- United States

- /

- Biotech

- /

- NasdaqGM:RNA

Avidity Biosciences (RNA) Is Up 12.2% After Positive DMD Therapy Data Revealed at WMS Congress – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Avidity Biosciences recently announced upcoming data presentations at the 30th Annual International Congress of the World Muscle Society, showcasing their investigational RNA therapy delpacibart zotadirsen for Duchenne muscular dystrophy patients amenable to exon 44 skipping.

- The data build on prior positive results, highlighting trends of disease reversal and functional improvement after one year of treatment, underscoring the program’s potential to address significant unmet need in rare neuromuscular disease therapy.

- We'll explore how this new evidence of clinical benefit in Duchenne muscular dystrophy shapes Avidity Biosciences' long-term investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Avidity Biosciences' Investment Narrative?

For anyone considering Avidity Biosciences, the central question is belief in the company’s ability to turn innovative RNA therapies into a sustainable business, despite ongoing losses and heavy spending. The recent data presentation showcasing clinical improvement in Duchenne muscular dystrophy patients with del-zota could reshape the company’s short-term narrative, bringing renewed focus to regulatory catalysts like the upcoming BLA submission and the significance of new partnerships such as the Lonza manufacturing deal. This latest evidence of clinical benefit has added weight to Avidity’s core program and has helped boost investor optimism, as seen in strong multi-month share price gains. Still, persistent losses, the recent equity dilution, and uncertainty over broader commercial success remain. How these factors play out relative to the importance of the new clinical data will be crucial over the months ahead. Yet, investors should watch for volatility as lock-up periods expire and regulatory milestones approach.

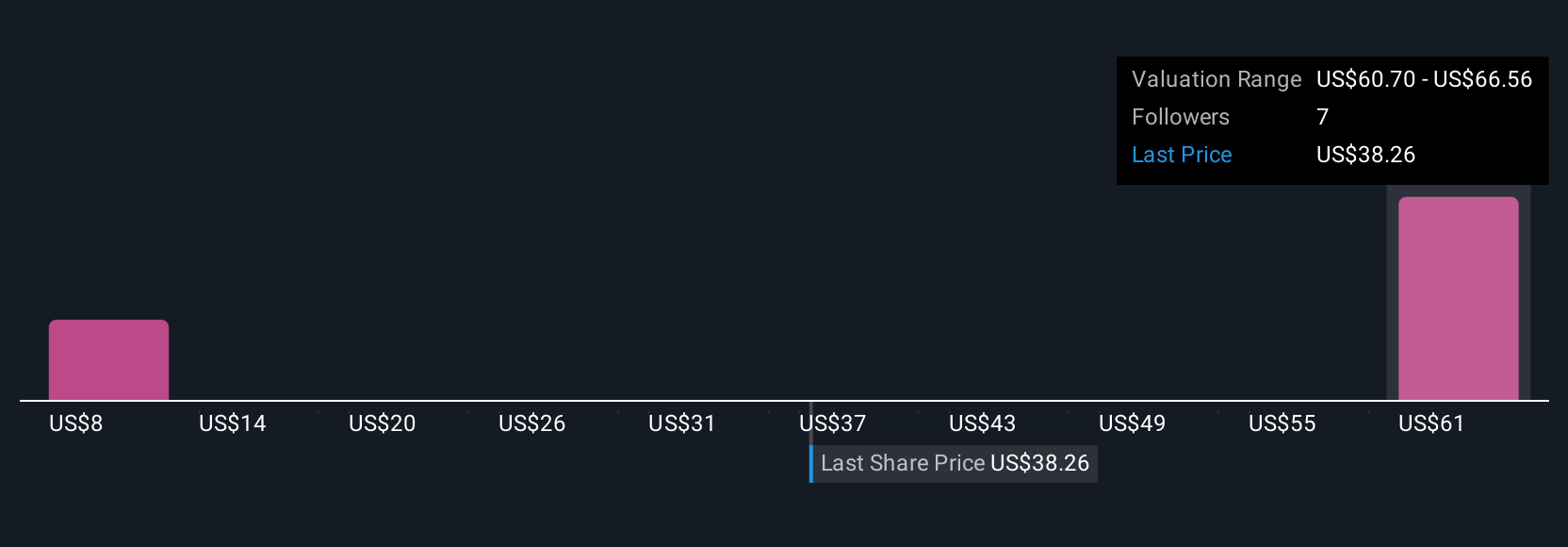

Avidity Biosciences' shares are on the way up, but they could be overextended by 35%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on Avidity Biosciences - why the stock might be worth as much as 41% more than the current price!

Build Your Own Avidity Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avidity Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Avidity Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avidity Biosciences' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RNA

Avidity Biosciences

A biopharmaceutical company, engages in the delivery of RNA therapeutics called antibody oligonucleotide conjugates (AOCs).

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives