- United States

- /

- Pharma

- /

- NasdaqCM:RGC

Regencell Bioscience Holdings (NasdaqCM:RGC): Valuation Insights Following S&P Global BMI Index Inclusion

Reviewed by Kshitija Bhandaru

If you are holding or eyeing Regencell Bioscience Holdings (NasdaqCM:RGC), the latest development may be hard to ignore. The company was just added to the S&P Global BMI Index, which often brings a wave of attention from institutional investors and passive index funds. While an index inclusion itself does not guarantee future performance, it is a sign the company now sits on the radar of a larger base of market participants. This potentially makes RGC shares more liquid and visible than before.

This fresh visibility helps explain why Regencell’s stock has seen some energetic trading lately. The shares have soared 22% over the past month, more than doubling year-to-date, capping a 101% gain over the last twelve months. On the other hand, longer-term momentum has seen its ups and downs, with a dip of 32% over the past three months tempering what had been a sustained rally. A backdrop of zero reported revenue and continued net losses keeps valuation at the forefront, but the company’s addition to a major global index marks a shift in how the market might be pricing Regencell’s future.

After this substantial run, are we looking at an opportunity with room left to grow, or is the market already building in brighter days ahead for Regencell Bioscience Holdings?

Price-to-Book of 1151.7x: Is it justified?

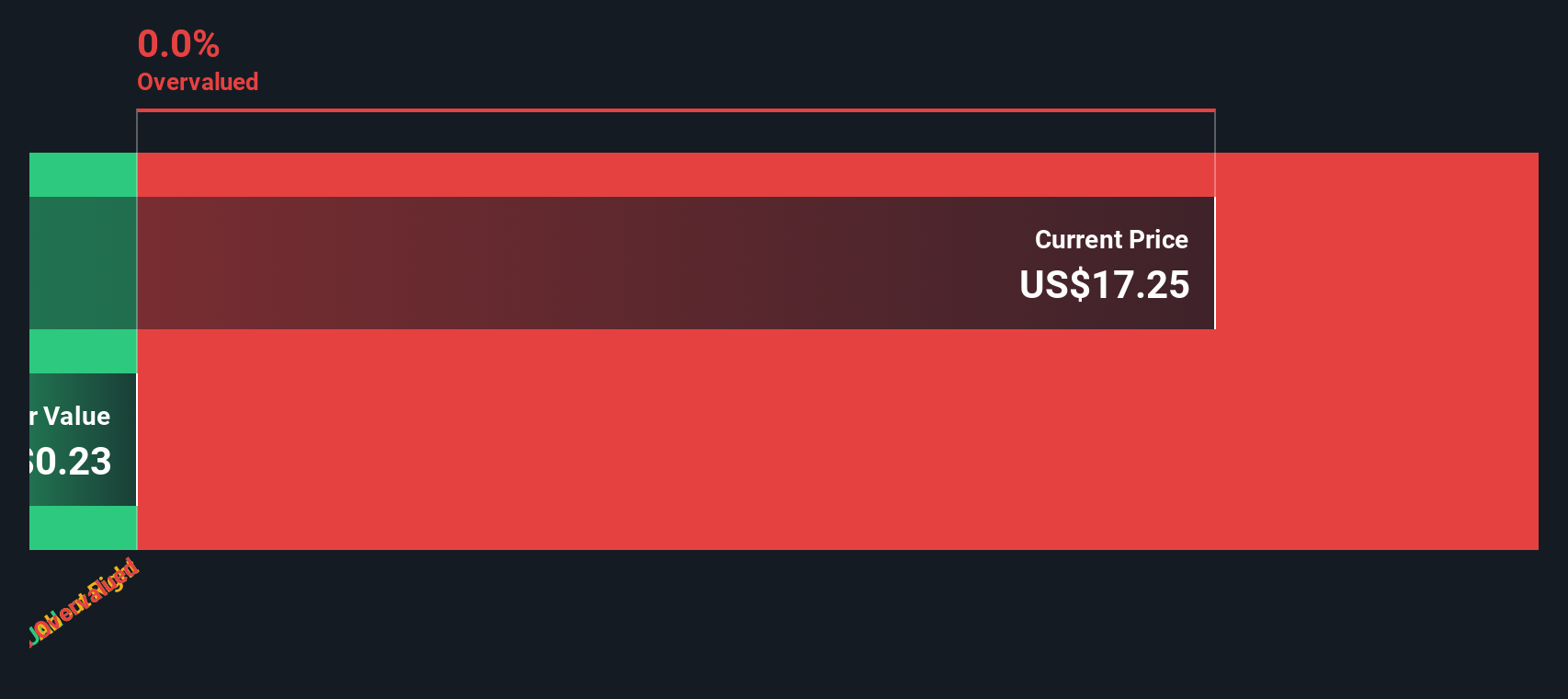

Regencell Bioscience Holdings currently trades at a striking price-to-book (P/B) ratio of 1151.7 times, far exceeding both peer averages and the industry benchmark. This figure indicates that the market price of RGC shares is dramatically higher than the company’s net asset value per share. This raises important questions about whether investors are paying far too much for the underlying business.

The price-to-book ratio is a popular yardstick for valuing companies, especially in the pharmaceuticals and biotech sector, where assets on the balance sheet can play a central role in perceived value. A higher P/B typically reflects future earnings potential, valuable intangible assets, or market speculation about growth. However, such an elevated multiple may also suggest market exuberance that is not connected to fundamentals, particularly given RGC’s lack of meaningful revenue or profitability.

In the case of Regencell, this extremely high P/B implies that investors are heavily weighing future breakthroughs or significant value creation rather than current assets or operations. The premium may be difficult to justify in the absence of commercial progress and sustainable earnings. As a result, this is a valuation that demands careful scrutiny from prospective shareholders.

Result: Fair Value of $0 (OVERVALUED)

See our latest analysis for Regencell Bioscience Holdings.However, a breakthrough in revenue generation or positive clinical results could quickly reshape market sentiment and challenge the current skeptical outlook.

Find out about the key risks to this Regencell Bioscience Holdings narrative.Another View: SWS DCF Model Offers No Reprieve

Taking a different approach, our DCF model can provide a reality check when other measures seem stretched. In this case, there is insufficient data for a definitive DCF valuation, so it does not offer a real counterpoint to the sky-high market price. Can any method really justify where Regencell trades today?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Regencell Bioscience Holdings Narrative

If you have a different perspective or want to dig into the numbers first-hand, take a few minutes to craft your own outlook and see where the evidence leads. Do it your way.

A great starting point for your Regencell Bioscience Holdings research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Smart investors always look beyond the headline names and find opportunities where others aren’t searching. Give yourself an edge and check out these hand-picked stock themes, carefully selected to match a variety of strategies and interests. These could be your next great moves.

- Unlock the potential of the future of medicine by tapping into healthcare AI stocks, where cutting-edge companies are blending artificial intelligence with healthcare for real-world breakthroughs.

- Amplify your portfolio’s yield and stability with shares from dividend stocks with yields > 3%, highlighting companies that offer robust, market-beating dividends exceeding 3%.

- Seize the chance to catch tomorrow’s standouts before the crowd with penny stocks with strong financials, uncovering affordable stocks backed by solid financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RGC

Regencell Bioscience Holdings

Operates as a Traditional Chinese medicine (TCM) bioscience company in Hong Kong.

Adequate balance sheet with low risk.

Market Insights

Community Narratives