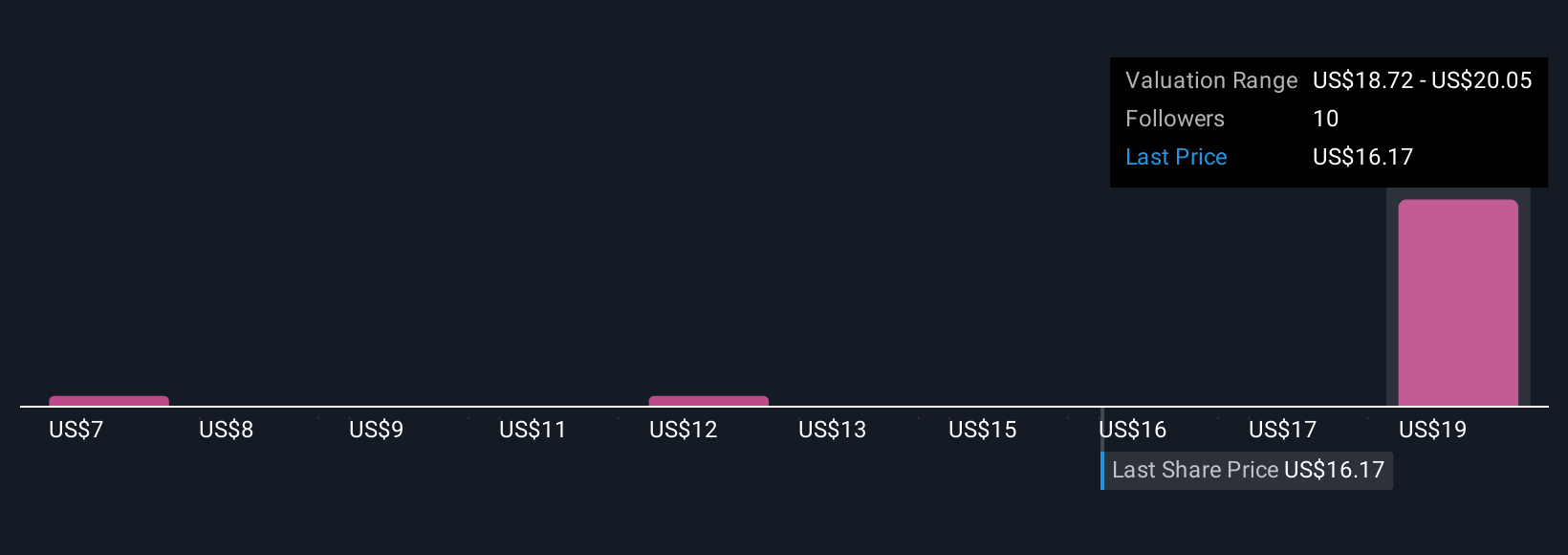

Four fair value estimates from the Simply Wall St Community for Roivant Sciences range widely from US$6.84 to US$20.05 per share. With many investors focused on clinical trial execution as a core driver, the divergence in community opinions could signal broader debates about risk and potential upside for the company’s future.

Explore 4 other fair value estimates on Roivant Sciences - why the stock might be worth less than half the current price!

Build Your Own Roivant Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Roivant Sciences research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Roivant Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Roivant Sciences' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROIV

Roivant Sciences

A clinical-stage biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines and technologies.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives