- United States

- /

- Biotech

- /

- NasdaqGS:RARE

Will the DTX401 FDA Filing Advance Ultragenyx Pharmaceutical's (RARE) Late-Stage Pipeline Narrative?

Reviewed by Simply Wall St

- Ultragenyx Pharmaceutical recently announced the initiation of a rolling submission of a Biologics License Application to the FDA for DTX401, an AAV gene therapy aimed at treating Glycogen Storage Disease Type Ia, including 96-week positive clinical data and updates to address previous regulatory feedback.

- This milestone highlights the company's continued progress in advancing its late-stage pipeline and responsiveness to regulatory challenges, particularly around chemistry, manufacturing, and controls for gene therapies.

- We will assess how this critical step toward regulatory approval for DTX401 may impact Ultragenyx's investment narrative and future growth prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Ultragenyx Pharmaceutical Investment Narrative Recap

Ultragenyx shareholders need confidence in the company’s ability to convert its pipeline progress into regulatory wins and, crucially, move closer to profitability amid ongoing high cash burn. The recent rolling BLA submission for DTX401 addresses the most important near-term catalyst, regulatory approval for a lead gene therapy asset, while also signaling ongoing vulnerability to regulatory review outcomes, especially concerning chemistry, manufacturing, and controls processes. This news meaningfully raises the stakes for DTX401 as the pivotal focus for shareholder value and near-term growth.

Among recent announcements, the July 2025 FDA Complete Response Letter for UX111 is most relevant as it underscored challenges with CMC compliance, an obstacle explicitly addressed in the DTX401 application strategy. Proactively tackling feedback from that setback suggests Ultragenyx is prioritizing smoother regulatory pathways for its pipeline, especially for gene therapies where approval timelines and outcomes directly impact the company’s potential revenue ramp and liquidity.

By contrast, investors should be mindful of the increased risk that, if regulatory feedback on DTX401’s CMC section echoes prior hurdles...

Read the full narrative on Ultragenyx Pharmaceutical (it's free!)

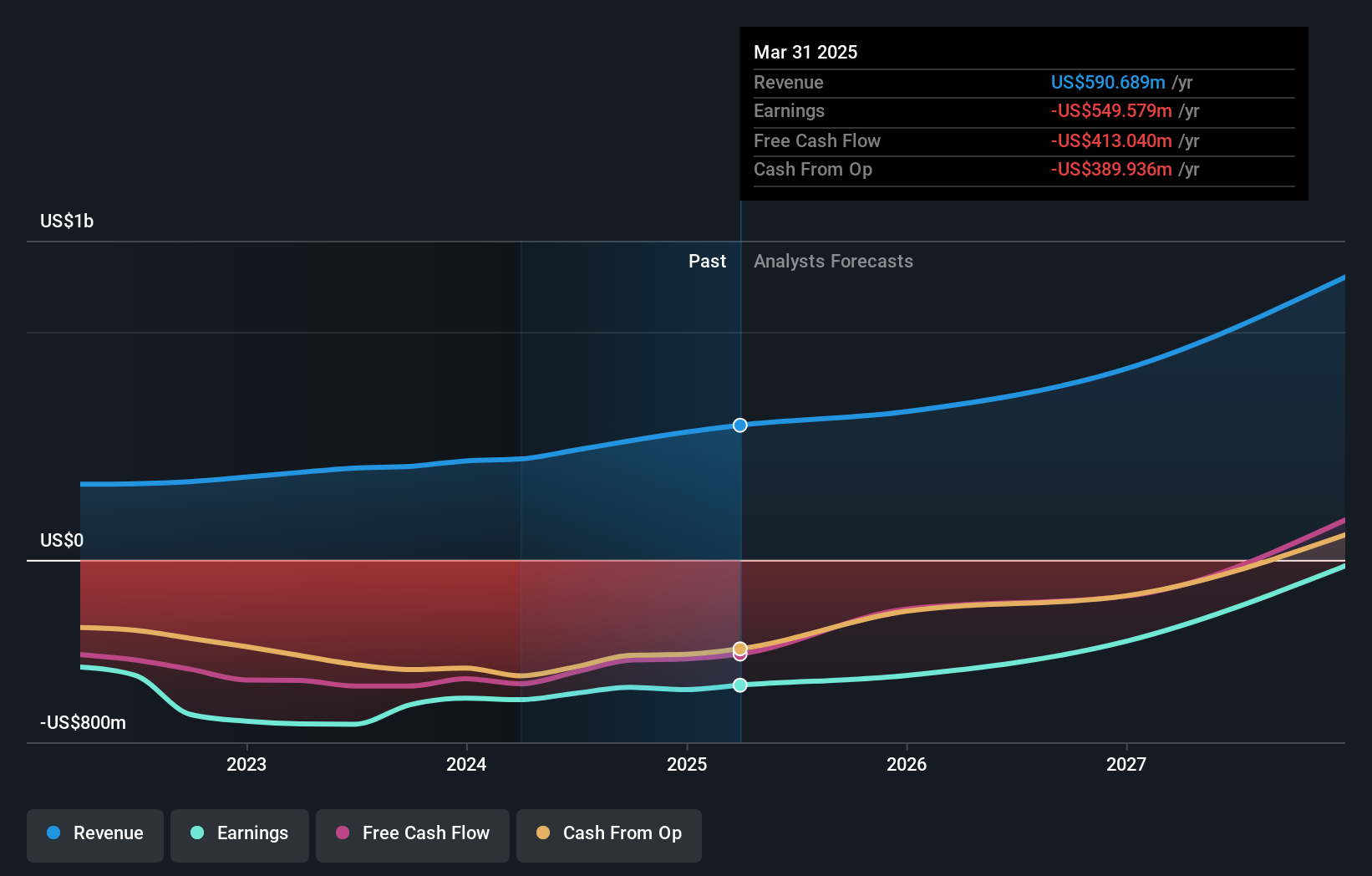

Ultragenyx Pharmaceutical's narrative projects $1.4 billion revenue and $46.9 million earnings by 2028. This requires 32.0% yearly revenue growth and a $579.8 million earnings increase from -$532.9 million today.

Uncover how Ultragenyx Pharmaceutical's forecasts yield a $86.05 fair value, a 189% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair value estimates for Ultragenyx between US$86 and US$413, reflecting very broad outlooks from just 2 analyses. Ongoing regulatory risks may keep views divided on when, or if, the company’s gene therapy pipeline translates into meaningful revenue growth.

Explore 2 other fair value estimates on Ultragenyx Pharmaceutical - why the stock might be a potential multi-bagger!

Build Your Own Ultragenyx Pharmaceutical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ultragenyx Pharmaceutical research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Ultragenyx Pharmaceutical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ultragenyx Pharmaceutical's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RARE

Ultragenyx Pharmaceutical

A biopharmaceutical company, focuses on the identification, acquisition, development, and commercialization of novel products for the treatment of rare and ultra-rare genetic diseases in North America, Latin America, Europe, the Middle East, Africa, and the Asia-Pacific.

High growth potential and good value.

Market Insights

Community Narratives