- United States

- /

- Biotech

- /

- NasdaqGS:REGN

Will a Positive EMA Opinion on Libtayo Shape Regeneron Pharmaceuticals' (REGN) Global Oncology Trajectory?

Reviewed by Sasha Jovanovic

- Earlier this month, Regeneron Pharmaceuticals announced that the European Medicines Agency's Committee for Medicinal Products for Human Use adopted a positive opinion recommending Libtayo (cemiplimab) as an adjuvant treatment for adults with cutaneous squamous cell carcinoma at high risk of recurrence following surgery and radiation.

- This development is supported by robust Phase 3 C-POST trial data showing that Libtayo significantly reduces the risk of disease recurrence or death in this patient population, and the final European Commission decision is expected in the coming months.

- We’ll examine how the positive EMA CHMP opinion on Libtayo could impact Regeneron’s future global oncology growth narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Regeneron Pharmaceuticals Investment Narrative Recap

To be a Regeneron shareholder, you need to believe the company's broad, advancing pipeline, particularly in oncology and immunology, is poised to offset revenue headwinds from heightened EYLEA competition and patent erosion. The recent positive EMA opinion on Libtayo may help strengthen Regeneron’s global oncology narrative and represents a short-term catalyst, but does not fully resolve key risks associated with continued pressure on EYLEA sales and uncertainties around pipeline diversification.

Amid these headline oncology developments, Regeneron's October release of positive pivotal data for gene therapy DB-OTO in genetic hearing loss stands out. While this has limited direct connection to the Libtayo announcement, it illustrates the company's ongoing push to expand into new therapeutic areas, supporting the long-term case for pipeline-driven revenue growth if late-stage assets can deliver commercial success.

By contrast, investors should be aware of ongoing risks tied to unresolved pricing and biosimilar competition for EYLEA, which...

Read the full narrative on Regeneron Pharmaceuticals (it's free!)

Regeneron Pharmaceuticals' outlook anticipates $16.6 billion in revenue and $5.0 billion in earnings by 2028. This projection is based on expected annual revenue growth of 5.4% and a $0.5 billion increase in earnings from the current $4.5 billion.

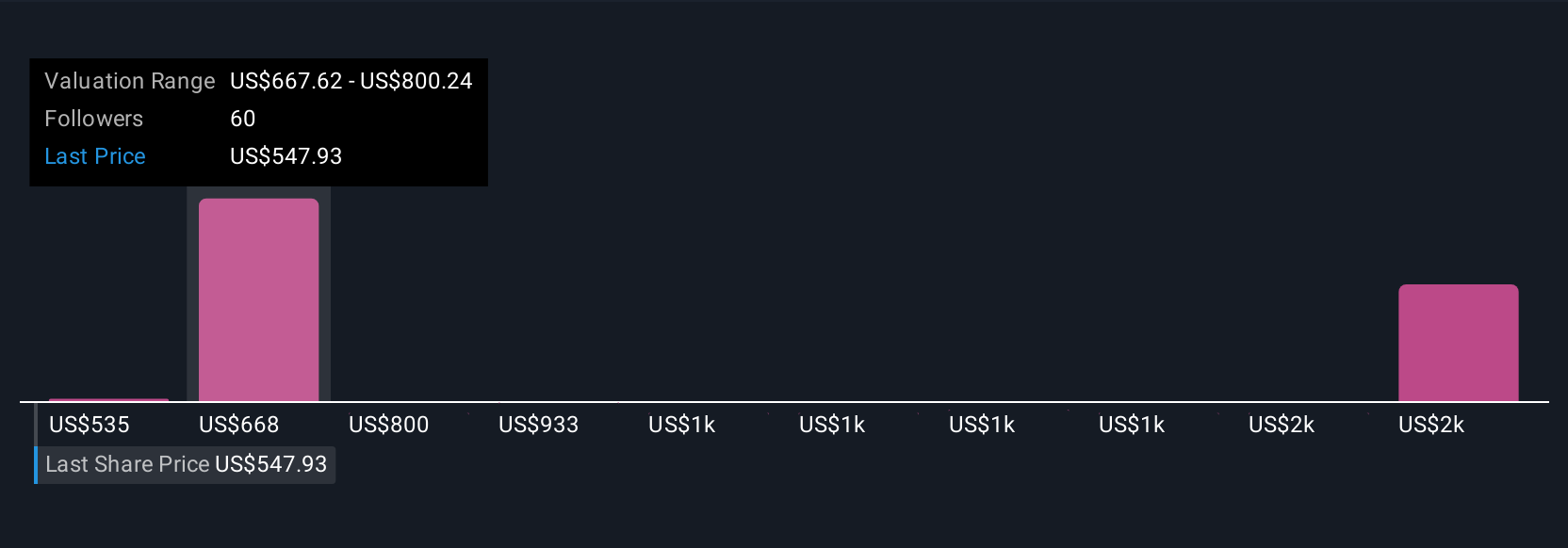

Uncover how Regeneron Pharmaceuticals' forecasts yield a $722.20 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Some analysts before the latest news were much more optimistic, expecting Regeneron’s annual earnings could reach US$6.2 billion with rising margins by 2028. If you were in this camp, you might have expected expanding pipeline assets like Libtayo to accelerate revenue diversification, but this bullish view is highly sensitive to the actual pace of pipeline adoption and evolving competition. It's a reminder to check the range of analyst expectations when considering the stock's outlook.

Explore 11 other fair value estimates on Regeneron Pharmaceuticals - why the stock might be worth 6% less than the current price!

Build Your Own Regeneron Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regeneron Pharmaceuticals research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Regeneron Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regeneron Pharmaceuticals' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives