- United States

- /

- Pharma

- /

- NasdaqCM:PULM

Earnings Beat: Pulmatrix, Inc. (NASDAQ:PULM) Just Beat Analyst Forecasts, And Analysts Have Been Lifting Their Forecasts

Pulmatrix, Inc. (NASDAQ:PULM) just released its latest second-quarter results and things are looking bullish. Sales crushed expectations at US$2.3m, beating expectations by 47%. Pulmatrix reported a statutory loss of US$0.07 per share, which - although not amazing - was much smaller than the analyst predicted. The analyst typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We've gathered the most recent statutory forecasts to see whether the analyst has changed their earnings models, following these results.

See our latest analysis for Pulmatrix

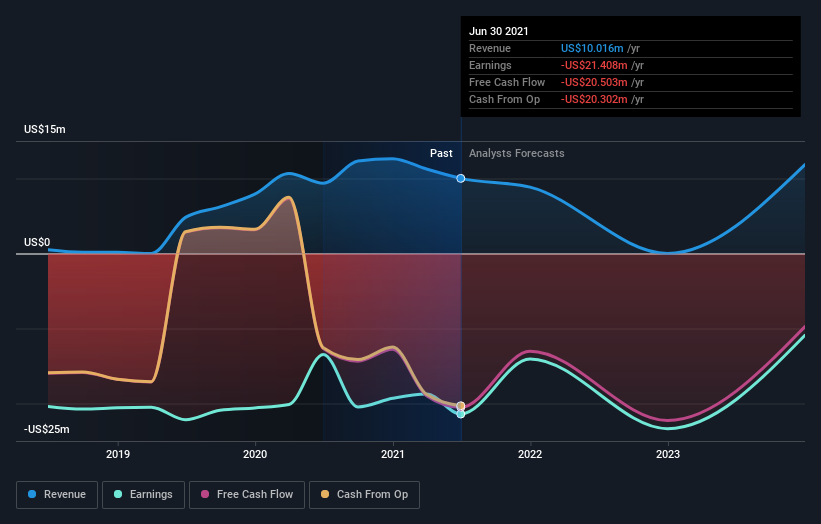

After the latest results, the consensus from Pulmatrix's sole analyst is for revenues of US$8.85m in 2021, which would reflect a considerable 12% decline in sales compared to the last year of performance. The loss per share is expected to greatly reduce in the near future, narrowing 48% to US$0.26. Yet prior to the latest earnings, the analyst had been forecasting revenues of US$6.45m and losses of US$0.36 per share in 2021. We can see there's definitely been a change in sentiment in this update, with the analyst administering a sizeable upgrade to this year's revenue estimates, while at the same time reducing their loss estimates.

Yet despite these upgrades, the analyst cut their price target 50% to US$5.00, implicitly signalling that the ongoing losses are likely to weigh negatively on Pulmatrix's valuation.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that sales are expected to reverse, with a forecast 22% annualised revenue decline to the end of 2021. That is a notable change from historical growth of 62% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 3.4% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Pulmatrix is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that the analyst reconfirmed their loss per share estimates for next year. They also upgraded their revenue estimates for next year, even though sales are expected to grow slower than the wider industry. The consensus price target fell measurably, with the analyst seemingly not reassured by the latest results, leading to a lower estimate of Pulmatrix's future valuation.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At least one analyst has provided forecasts out to 2023, which can be seen for free on our platform here.

Before you take the next step you should know about the 3 warning signs for Pulmatrix (1 is potentially serious!) that we have uncovered.

If you’re looking to trade Pulmatrix, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:PULM

Pulmatrix

A clinical stage biotechnology company, focused on development of novel inhaled therapeutic products to prevent and treat respiratory and other diseases with unmet medical needs in the United States.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026