- United States

- /

- Biotech

- /

- NasdaqGS:RLYB

US Penny Stocks To Consider In December 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences a pullback from recent record highs, investors are closely monitoring economic indicators and potential interest rate changes. For those willing to explore beyond well-known large-cap stocks, penny stocks can offer intriguing opportunities despite their historical connotations. While often associated with smaller or newer companies, penny stocks can present a blend of affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.82957 | $5.86M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $145.67M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.74 | $2.01B | ★★★★☆☆ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.88 | $87.96M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.24 | $8.79M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.50 | $48.84M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.80 | $13.15M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.90 | $79.06M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.87 | $420.7M | ★★★★☆☆ |

Click here to see the full list of 707 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Rallybio (NasdaqGS:RLYB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rallybio Corporation is a clinical-stage biotechnology company focused on developing and commercializing therapies for severe and rare diseases, with a market cap of $49.37 million.

Operations: Rallybio Corporation has not reported any revenue segments.

Market Cap: $49.37M

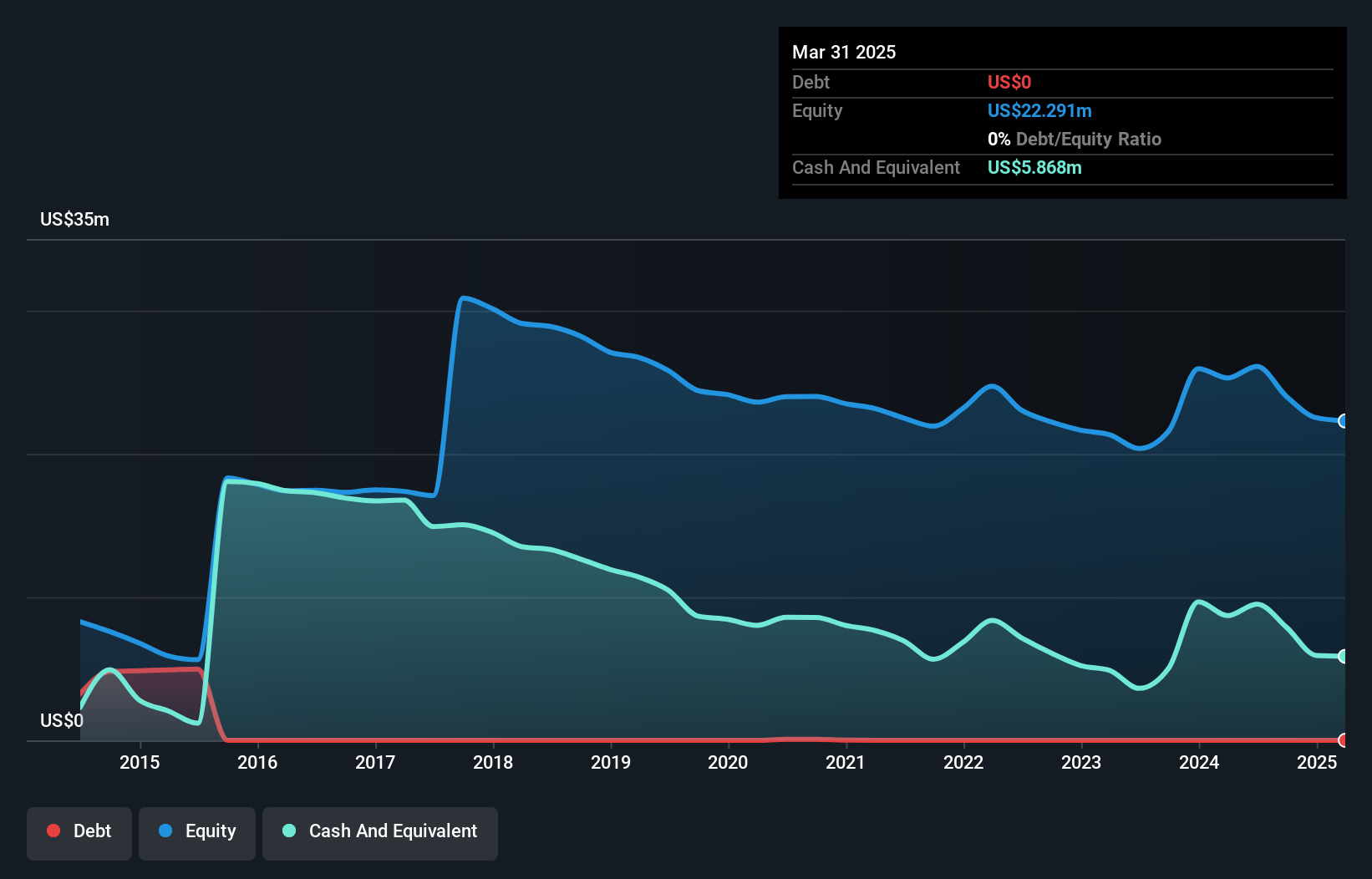

Rallybio Corporation, with a market cap of US$49.37 million, is a pre-revenue biotech firm focusing on rare diseases. Recent announcements highlight promising preclinical data for its pipeline candidates RLYB212 and RLYB332, suggesting potential best-in-class therapies. Despite being debt-free and possessing sufficient cash runway for over a year, Rallybio remains unprofitable with minimal revenue (US$0.598 million). The company has experienced shareholder dilution by 9.8% in the past year and faces challenges in achieving profitability soon. However, its seasoned management team and ongoing clinical trials may offer future growth prospects within the biotech sector.

- Navigate through the intricacies of Rallybio with our comprehensive balance sheet health report here.

- Evaluate Rallybio's prospects by accessing our earnings growth report.

Solitario Resources (NYSEAM:XPL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Solitario Resources Corp. is an exploration stage company focused on acquiring and exploring precious metal, zinc, and other base metal properties in North and South America, with a market cap of $50.01 million.

Operations: Solitario Resources Corp. does not report distinct revenue segments as it is an exploration stage company focused on acquiring and exploring metal properties in the Americas.

Market Cap: $50.01M

Solitario Resources Corp., with a market cap of US$50.01 million, is a pre-revenue exploration company focused on precious metals and base metals in the Americas. Recent drilling at its Golden Crest Project revealed significant gold mineralization, enhancing its strategic land holdings in South Dakota. Despite being debt-free and having sufficient cash runway for 1.8 years, Solitario remains unprofitable with increased losses over five years. Shareholder dilution occurred with a 3% increase in shares outstanding last year. The experienced board may support future project developments despite current financial challenges and lack of revenue streams above US$1 million.

- Take a closer look at Solitario Resources' potential here in our financial health report.

- Examine Solitario Resources' past performance report to understand how it has performed in prior years.

Perfect (NYSE:PERF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perfect Corp. is an AI software as a service company offering AI and AR solutions for the beauty, fashion, and skincare industries globally, with a market cap of approximately $235.27 million.

Operations: The company's revenue is generated entirely from its Internet Software & Services segment, amounting to $58.45 million.

