- United States

- /

- Biotech

- /

- NasdaqGS:REPL

Replimune Group (REPL): Valuation Update After FDA Acceptance of RP1 Application Spurs Investor Optimism

Reviewed by Simply Wall St

The FDA’s acceptance of Replimune Group’s resubmitted Biologics License Application for RP1, combined with nivolumab, has sparked renewed optimism among investors. This regulatory milestone follows months of addressing agency feedback and signals real progress for the company’s advanced melanoma program.

See our latest analysis for Replimune Group.

The FDA's green light for Replimune's RP1 application sent the share price soaring nearly 99% in a single day, erasing months of slow declines and sparking intense trading. Despite this dramatic short-term rally, total shareholder return still sits at a substantial loss over the past year and longer timeframes. This offers a stark reminder of the volatility and risk that can accompany biotech breakthroughs.

Outside the spotlight on Replimune, there are plenty of other healthcare innovators making waves lately. If you want to discover what's next, check out See the full list for free.

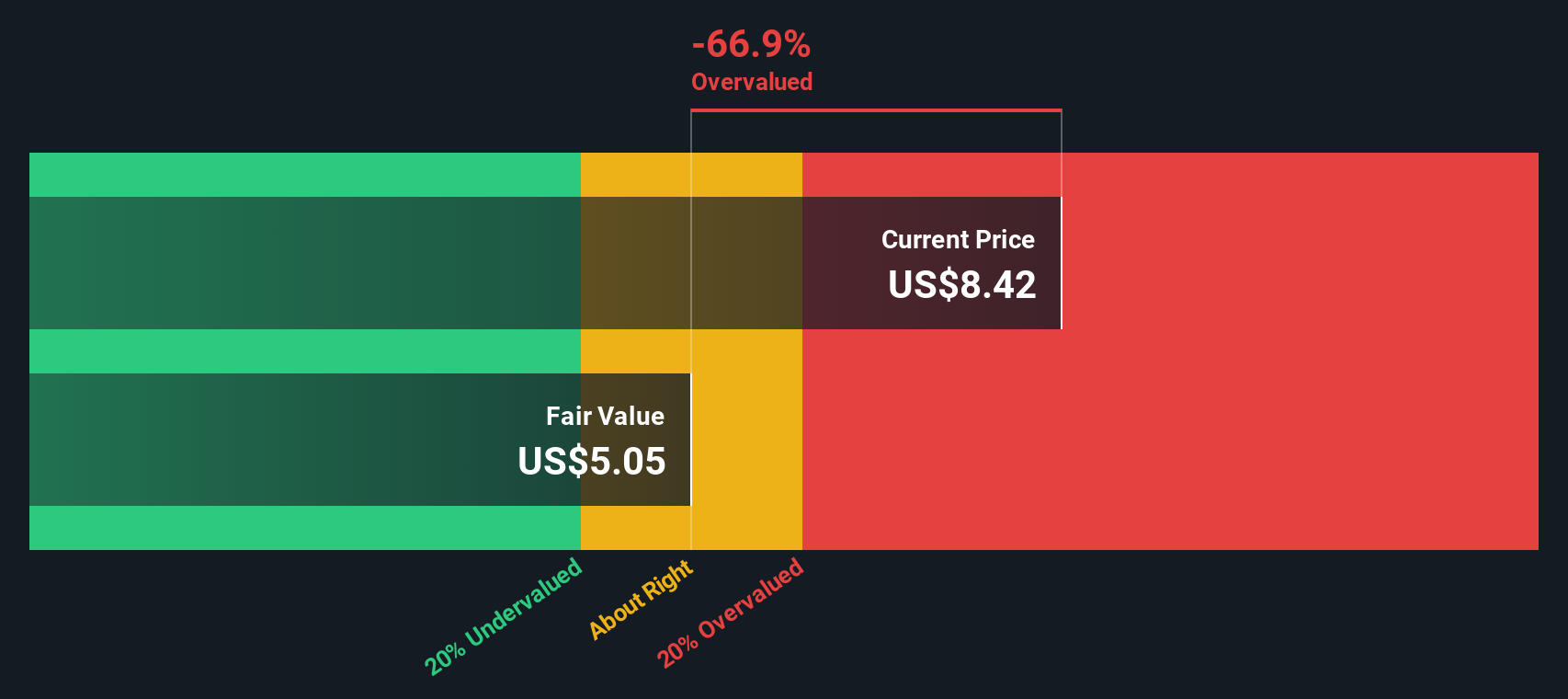

So with the recent surge and analyst upgrades, is Replimune still trading at a discount after months of losses? Or is the recent optimism now fully reflected in the share price and future growth prospects?

Price-to-Book of 2.1x: Is it justified?

Replimune trades at a Price-to-Book ratio of 2.1x, notably below both the US Biotechs industry average of 2.6x and its peer average of 8.3x. With shares recently rebounding, this discount relative to rivals stands out.

The price-to-book ratio compares a company's market value to its book value, and is often used in biotech where profits remain elusive but asset-backed value matters. For loss-making biotechs, a lower ratio may indicate skepticism about near-term commercial success or potential future cash needs.

Relative to most peers, the market is pricing Replimune’s assets at a significant discount. This may reflect uncertainty around clinical milestones or concerns about ongoing losses. However, a ratio well beneath the norm could also signal opportunity if upcoming catalysts are delivered.

Compared to industry and peer averages, Replimune's price-to-book stands out as compelling value. If sentiment improves, the market could begin to close this gap.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 2.1x (UNDERVALUED)

However, clinical setbacks or ongoing losses may still weigh on Replimune’s outlook. These factors can quickly shift sentiment and impact valuation despite recent progress.

Find out about the key risks to this Replimune Group narrative.

Another View: SWS DCF Model Paints a Different Picture

While the price-to-book ratio suggests Replimune is trading at a discount to industry and peers, our DCF model indicates an even steeper disconnect. According to this approach, shares trade at 86% below estimated fair value. This points to significant undervaluation based on future cash flow potential. Is the market missing something, or are the risks simply too high?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Replimune Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Replimune Group Narrative

If you want to dig deeper or have your own perspective on Replimune, shaping your own analysis takes just a few minutes. Do it your way

A great starting point for your Replimune Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next savvy move by checking out powerful stock ideas others might overlook. The right opportunity could be waiting for you. Don’t miss your edge with these top picks:

- Tap into the latest disruptive innovations by reviewing these 24 AI penny stocks. Here, emerging leaders in artificial intelligence show their growth potential.

- Get ahead of the pack by uncovering attractive income opportunities among these 17 dividend stocks with yields > 3% that deliver healthy yields above 3%.

- Seize undervalued prospects in the market now through these 873 undervalued stocks based on cash flows and spot stocks trading at a discount to intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REPL

Replimune Group

A clinical-stage biotechnology company, focuses on the development and commercialization of oncolytic immunotherapies to treat cancer.

Excellent balance sheet and good value.

Market Insights

Community Narratives