- United States

- /

- Biotech

- /

- NasdaqCM:RCEL

AVITA Medical (RCEL) Is Down 22.4% After CEO Departure and Revenue Guidance Cut—Has the Thesis Changed?

Reviewed by Sasha Jovanovic

- Earlier this week, AVITA Medical appointed Chairman Cary Vance as Interim CEO following the departure of Jim Corbett and released preliminary third-quarter revenue guidance of approximately US$17 million, while also securing a waiver on its revenue covenant from OrbiMed and initiating a search for a permanent CEO.

- This leadership transition and concurrent financial updates come as AVITA continues to address operational and reimbursement challenges in its core wound care markets.

- We will explore how the sudden executive change during ongoing financial headwinds may influence AVITA Medical's investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

AVITA Medical Investment Narrative Recap

To be a shareholder in AVITA Medical, you must believe in the company’s ability to overcome reimbursement obstacles with its RECELL system and reignite sales growth, especially as hospital adoption and payer clarity improve. The recent CEO transition and preliminary revenue results do not meaningfully shift the near-term focus, as restoring provider confidence in reimbursement remains the essential catalyst, while persistent claims and operational issues are still the main risk. In my view, this executive change is more of a governance update than a short-term pivot affecting underlying business dynamics.

Among AVITA's recent announcements, the preliminary third-quarter revenue guidance of approximately US$17 million stands out, arriving below earlier quarters and coinciding with ongoing claims processing backlogs. This update directly reflects the current pressure on top-line growth and the sensitivity of AVITA’s trajectory to timely reimbursement resolutions, a central theme for anyone watching catalysts and risks tied to the stock’s short-term performance.

But in contrast, investors should be aware of how continued uncertainty around claims processing timelines could still ...

Read the full narrative on AVITA Medical (it's free!)

AVITA Medical's outlook anticipates $214.8 million in revenue and $77.2 million in earnings by 2028. This projection relies on 42.1% annual revenue growth and a $128.8 million increase in earnings from the current -$51.6 million.

Uncover how AVITA Medical's forecasts yield a $8.26 fair value, a 107% upside to its current price.

Exploring Other Perspectives

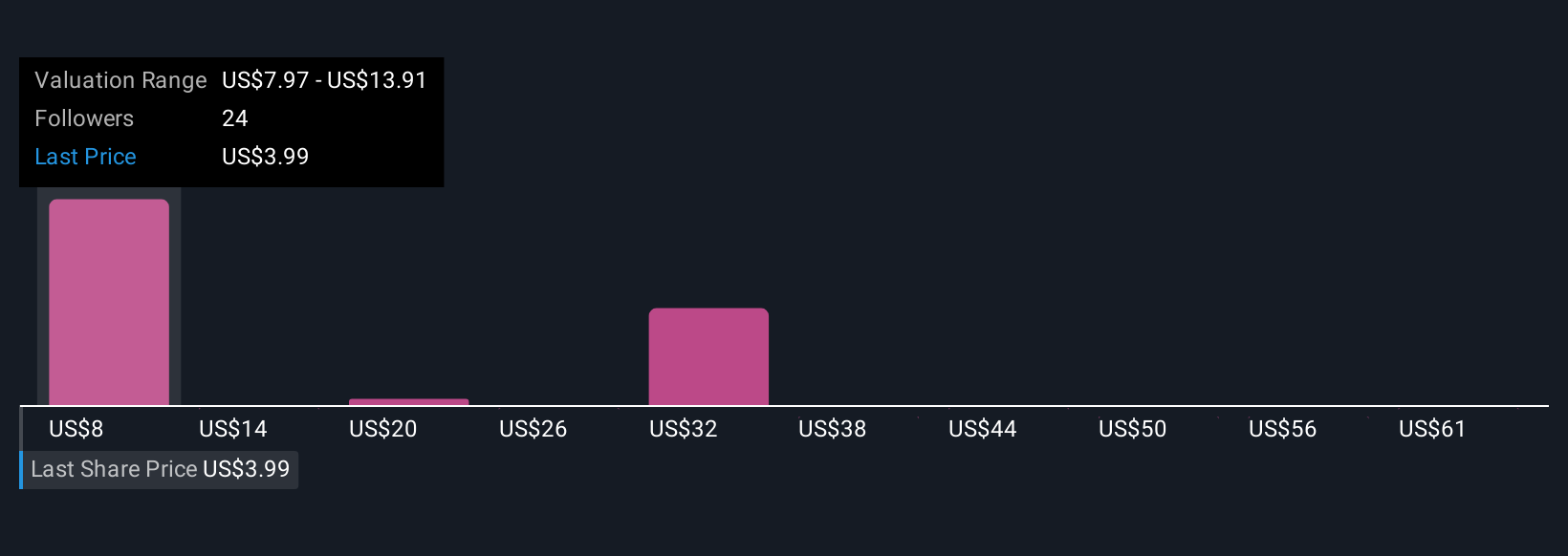

Ten fair value assessments from the Simply Wall St Community range from US$7.97 up to US$67.44 per share, showing widely differing expectations. As reimbursement challenges can delay revenue and earnings, be mindful that broad outcomes remain possible for AVITA Medical’s path forward.

Explore 10 other fair value estimates on AVITA Medical - why the stock might be a potential multi-bagger!

Build Your Own AVITA Medical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AVITA Medical research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AVITA Medical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AVITA Medical's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RCEL

AVITA Medical

Operates as a therapeutic acute wound care company in the United States, Japan, the European Union, Australia, and the United Kingdom.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives