- United States

- /

- Biotech

- /

- NasdaqGS:REGN

Regeneron Pharmaceuticals (NasdaqGS:REGN) Gains Conditional EC Approval For Lynozyfic In Multiple Myeloma

Reviewed by Simply Wall St

Regeneron Pharmaceuticals (NasdaqGS:REGN) experienced a 7% price increase over the past week, coinciding with the European Commission's regulatory approval of Lynozyfic for relapsed and refractory multiple myeloma, which may have bolstered investor confidence despite broader uncertainties. This positive development for Regeneron came while the market overall saw a similar upward trajectory of 7%. Additionally, the company's efforts to expand its manufacturing capacity with FUJIFILM Diosynth Biotechnologies add weight to its growth prospects, which aligns with the market’s recovery from recent declines.

The recent regulatory approval of Lynozyfic for relapsed and refractory multiple myeloma could significantly bolster Regeneron Pharmaceuticals' pipeline, directly impacting revenue and earnings forecasts. The expansion efforts in manufacturing capabilities with FUJIFILM Diosynth Biotechnologies are aligning well with the anticipated market opportunities, potentially supporting the company's long-term growth strategy. This news, adding to the recent 7% weekly share price increase, reflects investor confidence in Regeneron's projected expansion in personalized medicine and healthcare analytics.

Over a longer five-year period, Regeneron's total return, including both share price and dividends, reached 11.37%, providing a more tempered view of its growth trajectory. Contextually, Regeneron's one-year performance lagged behind both the US Biotechs industry and the broader market, as the company returned below industry averages. This underperformance underscores the importance of upcoming product approvals and market entries in shifting the growth narrative.

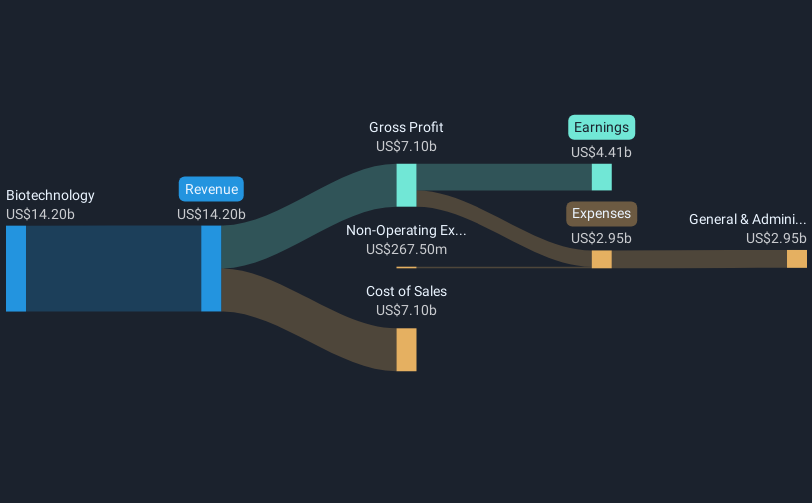

As of today's date, the share price stands at US$585.49, which is discounted significantly from the bullish analyst price target of US$1081.0. Should the company achieve the revenue growth and profit margins projected by bullish analysts, this potential upside could make the shares more attractive. Investors should consider the implications of anticipated revenues reaching $19.8 billion and earnings of $6.7 billion by 2028, against the backdrop of the current market environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives