- United States

- /

- Life Sciences

- /

- NasdaqGS:RGEN

Repligen (RGEN): Assessing Valuation Following HSBC’s Positive Coverage and Renewed Biotech Optimism

Reviewed by Kshitija Bhandaru

Repligen (RGEN) shares have climbed after HSBC initiated coverage with a positive outlook. The firm highlighted the company’s leadership in bioprocessing, focus on innovation, and solid revenue growth expectations. Investor optimism has followed suit as sector sentiment improves.

See our latest analysis for Repligen.

Repligen’s stock has enjoyed renewed momentum, gaining attention after HSBC’s positive coverage as well as a recent wave of upbeat analyst sentiment across the sector. While the share price return over the past year has been modest, investors seem to be warming up to Repligen’s growth story as optimism builds around bioprocessing and innovation-driven companies.

If this resurgence has you interested in what's next for biotech, consider broadening your perspective and discover See the full list for free.

After such a strong surge, the key question becomes whether Repligen is still trading at a discount or whether the latest optimism is already fully reflected in its price. This presents investors with either an opportunity or a cautionary tale.

Most Popular Narrative: 17% Undervalued

Repligen’s narrative fair value estimate of $179.78 is well above the current price of $148.73. This suggests that the stock’s true potential may not be fully reflected in the market price. This narrative includes ambitious growth plans and changing industry dynamics, which collectively support a higher share price.

“Strong and sustained order growth across biopharma, CDMO, and capital equipment segments, supported by record multi-quarter book-to-bill ratios and robust funnel, positions the company for above-market revenue increases as therapy pipelines expand and demand for advanced bioprocessing solutions rises.”

What is fueling this optimistic valuation? The narrative centers on bold revenue projections and margin gains that are rarely seen outside the tech sector. Which core assumptions support such a high fair value for a company that remains unprofitable? Explore further to uncover the key financial expectations analysts are considering.

Result: Fair Value of $179.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, soft biotech funding and high exposure to volatile gene therapy markets could quickly challenge Repligen’s growth assumptions if recent headwinds continue.

Find out about the key risks to this Repligen narrative.

Another View: How Does the Price Stack Up on Sales Ratios?

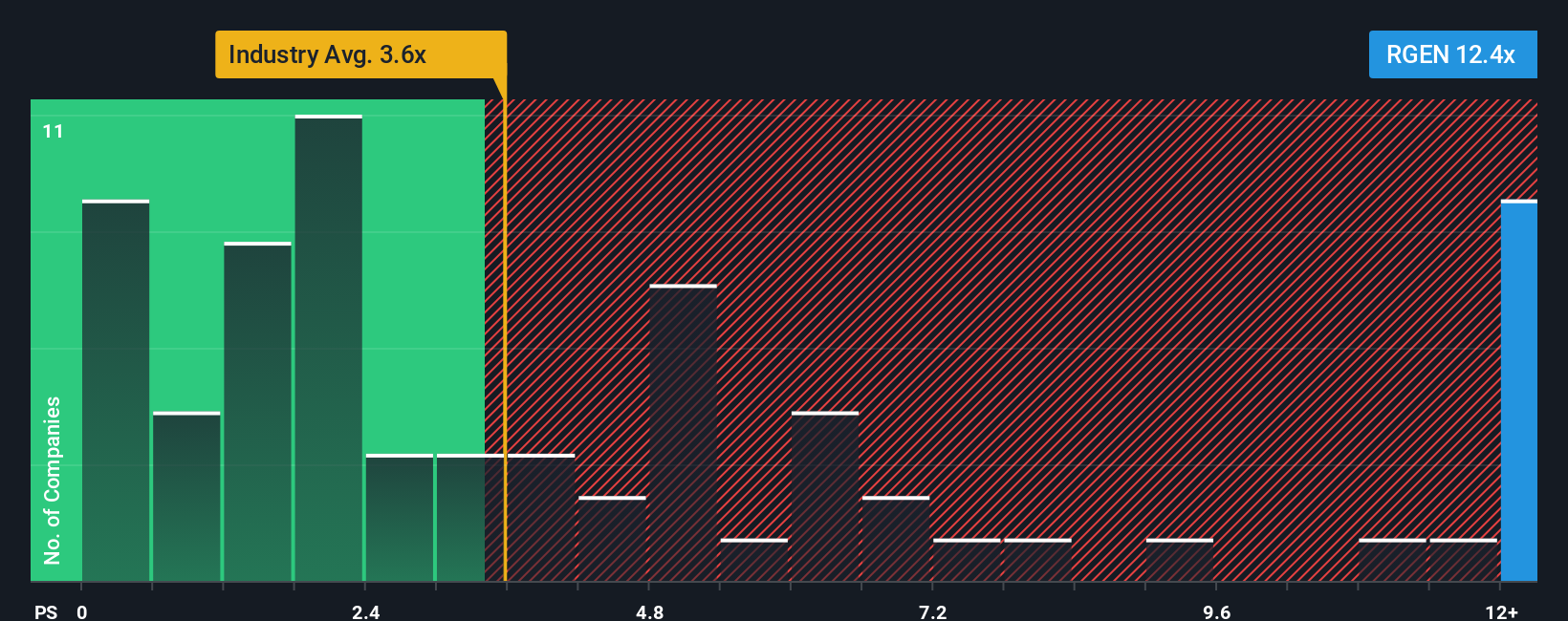

While fair value estimates suggest Repligen is undervalued, the company looks expensive on its price-to-sales ratio. It trades at 12.4 times sales, well above both the US Life Sciences industry average (3.8x), the peer average (2.7x), and even the fair ratio of 5.2x. This substantial gap could limit upside if market enthusiasm cools. Does the market really see this growth story as that much stronger than the rest?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Repligen Narrative

If you want to dig into the numbers or believe your analysis points to a different conclusion, you can craft your own narrative in just a few minutes, so why not Do it your way

A great starting point for your Repligen research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for just one opportunity. Some of the most promising stocks could be just a few clicks away using these powerful tools from Simply Wall St.

- Uncover high-potential artificial intelligence companies reshaping countless industries by checking out these 25 AI penny stocks. This can help you get ahead in tomorrow’s tech race.

- Strengthen your portfolio with market standouts offering generous yields by securing access to these 19 dividend stocks with yields > 3%, setting yourself up for stronger returns.

- Step into the world of digital innovation with these 78 cryptocurrency and blockchain stocks to spot unique businesses powering the cryptocurrency revolution and next-generation financial systems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGEN

Repligen

A life sciences company, develops and commercializes bioprocessing technologies and systems in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives