- United States

- /

- Life Sciences

- /

- NasdaqGM:QTRX

Quanterix Corporation's (NASDAQ:QTRX) 31% Cheaper Price Remains In Tune With Revenues

Quanterix Corporation (NASDAQ:QTRX) shares have had a horrible month, losing 31% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 42%, which is great even in a bull market.

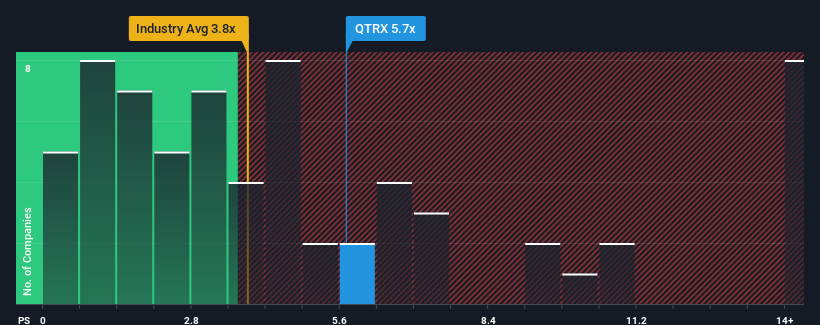

Although its price has dipped substantially, you could still be forgiven for thinking Quanterix is a stock not worth researching with a price-to-sales ratios (or "P/S") of 5.7x, considering almost half the companies in the United States' Life Sciences industry have P/S ratios below 3.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Quanterix

What Does Quanterix's Recent Performance Look Like?

Recent times have been pleasing for Quanterix as its revenue has risen in spite of the industry's average revenue going into reverse. It seems that many are expecting the company to continue defying the broader industry adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Quanterix's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Quanterix?

Quanterix's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 42% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 18% each year over the next three years. That's shaping up to be materially higher than the 6.4% each year growth forecast for the broader industry.

With this in mind, it's not hard to understand why Quanterix's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

There's still some elevation in Quanterix's P/S, even if the same can't be said for its share price recently. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Quanterix maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Life Sciences industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Quanterix that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Quanterix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:QTRX

Quanterix

A life sciences company, engages in development and marketing of digital immunoassay platforms that advances precision health for life sciences research and diagnostics in North America, Europe, the Middle East, Africa, and the Asia Pacific regions.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives