- United States

- /

- Biotech

- /

- NasdaqGS:PRAX

Is It Too Late to Consider Praxis Precision Medicines After Its 509% Three Year Surge?

Reviewed by Bailey Pemberton

- Wondering if Praxis Precision Medicines is still a smart bet after its huge run, or if most of the upside is already priced in? This breakdown will help you decide whether the current share price offers real value or just excitement.

- The stock has been on a wild ride, rising 138.9% year to date and 172.0% over the last year. This comes even after a recent 3.3% slip over the past week and a strong 15.4% gain across the last 30 days, with a massive 508.9% climb over three years standing in contrast to a 72.2% drop over five years.

- Those swings have coincided with growing investor attention on Praxis Precision Medicines pipeline, particularly around its late stage neurology candidates that aim to treat central nervous system disorders and movement conditions more effectively than current options. As sentiment has shifted toward high conviction biotech names with differentiated science and clearer regulatory paths, Praxis has increasingly been treated as a higher potential growth story rather than just another speculative small cap pharma play.

- Right now, the company scores a 2 out of 6 on our undervaluation checks. This suggests some parts of the market may see it as fairly or even fully valued, at least on traditional metrics. In the sections ahead we will walk through those standard valuation approaches, then finish with a more powerful way to think about what Praxis Precision Medicines might really be worth over the long run.

Praxis Precision Medicines scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Praxis Precision Medicines Discounted Cash Flow (DCF) Analysis

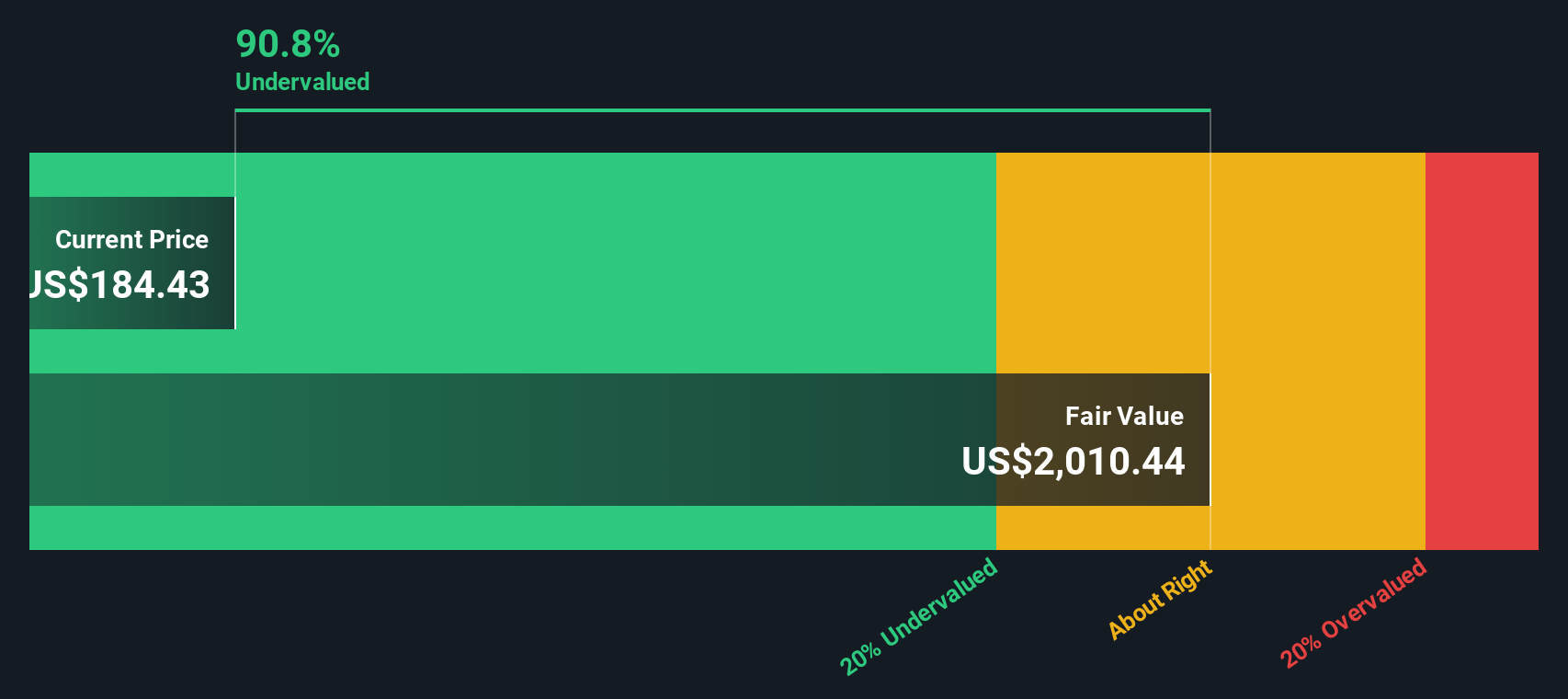

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it could generate in the future and discounting those dollars back to their present value. For Praxis Precision Medicines, the latest twelve month Free Cash Flow is a negative $228.9 Million, reflecting the heavy investment phase typical of clinical stage biotechs.

Analysts expect cash flows to remain negative in the near term, with projections of about negative $334.1 Million in 2026 and negative $42.1 Million in 2027. From there, Simply Wall St extrapolates a sharp improvement, with Free Cash Flow turning positive and rising to around $3.6 Billion by 2035 as key programs potentially reach the market. Aggregating and discounting these projected cash flows using a 2 Stage Free Cash Flow to Equity model yields an estimated intrinsic value of about $2.4 Billion.

Based on this analysis, the DCF indicates that Praxis Precision Medicines is trading at a 92.1% discount to its implied value. This suggests that the market is heavily discounting its long term pipeline potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Praxis Precision Medicines is undervalued by 92.1%. Track this in your watchlist or portfolio, or discover 912 more undervalued stocks based on cash flows.

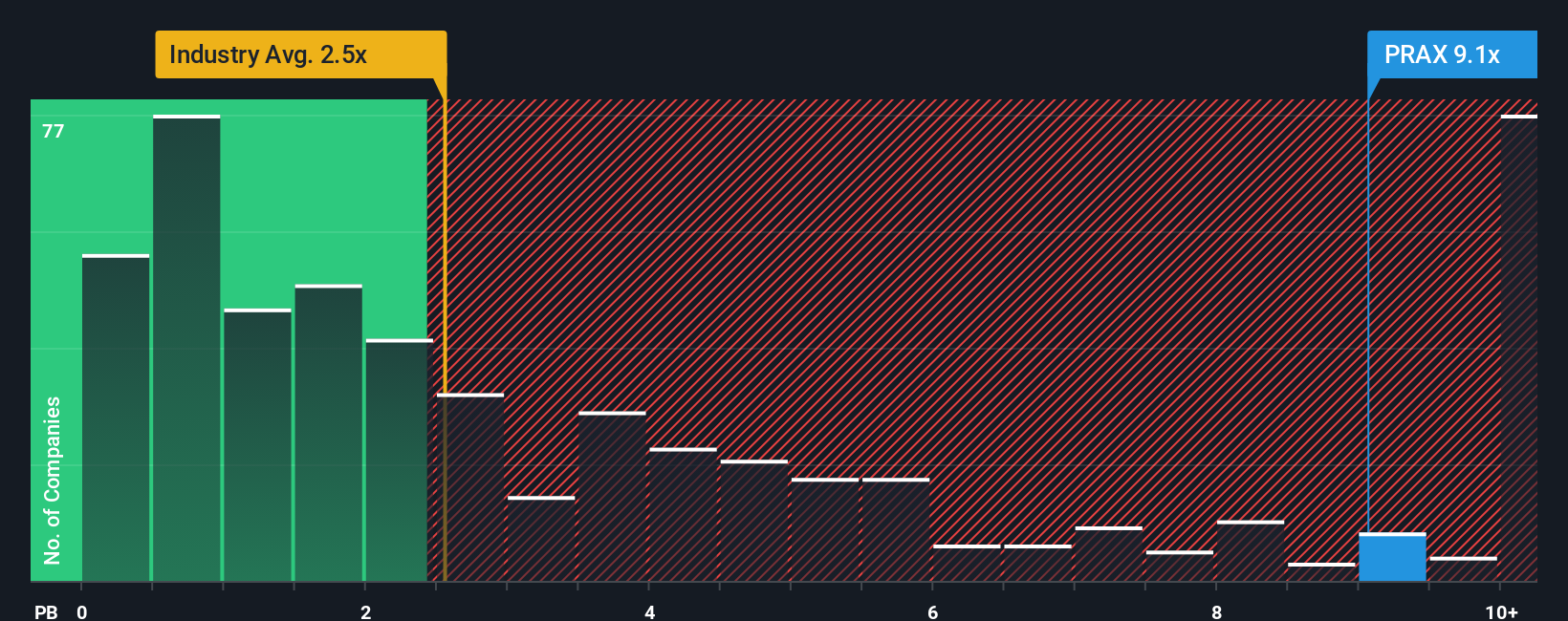

Approach 2: Praxis Precision Medicines Price vs Book

For companies that are not yet profitable, traditional metrics like Price to Earnings are less meaningful. Investors often turn to balance sheet based measures like Price to Book as a proxy for how the market values the assets underpinning future growth. In general, faster growth and lower perceived risk can justify a higher multiple, while slower growth and higher risk usually call for a discount.