Market Cap: $235.27M

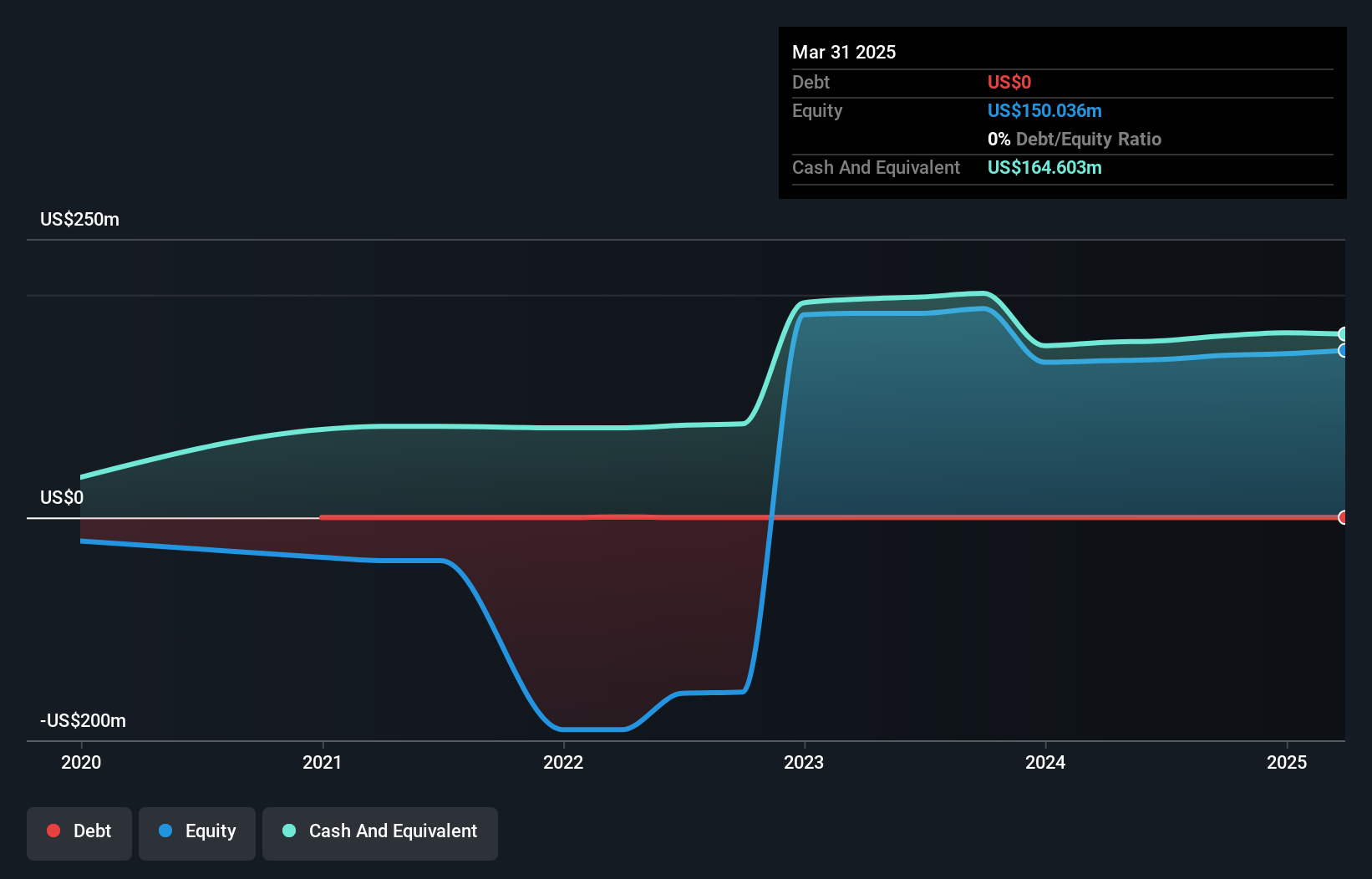

Perfect Corp., with a market cap of US$235.27 million, has shown profitability this year, reporting US$16.13 million in third-quarter sales and a net income of US$2.53 million. The company is debt-free, with short-term assets significantly exceeding liabilities, indicating strong financial health. Recent collaborations, such as with Holidermie for AI-powered skincare solutions and TIMEZ for AR watch try-ons, highlight its innovative approach in the beauty and fashion sectors. However, its share price remains highly volatile despite high-quality earnings and stable weekly volatility over the past year compared to most U.S stocks.

- Dive into the specifics of Perfect here with our thorough balance sheet health report.

- Assess Perfect's future earnings estimates with our detailed growth reports.

Taking Advantage

- Access the full spectrum of 707 US Penny Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RLYB

Rallybio

A clinical-stage biotechnology company, engages in development and commercialization of life-transforming therapies for patients suffering from severe and rare diseases.

Flawless balance sheet slight.

Market Insights

Community Narratives