- United States

- /

- Biotech

- /

- NasdaqCM:PRQR

Some ProQR Therapeutics N.V. (NASDAQ:PRQR) Shareholders Look For Exit As Shares Take 29% Pounding

The ProQR Therapeutics N.V. (NASDAQ:PRQR) share price has softened a substantial 29% over the previous 30 days, handing back much of the gains the stock has made lately. Looking at the bigger picture, even after this poor month the stock is up 32% in the last year.

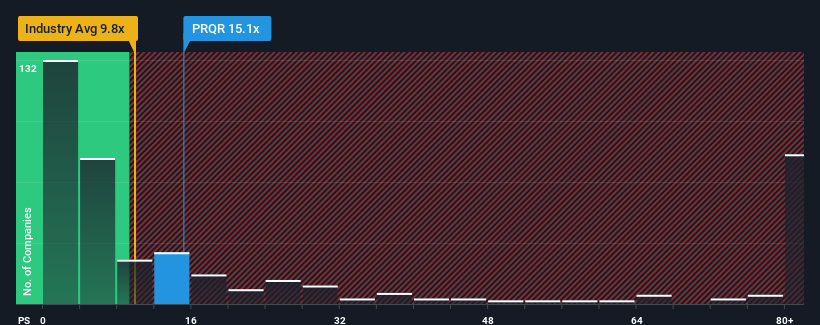

Although its price has dipped substantially, ProQR Therapeutics may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 15.1x, when you consider almost half of the companies in the Biotechs industry in the United States have P/S ratios under 9.8x and even P/S lower than 3x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for ProQR Therapeutics

How Has ProQR Therapeutics Performed Recently?

With revenue growth that's inferior to most other companies of late, ProQR Therapeutics has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on ProQR Therapeutics will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, ProQR Therapeutics would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 9.7% each year as estimated by the five analysts watching the company. Meanwhile, the broader industry is forecast to expand by 114% each year, which paints a poor picture.

In light of this, it's alarming that ProQR Therapeutics' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On ProQR Therapeutics' P/S

A significant share price dive has done very little to deflate ProQR Therapeutics' very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that ProQR Therapeutics currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. At these price levels, investors should remain cautious, particularly if things don't improve.

It is also worth noting that we have found 4 warning signs for ProQR Therapeutics (2 are concerning!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PRQR

ProQR Therapeutics

A biotechnology company, focuses on the discovery and development of novel therapeutic medicines.

Flawless balance sheet low.