Praxis Precision Medicines currently trades at about 13.83x its book value, which is well above the Biotechs industry average of roughly 2.72x and slightly above the peer group average of around 12.77x. To go a step further, Simply Wall St uses a proprietary “Fair Ratio” framework, which estimates what a reasonable Price to Book multiple should be after factoring in the company’s expected growth, profitability profile, risk, industry, and size. This tailored benchmark is more informative than a simple comparison with sector or peer averages because it aligns the multiple with the company’s specific fundamentals rather than broad buckets.

On this basis, Praxis Precision Medicines appears OVERVALUED relative to where its Fair Ratio would likely sit.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

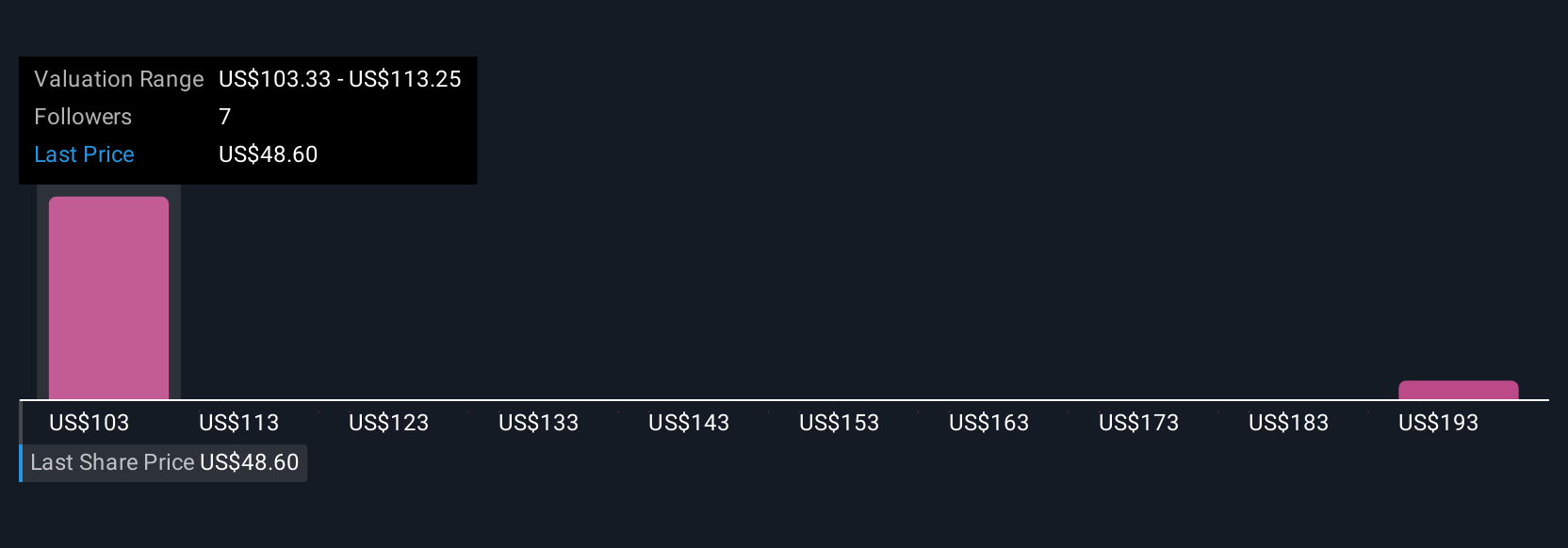

Upgrade Your Decision Making: Choose your Praxis Precision Medicines Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a business with the numbers behind it. A Narrative is your story about a company, expressed through your assumptions about its future revenue, earnings and margins, which then flow into a financial forecast and ultimately a fair value estimate. On Simply Wall St, Narratives sit at the heart of the Community page, where millions of investors use them as an easy, accessible tool to test their thinking without needing to build complex spreadsheets. Narratives can help you compare your fair value estimate to the current share price, so you can see at a glance whether your story points to potential upside or downside. They also update dynamically as new information such as trial results, earnings or regulatory news arrives, keeping your view current. For Praxis Precision Medicines, some investors may build a Narrative that assumes blockbuster level adoption and a very high fair value, while others might use more conservative launch timelines and lower margins, resulting in a more cautious estimate.

Do you think there's more to the story for Praxis Precision Medicines? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRAX

Praxis Precision Medicines

A clinical-stage biopharmaceutical company, engages in the development of therapies for central nervous system (CNS) disorders characterized by neuronal excitation-inhibition imbalance.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026