- United States

- /

- Biotech

- /

- NasdaqGS:PRAX

Is Now the Right Time to Reassess Praxis Precision Medicines After Its 266% Surge?

Reviewed by Bailey Pemberton

If you’ve been thinking about what to do with your shares of Praxis Precision Medicines or are simply curious about the meteoric moves you’ve seen on the chart, you’re in the right place. The stock has delivered a jaw-dropping 266.3% gain over the past month and a remarkable 123.9% increase year-to-date, numbers that catch the eye of even the most seasoned investors. Over the last year, Praxis has soared 152.5%, and the three-year return clocks in at an astonishing 514.9%. While these rapid gains may stir up some fear of missing out, it is important not to ignore the longer-term downside. The stock is still down 65.3% over five years, adding a layer of complexity to the narrative.

What is behind this dramatic comeback? Recent news from the company points to promising advancements in their clinical pipeline, with positive trial updates rekindling optimism around Praxis’s future. This kind of momentum often drives not only short-term price pops but also shifts the way investors view the company’s risk profile going forward. The context is that Praxis currently scores a 3 out of 6 on our valuation check, signaling that it passes half the tests for being undervalued. That is a solid foundation, especially after a stretch of volatility and skepticism in previous years.

So how should you think about Praxis’s valuation right now? Let’s dig into the different approaches investors use to evaluate whether this stock truly has more upside ahead or if it is running a bit hot. As we work through the numbers, I will also share an even sharper way to make sense of the company’s worth that might surprise you.

Approach 1: Praxis Precision Medicines Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model projects a company's expected future cash flows and then discounts them back to today's dollars, creating an estimate of the present-day intrinsic value of the business. For Praxis Precision Medicines, this approach uses a two-stage Free Cash Flow to Equity method, reflecting both analyst estimates and extrapolated long-term growth.

Currently, Praxis generates a Free Cash Flow (FCF) of -$191.4 Million, meaning it is not yet profitable but is investing heavily in development. Analyst forecasts predict dramatic growth as Praxis’s FCF is projected to rise to $530.6 Million by 2029. Beyond that, Simply Wall St extrapolates FCF projections and estimates further substantial increases into the next decade.

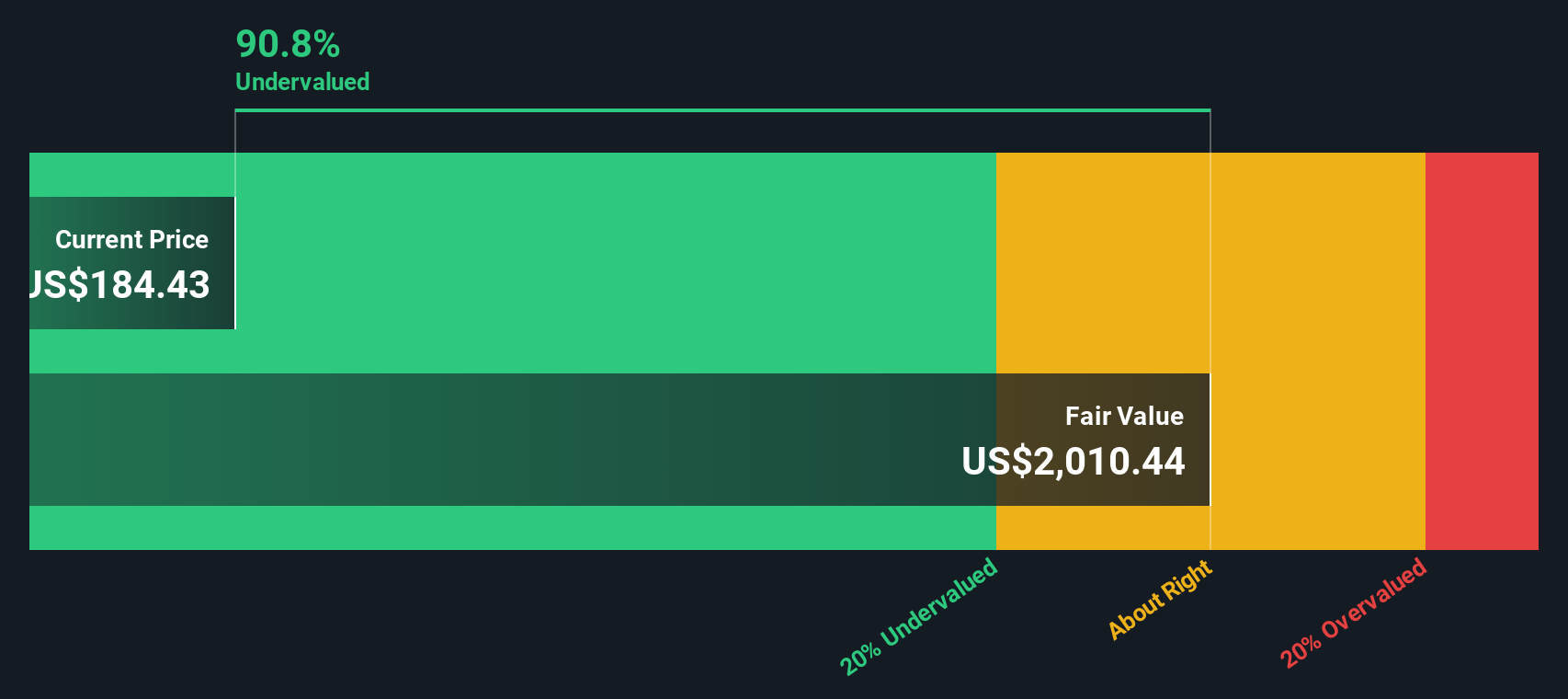

Based on these cash flow projections, the model arrives at an intrinsic value of $2,016.39 per share. With the DCF model indicating the stock trades at a 91.2% discount to this value, Praxis Precision Medicines appears to be significantly undervalued relative to its projected long-term cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Praxis Precision Medicines is undervalued by 91.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Praxis Precision Medicines Price vs Book

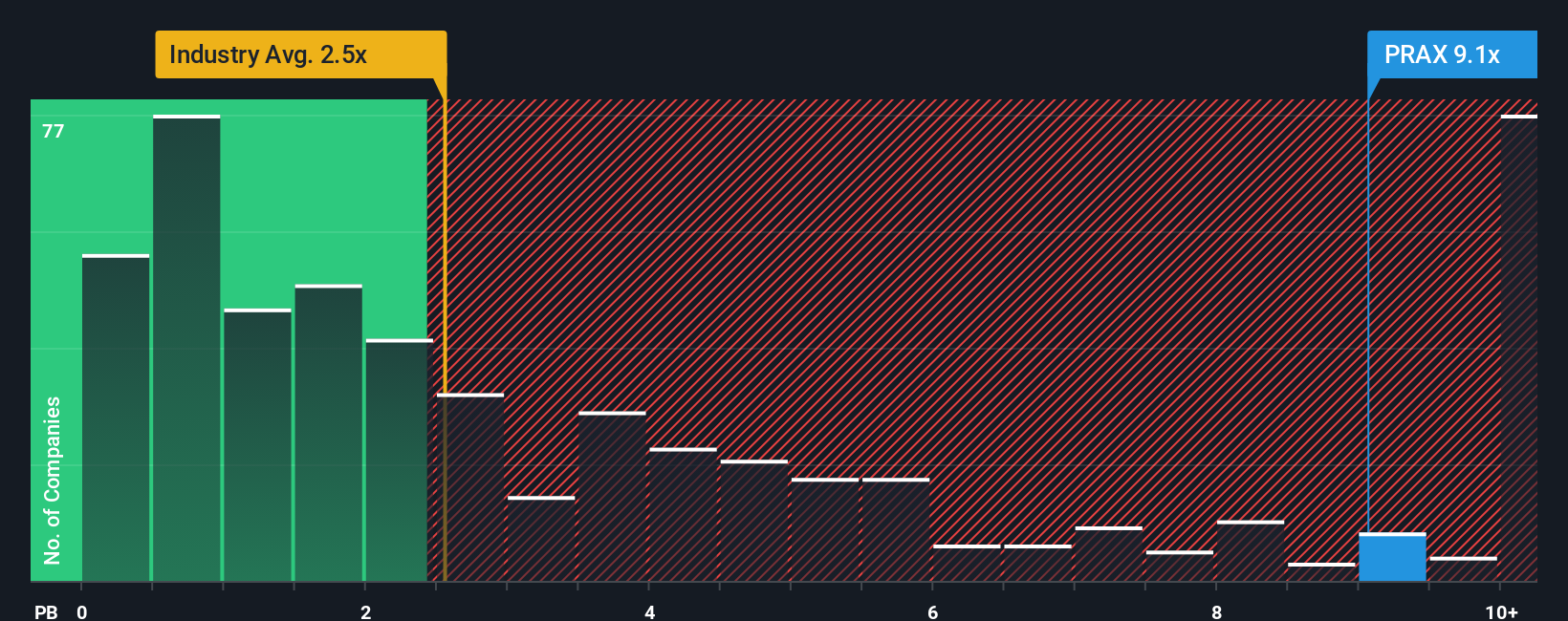

Price-to-Book (P/B) ratio is a widely used metric for companies in the biotech sector, especially when profitability is limited or earnings are negative. This ratio provides insight into what investors are willing to pay for each dollar of net assets, making it more relevant than earnings-based multiples for businesses still investing heavily in research and development, such as Praxis Precision Medicines.

Looking at the numbers, Praxis currently trades at a P/B ratio of 9.27x. For context, the average for its Biotechs industry peers is 2.48x, and the peer average is even higher at 12.82x. On the surface, Praxis is trading well above the typical industry valuation, but at a slight discount compared to its closest peers. This suggests the market may be pricing in expectations for future growth, new product launches, or higher levels of risk.

To sharpen the picture, we turn to Simply Wall St’s Fair Ratio, which is a proprietary metric that calculates what the preferred multiple should be after accounting for factors like Praxis’s growth prospects, risk profile, profit margins, market cap, and industry context. Unlike a simple comparison with industry benchmarks, the Fair Ratio is tailored to the company's unique dynamics.

Comparing Praxis’s actual P/B ratio to its Fair Ratio provides a clearer signal for investors. If the Fair Ratio lines up closely with the current multiple, the stock is fairly priced. In Praxis’s case, the company’s P/B ratio is several points above the industry average, but without the Fair Ratio figure available here, we cannot definitively call Praxis overvalued or undervalued solely on this metric. However, when the actual and fair ratios are closely aligned, that usually signals the stock is priced about right given its prospects and risks.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Praxis Precision Medicines Narrative

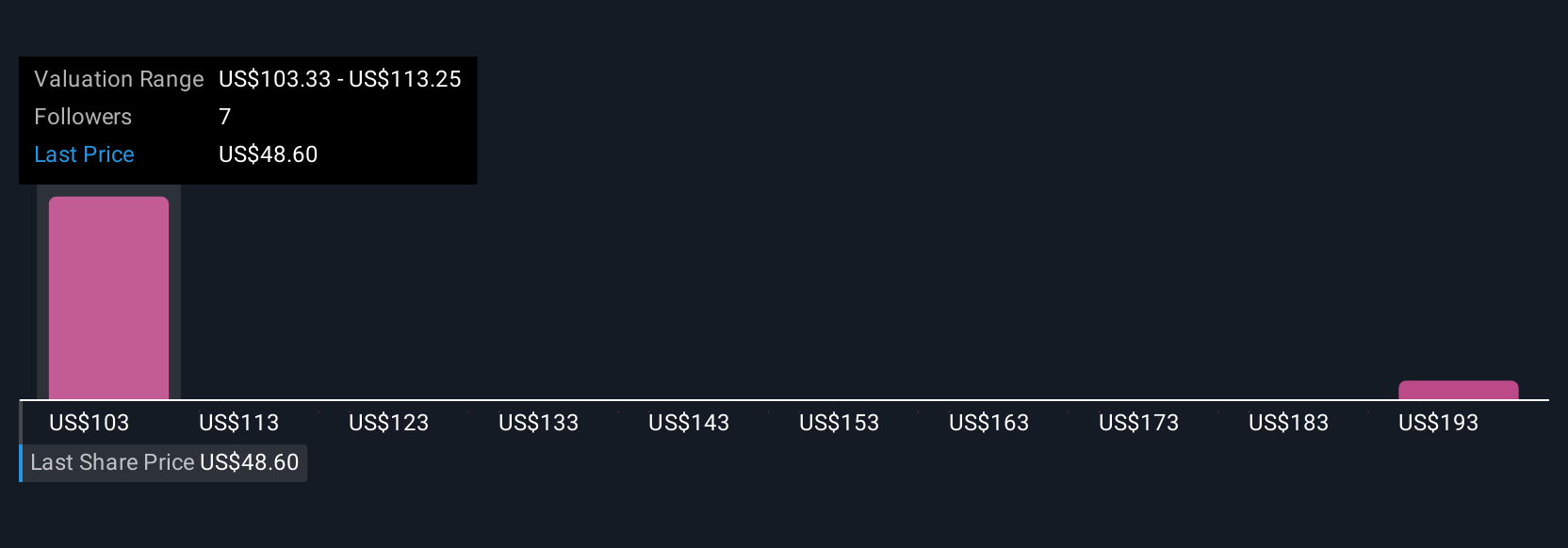

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story—your personal perspective on a company like Praxis Precision Medicines—which connects what you believe about its future to concrete financial forecasts and a fair value estimate. Rather than just relying on numbers or historical ratios, Narratives let you link your view of Praxis’s products, leadership, and opportunities to things like future revenue growth, profit margins, and what the stock should be worth.

Available to millions of investors on Simply Wall St’s Community page, Narratives are a simple, accessible tool for turning your ideas into actionable insights. They help you decide whether to buy or sell by comparing your calculated Fair Value (from your Narrative) to the current share price, and they automatically update as new information or news becomes available. For example, some investors’ Narratives for Praxis Precision Medicines might suggest a much higher fair value thanks to optimism about clinical breakthroughs, while others may see a more conservative outlook based on the company’s risk profile. By focusing on the story behind the stock, Narratives offer a dynamic, smarter way to invest that is truly your own.

Do you think there's more to the story for Praxis Precision Medicines? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRAX

Praxis Precision Medicines

A clinical-stage biopharmaceutical company, engages in the development of therapies for central nervous system (CNS) disorders characterized by neuronal excitation-inhibition imbalance.

Flawless balance sheet and fair value.

Market Insights

Community Narratives