- United States

- /

- Biotech

- /

- NasdaqGS:PSTX

Investors Don't See Light At End Of Poseida Therapeutics, Inc.'s (NASDAQ:PSTX) Tunnel And Push Stock Down 27%

Poseida Therapeutics, Inc. (NASDAQ:PSTX) shares have had a horrible month, losing 27% after a relatively good period beforehand. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 10%.

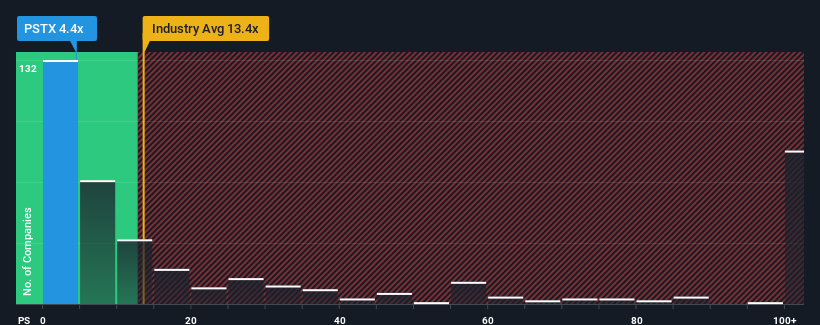

After such a large drop in price, Poseida Therapeutics may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 4.4x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 13.4x and even P/S higher than 70x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Poseida Therapeutics

How Has Poseida Therapeutics Performed Recently?

While the industry has experienced revenue growth lately, Poseida Therapeutics' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Poseida Therapeutics.Is There Any Revenue Growth Forecasted For Poseida Therapeutics?

Poseida Therapeutics' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 50%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 56% per year during the coming three years according to the four analysts following the company. With the industry predicted to deliver 168% growth each year, that's a disappointing outcome.

With this in consideration, we find it intriguing that Poseida Therapeutics' P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Shares in Poseida Therapeutics have plummeted and its P/S has followed suit. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that Poseida Therapeutics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Poseida Therapeutics' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Poseida Therapeutics.

If you're unsure about the strength of Poseida Therapeutics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PSTX

Poseida Therapeutics

A clinical-stage biopharmaceutical company, focuses on developing therapeutics for patients with high unmet medical needs.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives