- United States

- /

- Pharma

- /

- NasdaqGM:RANI

Rani Therapeutics Holdings (RANI) Is Up 257.9% After Billion-Dollar Chugai Deal for Oral Biologics Innovation Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Rani Therapeutics Holdings recently announced a collaboration and license agreement with Chugai Pharmaceutical to develop and commercialize an oral product using the RaniPill platform and Chugai’s investigational rare disease antibody, with the deal including a US$10 million upfront payment, up to US$175 million in milestones, single digit royalties, and a potential total value of up to US$1.09 billion if all options are exercised.

- This agreement underscores increased industry interest in Rani’s oral biologic delivery technology and highlights the significant commercial potential for rare disease therapeutics administered orally.

- We’ll explore how this new partnership, which offers future milestone and royalty opportunities, impacts Rani’s existing investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Rani Therapeutics Holdings Investment Narrative Recap

Owning shares in Rani Therapeutics Holdings means believing in the promise of its RaniPill technology to unlock oral biologic treatments and drive substantial future growth, especially in rare diseases and obesity. The recent Chugai collaboration materially impacts the top short-term catalyst, monetizing the RaniPill platform through partnerships, but funding risks linger, as ongoing losses and new developments require significant capital to reach commercial milestones. The most prominent risk remains Rani’s historic reliance on outside capital to support its pipeline, even as milestone payments and royalties now appear more achievable.

Of recent announcements, the October 16 private placement, raising approximately US$60.3 million, stands out. This injection of new capital directly addresses the near-term cash concern, bolstering Rani’s ability to fund operations as it pursues the commercial potential unlocked by the Chugai deal and continues its primary focus on RT-114.

However, investors should also be conscious that even with new funding in place, future cash needs could arise if development timelines or milestones are delayed...

Read the full narrative on Rani Therapeutics Holdings (it's free!)

Rani Therapeutics Holdings' outlook anticipates $38.2 million in revenue and $8.9 million in earnings by 2028. This scenario assumes annual revenue growth of 217.0% and an earnings increase of $38.6 million from current earnings of -$29.7 million.

Uncover how Rani Therapeutics Holdings' forecasts yield a $7.75 fair value, a 373% upside to its current price.

Exploring Other Perspectives

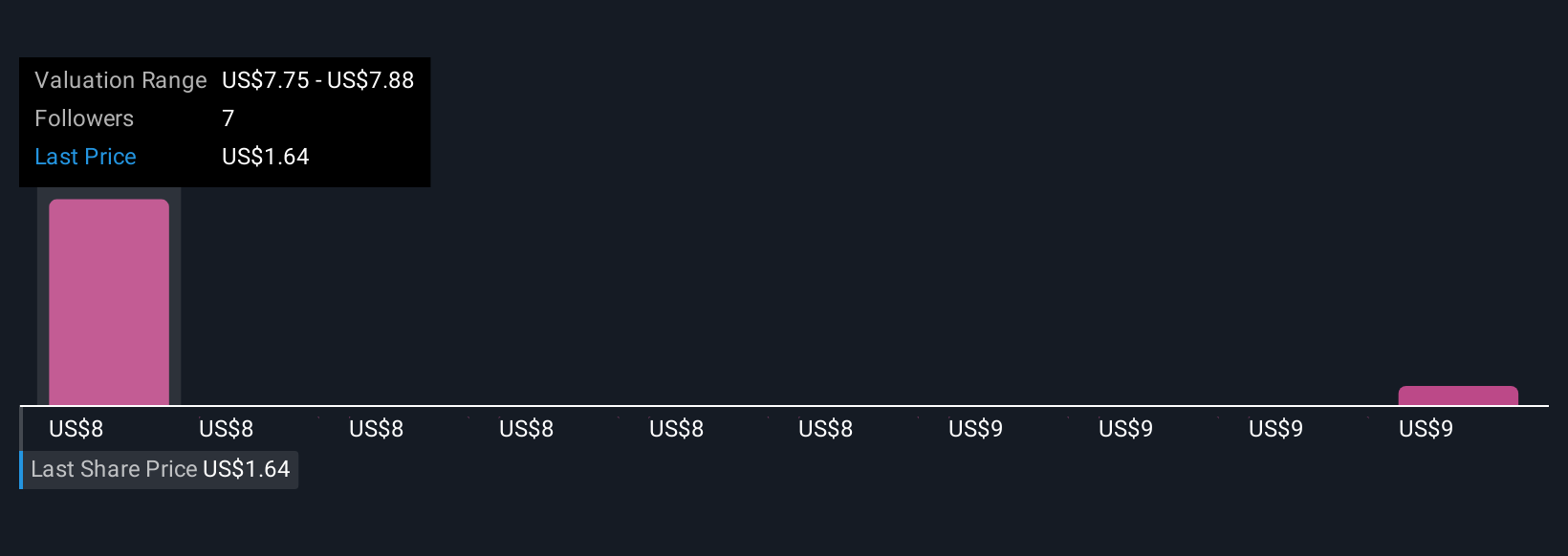

Two Simply Wall St Community fair value estimates for Rani Therapeutics range from US$7.75 to US$9 per share. With ongoing cash burn and a material new partnership, your own view on the company’s ability to achieve commercial milestones could shift meaningfully, explore multiple opinions for a broader outlook.

Explore 2 other fair value estimates on Rani Therapeutics Holdings - why the stock might be worth just $7.75!

Build Your Own Rani Therapeutics Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rani Therapeutics Holdings research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Rani Therapeutics Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rani Therapeutics Holdings' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RANI

Rani Therapeutics Holdings

Operates as a clinical stage biotherapeutics company, focusing on technologies to enable the administration of biologics and drugs orally for patients, physicians, and healthcare systems with a alternative to painful injections in the United States.

Moderate risk with limited growth.

Market Insights

Community Narratives