- United States

- /

- Biotech

- /

- NasdaqGS:REGN

Why Regeneron (REGN) Is Up 6.4% After FDA Expansion and Positive Late-Stage Trial Results

Reviewed by Sasha Jovanovic

- In late September 2025, Regeneron Pharmaceuticals announced a series of major clinical and regulatory achievements, including expanded US FDA approval of Evkeeza for children aged 1 to less than 5 with homozygous familial hypercholesterolemia and positive late-stage results for obesity and rare disease treatments.

- These developments emphasize Regeneron's increasing capacity to diversify beyond core products and strengthen its late-stage pipeline for future growth.

- We'll examine how the expansion of Evkeeza's approval to younger children underscores Regeneron's evolving investment narrative and portfolio diversification.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Regeneron Pharmaceuticals Investment Narrative Recap

To be a shareholder in Regeneron Pharmaceuticals, one must believe in the company’s potential to diversify its revenue base beyond legacy products such as EYLEA and Dupixent, with a robust pipeline that supports long-term earnings growth. The recent expansion of Evkeeza’s FDA approval exemplifies this strategic shift, but it does not materially alter the near-term outlook for Regeneron’s biggest catalyst, the ramp of EYLEA HD, or alleviate the largest risk: accelerating competition and pricing pressure in the branded anti-VEGF market.

Among Regeneron’s recent announcements, the positive late-stage results for garetosmab in fibrodysplasia ossificans progressiva stand out for their relevance. This pipeline milestone signals fresh commercial opportunities in rare diseases and further supports the case for pipeline-driven revenue growth, potentially helping to offset future declines in core ophthalmology sales and reducing dependence on established blockbusters.

Yet, in contrast, investors should also be mindful of how pricing risk and payer policy changes might impact future earnings if Regeneron’s core therapies lose ground to lower-cost competitors or face tougher reimbursement terms...

Read the full narrative on Regeneron Pharmaceuticals (it's free!)

Regeneron Pharmaceuticals’ outlook projects $16.6 billion in revenue and $5.0 billion in earnings by 2028. This forecast relies on a 5.4% annual revenue growth rate and a $0.5 billion increase in earnings from the current $4.5 billion.

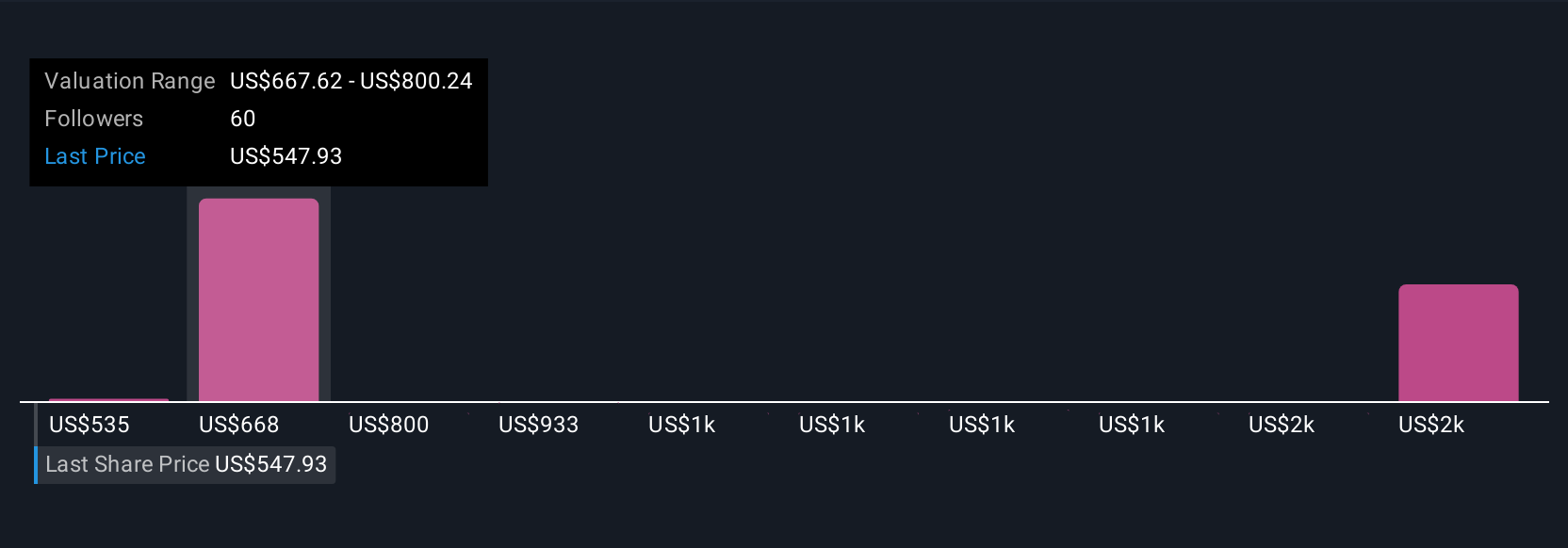

Uncover how Regeneron Pharmaceuticals' forecasts yield a $722.20 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts believed Regeneron could reach annual revenues of US$17.8 billion and earnings of US$6.2 billion by 2028, expecting faster Dupixent and EYLEA HD expansion. This narrative is much more upbeat than consensus, so if these projections appeal to you, be aware the latest news could sway expectations further. Disagreement is wide, so check different viewpoints to understand what makes Regeneron’s future so debated.

Explore 10 other fair value estimates on Regeneron Pharmaceuticals - why the stock might be worth 9% less than the current price!

Build Your Own Regeneron Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regeneron Pharmaceuticals research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Regeneron Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regeneron Pharmaceuticals' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives