- United States

- /

- Pharma

- /

- NasdaqCM:PRPH

ProPhase Labs (NASDAQ:PRPH) Posted Healthy Earnings But There Are Some Other Factors To Be Aware Of

Unsurprisingly, ProPhase Labs, Inc.'s (NASDAQ:PRPH) stock price was strong on the back of its healthy earnings report. We did some analysis and think that investors are missing some details hidden beneath the profit numbers.

See our latest analysis for ProPhase Labs

Zooming In On ProPhase Labs' Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

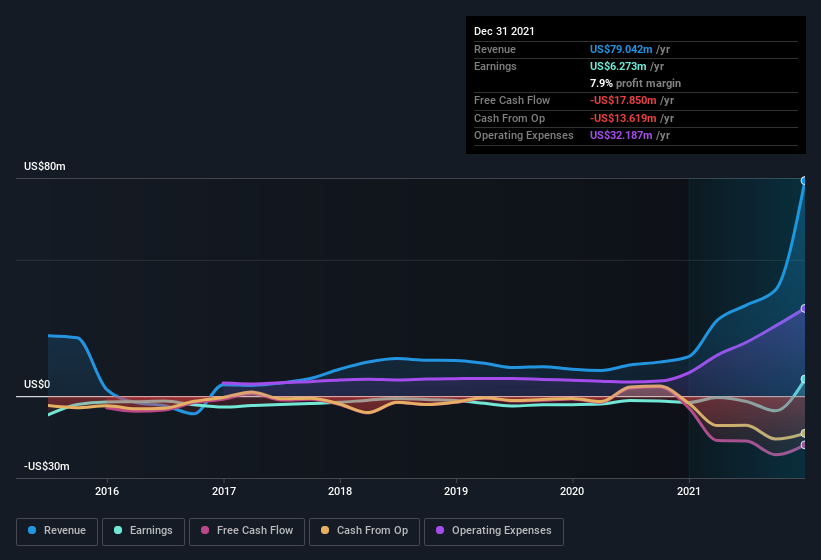

ProPhase Labs has an accrual ratio of 0.76 for the year to December 2021. Statistically speaking, that's a real negative for future earnings. To wit, the company did not generate one whit of free cashflow in that time. Even though it reported a profit of US$6.27m, a look at free cash flow indicates it actually burnt through US$18m in the last year. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of US$18m, this year, indicates high risk. Having said that it seems that a recent tax benefit and some unusual items have impacted its profit (and this its accrual ratio).

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

ProPhase Labs' profit suffered from unusual items, which reduced profit by US$4.2m in the last twelve months. In the case where this was a non-cash charge it would have made it easier to have high cash conversion, so it's surprising that the accrual ratio tells a different story. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. In the twelve months to December 2021, ProPhase Labs had a big unusual items expense. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

An Unusual Tax Situation

In addition to the notable accrual ratio, we can see that ProPhase Labs received a tax benefit of US$968k. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! The receipt of a tax benefit is obviously a good thing, on its own. And given that it lost money last year, it seems possible that the benefit is evidence that it now expects to find value in its past tax losses. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth.

Our Take On ProPhase Labs' Profit Performance

In conclusion, ProPhase Labs' accrual ratio suggests that its statutory earnings are not backed by cash flow, in part due to the tax benefit it received; but the fact unusual items actually weighed on profit may create upside if those unusual items do not recur. Based on these factors, we think that ProPhase Labs' statutory profits probably make it seem better than it is on an underlying level. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For instance, we've identified 3 warning signs for ProPhase Labs (1 is a bit concerning) you should be familiar with.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PRPH

ProPhase Labs

Develops and commercializes novel drugs, dietary supplements, and compounds in the United States.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives