- United States

- /

- Life Sciences

- /

- NasdaqGM:QSI

Here's Why We're Watching Quantum-Si's (NASDAQ:QSI) Cash Burn Situation

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So should Quantum-Si (NASDAQ:QSI) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Quantum-Si

When Might Quantum-Si Run Out Of Money?

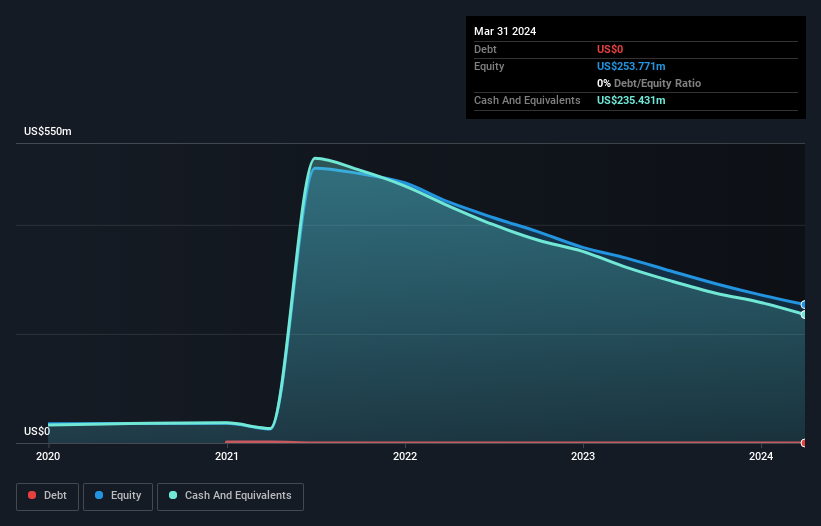

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Quantum-Si last reported its March 2024 balance sheet in May 2024, it had zero debt and cash worth US$235m. Importantly, its cash burn was US$91m over the trailing twelve months. So it had a cash runway of about 2.6 years from March 2024. That's decent, giving the company a couple years to develop its business. You can see how its cash balance has changed over time in the image below.

How Is Quantum-Si's Cash Burn Changing Over Time?

Whilst it's great to see that Quantum-Si has already begun generating revenue from operations, last year it only produced US$1.3m, so we don't think it is generating significant revenue, at this point. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. As it happens, the company's cash burn reduced by 15% over the last year, which suggests that management are maintaining a fairly steady rate of business development, albeit with a slight decrease in spending. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Quantum-Si To Raise More Cash For Growth?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Quantum-Si to raise more cash in the future. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Quantum-Si's cash burn of US$91m is about 65% of its US$140m market capitalisation. That's very high expenditure relative to the company's size, suggesting it is an extremely high risk stock.

So, Should We Worry About Quantum-Si's Cash Burn?

On this analysis of Quantum-Si's cash burn, we think its cash runway was reassuring, while its cash burn relative to its market cap has us a bit worried. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. Separately, we looked at different risks affecting the company and spotted 3 warning signs for Quantum-Si (of which 1 is a bit unpleasant!) you should know about.

Of course Quantum-Si may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

If you're looking to trade Quantum-Si, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Quantum-Si might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:QSI

Quantum-Si

A life sciences company, engages in the development of single-molecule detection platform to enable Next Generation Protein Sequencing (NGPS).

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives