- United States

- /

- Life Sciences

- /

- NasdaqGS:RGEN

Three Companies Estimated To Be Priced Below Their Intrinsic Value In November 2025

Reviewed by Simply Wall St

As the Dow Jones Industrial Average reaches new heights amid optimism surrounding a potential end to the U.S. government shutdown, investors are closely watching market fluctuations with mixed performances across major indices. In this environment, identifying stocks that may be undervalued becomes crucial, as these investments could offer opportunities for growth when priced below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Old National Bancorp (ONB) | $20.99 | $41.03 | 48.8% |

| Nicolet Bankshares (NIC) | $124.37 | $242.17 | 48.6% |

| Huntington Bancshares (HBAN) | $15.82 | $31.03 | 49% |

| Genius Sports (GENI) | $10.32 | $20.58 | 49.9% |

| First Busey (BUSE) | $23.03 | $45.34 | 49.2% |

| Fifth Third Bancorp (FITB) | $42.99 | $83.23 | 48.3% |

| CNB Financial (CCNE) | $25.15 | $48.36 | 48% |

| Byrna Technologies (BYRN) | $17.94 | $35.45 | 49.4% |

| BILL Holdings (BILL) | $46.57 | $92.80 | 49.8% |

| AbbVie (ABBV) | $225.17 | $433.66 | 48.1% |

We'll examine a selection from our screener results.

Li Auto (LI)

Overview: Li Auto Inc. operates in the energy vehicle market in the People’s Republic of China and has a market cap of approximately $20.37 billion.

Operations: The company's revenue segment includes Auto Manufacturers, generating CN¥143.32 billion.

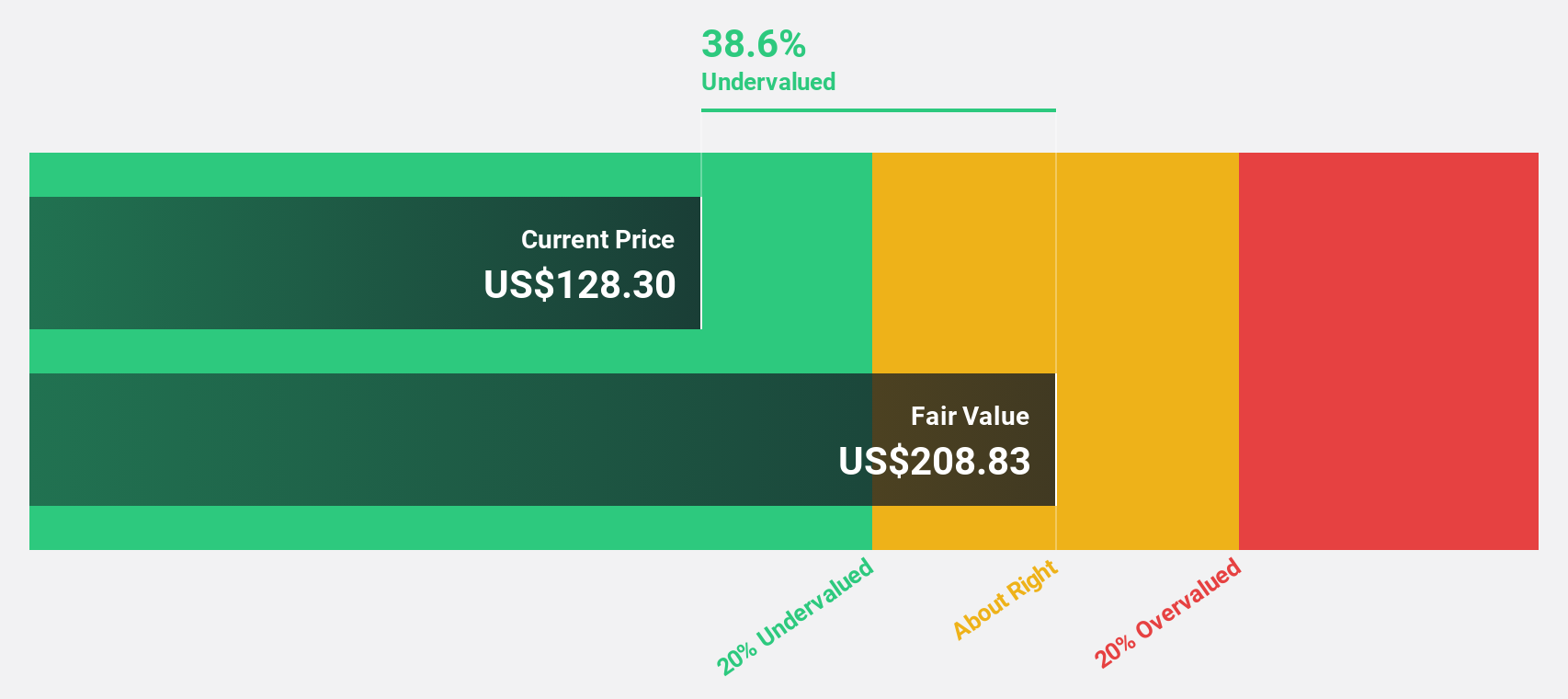

Estimated Discount To Fair Value: 42.5%

Li Auto is trading at US$20.42, significantly below its estimated fair value of US$35.52, indicating potential undervaluation based on cash flows. Despite being dropped from major indices in September 2025, Li Auto's earnings are forecast to grow at 24.8% annually, outpacing the broader US market. Recent vehicle deliveries show steady performance with 31,767 units delivered in October 2025 and a cumulative total reaching over 1.46 million vehicles by month-end.

- In light of our recent growth report, it seems possible that Li Auto's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Li Auto stock in this financial health report.

Repligen (RGEN)

Overview: Repligen Corporation is a life sciences company that develops and commercializes bioprocessing technologies and systems globally, with a market cap of approximately $8.20 billion.

Operations: Repligen generates revenue from its Medical Products segment, totaling $707.89 million.

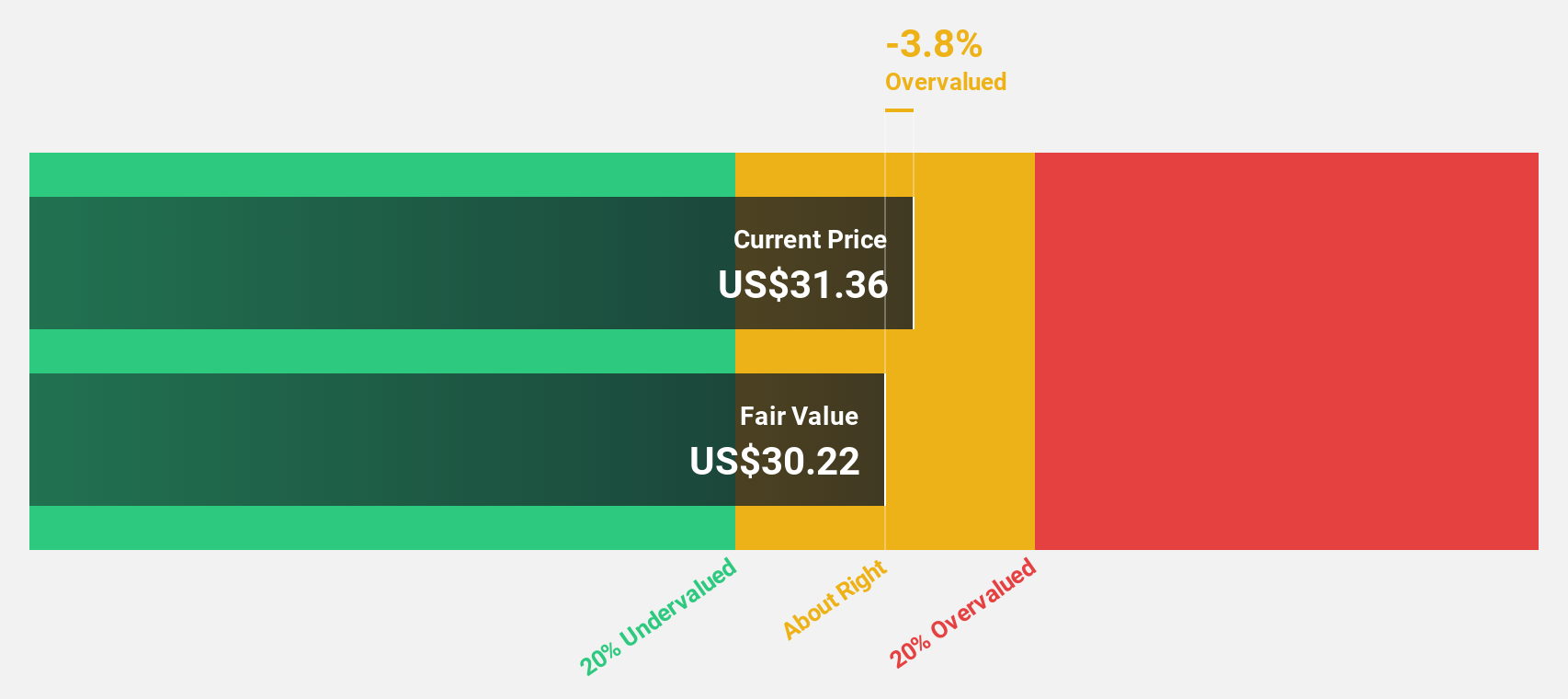

Estimated Discount To Fair Value: 15.5%

Repligen, trading at US$153.44, is undervalued compared to its fair value of US$181.57. The company's earnings are expected to grow significantly at 45% annually, surpassing the broader US market's growth rate. Despite a forecasted low return on equity and slower revenue growth of 14% per year, Repligen's recent financial results show improved profitability with net income rising to US$35.61 million for the first nine months of 2025 from last year's figures.

- Our expertly prepared growth report on Repligen implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Repligen's balance sheet health report.

Onto Innovation (ONTO)

Overview: Onto Innovation Inc. designs, develops, manufactures, and supports process control tools for optical metrology and inspection on a global scale, with a market cap of approximately $6.91 billion.

Operations: The company generates revenue primarily from its Semiconductor Equipment and Services segment, totaling $1 billion.

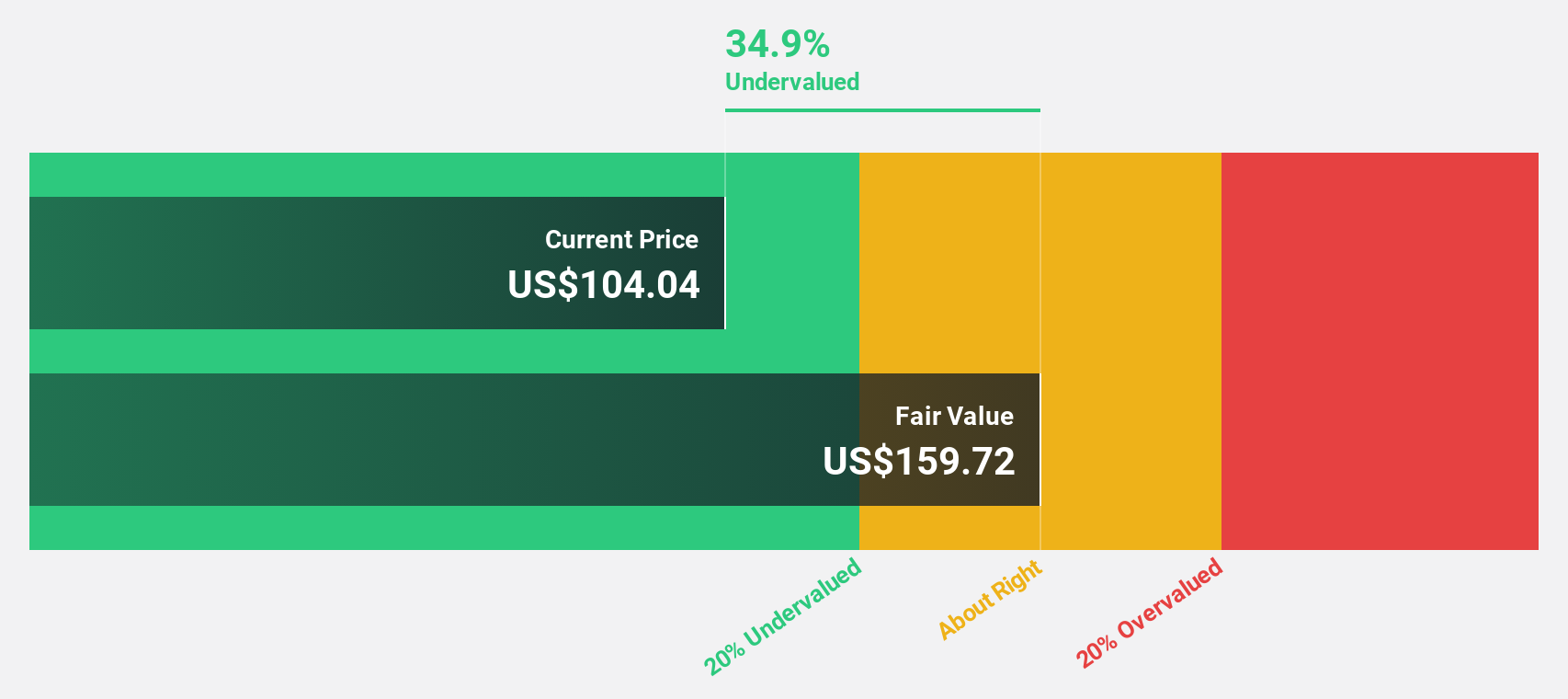

Estimated Discount To Fair Value: 19.1%

Onto Innovation, priced at US$133.44, is trading below its fair value estimate of US$164.85, representing a good value opportunity. Despite recent declines in quarterly sales and net income to US$218.19 million and US$28.22 million respectively, the company forecasts revenue growth between 12% and 20% annually over the next three years with significant earnings growth expected at 27.6% per year, outpacing the broader market's performance expectations for profitability expansion.

- Our growth report here indicates Onto Innovation may be poised for an improving outlook.

- Navigate through the intricacies of Onto Innovation with our comprehensive financial health report here.

Taking Advantage

- Access the full spectrum of 181 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGEN

Repligen

A life sciences company, develops and commercializes bioprocessing technologies and systems in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives