- United States

- /

- Biotech

- /

- NasdaqGS:RARE

Could Ultragenyx (RARE) Leverage New DTX401 Data to Strengthen Its Rare Disease Portfolio Strategy?

Reviewed by Simply Wall St

- Earlier this month, Ultragenyx Pharmaceutical announced positive 96-week Phase 3 results for its DTX401 gene therapy in glycogen storage disease type Ia, showing greater sustained reductions in daily cornstarch intake and improvements in glycemic control, with an acceptable safety profile.

- This new data highlights DTX401's potential to address unmet needs in GSDIa management by delivering both meaningful clinical benefit and quality-of-life improvements for patients.

- We will explore how these latest long-term clinical results for DTX401 may influence Ultragenyx's growth narrative and pipeline value proposition.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Ultragenyx Pharmaceutical Investment Narrative Recap

To be a shareholder in Ultragenyx Pharmaceutical, you need to believe in the power of gene therapy breakthroughs and the company's ability to convert clinical progress into commercial traction, particularly for rare diseases. This month's strong 96-week results for DTX401 support confidence in regulatory momentum for this key pipeline asset, but the near-term outlook still hinges on overcoming the risk of persistent losses and funding needs; while these results are highly encouraging, they do not immediately solve financial pressures or remove the dependency on further regulatory wins.

Among recent announcements, the August 2025 initiation of a rolling Biologics License Application (BLA) for DTX401 directly builds on the latest clinical trial readout. Incorporating the new 96-week data into its US regulatory submission could strengthen the approval case and impact the timing of potential revenue generation, which is crucial given the business’s current cash burn and need to demonstrate progress toward profitability.

However, investors should also recognize that a step forward in clinical trials does not necessarily offset the risk of continued high operating losses and the possibility of future equity dilution if cash flows do not improve as quickly as needed...

Read the full narrative on Ultragenyx Pharmaceutical (it's free!)

Ultragenyx Pharmaceutical's outlook forecasts $1.4 billion in revenue and $46.9 million in earnings by 2028. This scenario assumes a 32.0% annual revenue growth rate and an earnings improvement of $579.8 million from current earnings of -$532.9 million.

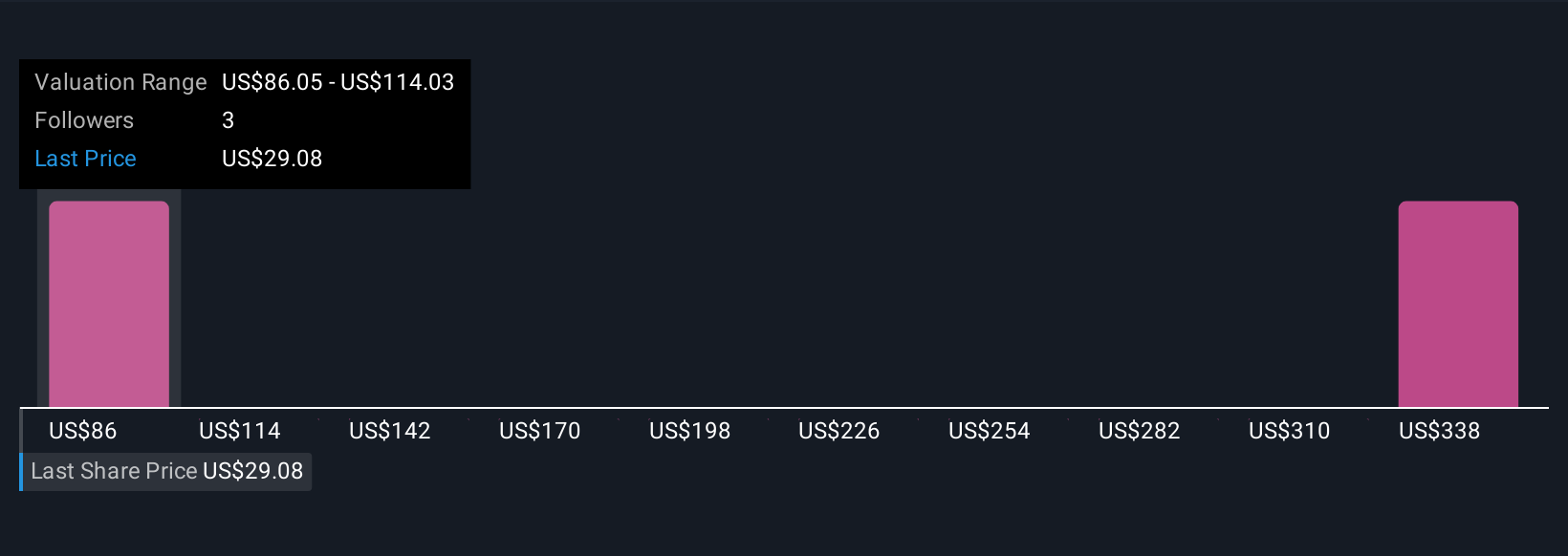

Uncover how Ultragenyx Pharmaceutical's forecasts yield a $86.05 fair value, a 206% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community have fair value estimates for Ultragenyx Pharmaceutical between US$86.05 and US$367.22. With persistent unprofitability and reliance on costly development, these differing views highlight just how much outlooks can shift based on assumptions around upcoming regulatory milestones.

Explore 2 other fair value estimates on Ultragenyx Pharmaceutical - why the stock might be worth just $86.05!

Build Your Own Ultragenyx Pharmaceutical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ultragenyx Pharmaceutical research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Ultragenyx Pharmaceutical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ultragenyx Pharmaceutical's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RARE

Ultragenyx Pharmaceutical

A biopharmaceutical company, focuses on the identification, acquisition, development, and commercialization of novel products for the treatment of rare and ultra-rare genetic diseases in North America, Latin America, Europe, the Middle East, Africa, and the Asia-Pacific.

High growth potential and good value.

Market Insights

Community Narratives