- United States

- /

- Life Sciences

- /

- NasdaqGM:PSNL

Market Cool On Personalis, Inc.'s (NASDAQ:PSNL) Revenues Pushing Shares 25% Lower

Personalis, Inc. (NASDAQ:PSNL) shares have had a horrible month, losing 25% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 51% loss during that time.

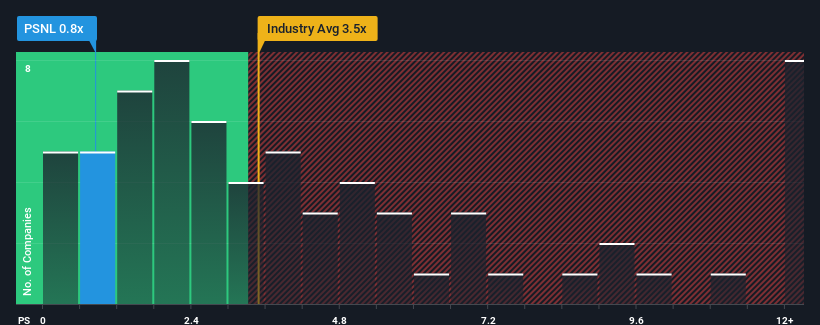

Since its price has dipped substantially, Personalis' price-to-sales (or "P/S") ratio of 0.8x might make it look like a strong buy right now compared to the wider Life Sciences industry in the United States, where around half of the companies have P/S ratios above 3.5x and even P/S above 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Personalis

How Personalis Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, Personalis has been doing quite well of late. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. Those who are bullish on Personalis will be hoping that this isn't the case and the company continues to beat out the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Personalis.Is There Any Revenue Growth Forecasted For Personalis?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Personalis' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. However, this wasn't enough as the latest three year period has seen an unpleasant 6.6% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 16% per annum during the coming three years according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 6.4% per year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Personalis' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Personalis' P/S

Shares in Personalis have plummeted and its P/S has followed suit. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems Personalis currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 4 warning signs for Personalis that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PSNL

Personalis

Develops, markets, and sells advanced cancer genomic tests and services in the United States and internationally.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives