- United States

- /

- Biotech

- /

- NasdaqGS:REPL

Replimune Group (NASDAQ:REPL) Has Debt But No Earnings; Should You Worry?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Replimune Group, Inc. (NASDAQ:REPL) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Replimune Group

How Much Debt Does Replimune Group Carry?

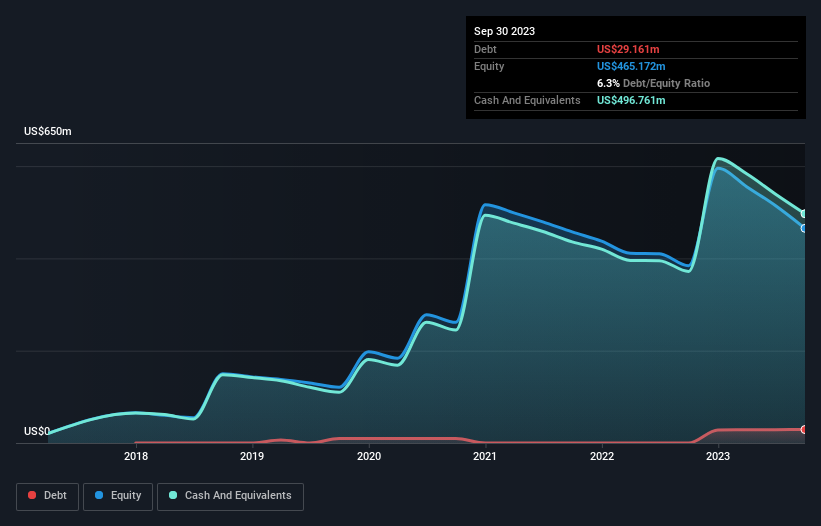

As you can see below, at the end of September 2023, Replimune Group had US$29.2m of debt, up from none a year ago. Click the image for more detail. But it also has US$496.8m in cash to offset that, meaning it has US$467.6m net cash.

How Strong Is Replimune Group's Balance Sheet?

According to the last reported balance sheet, Replimune Group had liabilities of US$39.8m due within 12 months, and liabilities of US$57.4m due beyond 12 months. Offsetting this, it had US$496.8m in cash and US$2.90m in receivables that were due within 12 months. So it actually has US$402.4m more liquid assets than total liabilities.

This luscious liquidity implies that Replimune Group's balance sheet is sturdy like a giant sequoia tree. Having regard to this fact, we think its balance sheet is as strong as an ox. Simply put, the fact that Replimune Group has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Replimune Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Since Replimune Group doesn't have significant operating revenue, shareholders may be hoping it comes up with a great new product, before it runs out of money.

So How Risky Is Replimune Group?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year Replimune Group had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of US$157m and booked a US$199m accounting loss. But the saving grace is the US$467.6m on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 5 warning signs for Replimune Group (1 is concerning) you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:REPL

Replimune Group

A clinical-stage biotechnology company, focuses on the development and commercialization of oncolytic immunotherapies to treat cancer.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion