- United States

- /

- Biotech

- /

- NasdaqGS:REGN

Will EU Approval of Dupixent for CSU Transform Regeneron Pharmaceuticals' (REGN) Long-Term Growth Narrative?

Reviewed by Sasha Jovanovic

- Regeneron Pharmaceuticals and Sanofi recently announced that the European Commission approved Dupixent (dupilumab) for the treatment of moderate-to-severe chronic spontaneous urticaria (CSU) in patients aged 12 years and older who are inadequately controlled by antihistamines and have not received anti-IgE therapy.

- This regulatory milestone brings the first new targeted therapy for CSU patients in over a decade and expands access to treatment for more than 270,000 eligible individuals in the EU.

- We'll explore how unlocking a new patient population through this approval could impact Regeneron's long-term growth outlook and investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Regeneron Pharmaceuticals Investment Narrative Recap

To be a shareholder in Regeneron, you need to believe in the power of new medicines like Dupixent to drive long-term growth and buffer the impact of ongoing EYLEA competition. The recent European approval for Dupixent in chronic spontaneous urticaria expands its market opportunity, but it is the ongoing stabilization and future prospects of EYLEA, amid competition and manufacturing challenges, that remain the biggest near-term catalyst and primary risk to the business. The Dupixent milestone does not immediately change this dynamic.

The recent approval of EYLEA HD by the FDA, which offers enhanced dosing flexibility for patients with retinal diseases, stands out as highly relevant. Both new launches reflect Regeneron's drive to offset biosimilar competition and pricing risks surrounding its key franchises. These types of product expansions and regulatory wins are essential to Regeneron's efforts to sustain revenue and margin growth in a competitive market.

But while product approvals open new doors, investors should be aware that risks around competition and pricing for blockbuster drugs like EYLEA...

Read the full narrative on Regeneron Pharmaceuticals (it's free!)

Regeneron Pharmaceuticals' outlook anticipates $16.6 billion in revenue and $5.0 billion in earnings by 2028. This scenario assumes a 5.4% annual revenue growth rate and a $0.5 billion increase in earnings from the current $4.5 billion.

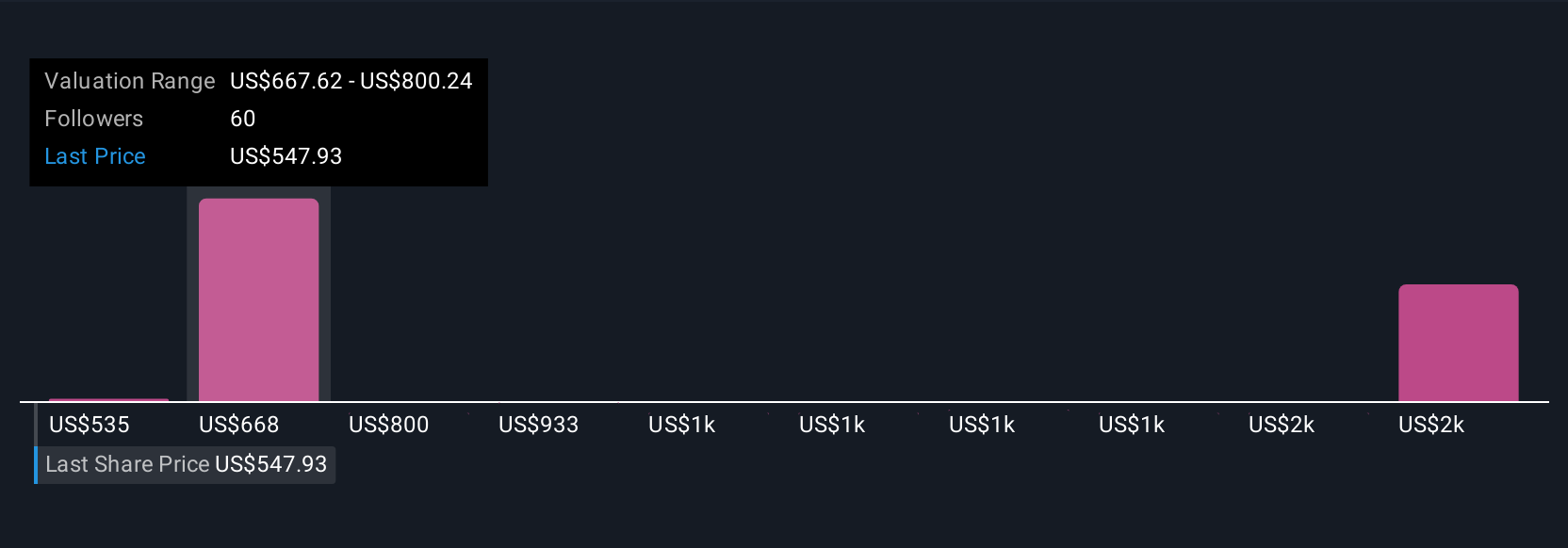

Uncover how Regeneron Pharmaceuticals' forecasts yield a $768.36 fair value, in line with its current price.

Exploring Other Perspectives

Some analysts expect a steeper ramp in Dupixent revenues, based on its breakthrough status for under-treated conditions. They previously forecast Regeneron could reach US$17,800,000,000 in revenue by 2028, and believe upcoming approvals will dramatically accelerate market share gains. This outlook is much more optimistic than the consensus, so it is worth considering how new developments could change those projections over time.

Explore 11 other fair value estimates on Regeneron Pharmaceuticals - why the stock might be worth 30% less than the current price!

Build Your Own Regeneron Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regeneron Pharmaceuticals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Regeneron Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regeneron Pharmaceuticals' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.