- United States

- /

- Biotech

- /

- NasdaqGS:PRAX

A Look at Praxis Precision Medicines (PRAX) Valuation Following Positive Phase 3 Results in Essential Tremor

Reviewed by Kshitija Bhandaru

Praxis Precision Medicines reported positive topline data from two pivotal Phase 3 studies of ulixacaltamide in essential tremor. Both trials met their goals, showing real improvement in tremor control and daily activities for participants.

See our latest analysis for Praxis Precision Medicines.

The positive trial news comes on the heels of a remarkable run for Praxis Precision Medicines, with its share price soaring 183.7% in just one day and delivering a staggering 287.4% return over the past month. Momentum has accelerated this year, and while the long-term picture remains volatile, the company’s 3-year total shareholder return of 549.5% underscores just how much optimism has taken hold following recent breakthroughs and regulatory advances.

If you’re curious about what else is capturing investor attention in the health sciences space, take a look at the full list of opportunities in our healthcare stocks screener: See the full list for free.

With shares now trading at less than half of analysts' average price target and recent gains fueled by clinical milestones, investors are left wondering if there is still upside here or if the market has already priced in future growth.

Price-to-Book of 8.5x: Is it justified?

Praxis Precision Medicines trades at a Price-to-Book Ratio of 8.5x, placing it below the peer average but notably higher than the broader US Biotech industry. Based on this metric, the market is currently valuing PRAX more generously than many direct competitors but less aggressively than some peers.

The price-to-book ratio is a key gauge of how much investors are paying for the company's net assets. In fast-evolving biotech, a higher ratio often reflects optimism around upcoming milestones, intellectual property, or growth prospects even when current profits are lacking.

Compared to the US Biotech industry average of just 2.6x, PRAX appears expensive by this measure. This sharp premium suggests investors are putting significant weight on its successful clinical results and projected revenue expansion, rather than current fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 8.5x (OVERVALUED)

However, regulatory hurdles or a slowdown in annual revenue growth could quickly temper current investor enthusiasm around Praxis Precision Medicines.

Find out about the key risks to this Praxis Precision Medicines narrative.

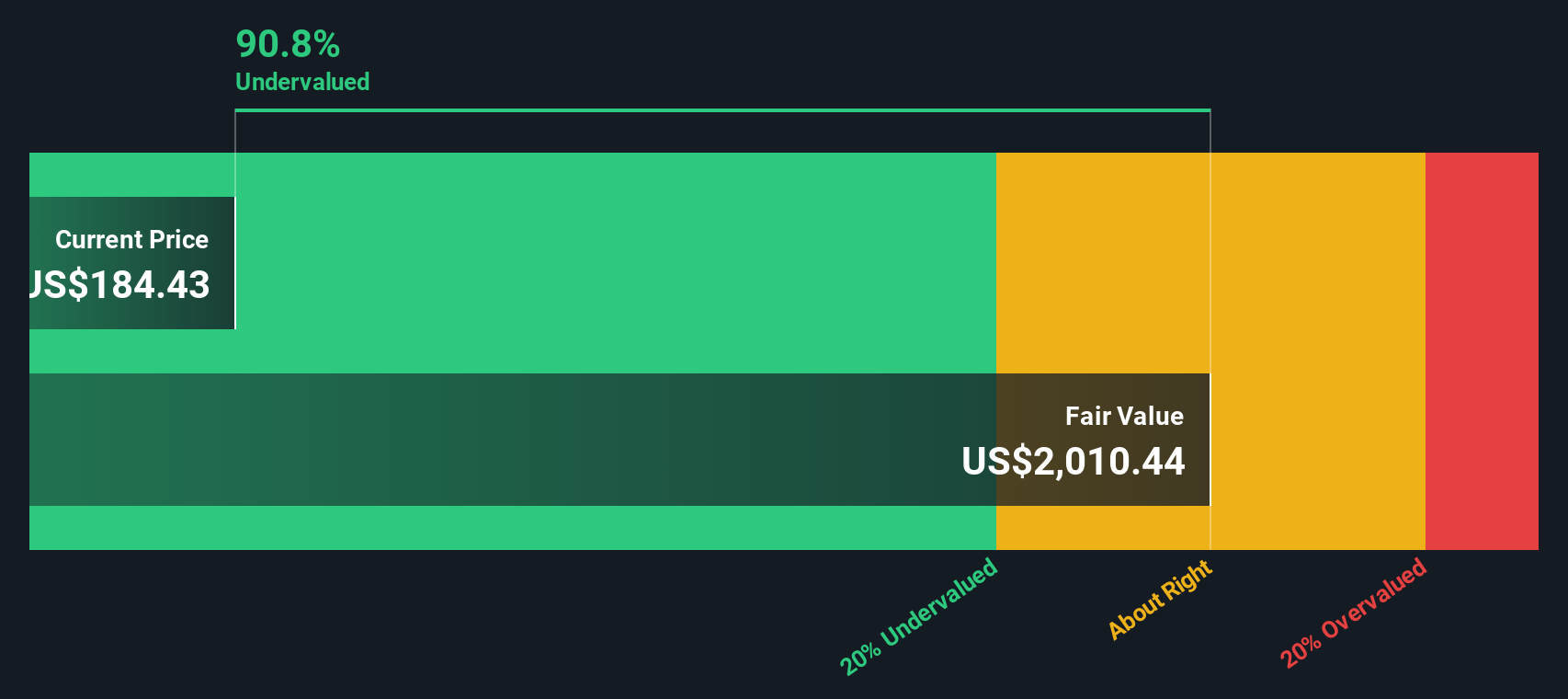

Another View: Discounted Cash Flow Signals Opportunity

Looking at things through our DCF model, Praxis Precision Medicines appears to be trading at a significant discount. The SWS DCF model estimates the fair value closer to $2,019.57, while shares are changing hands around $162.71. This could indicate that the market is overlooking longer-term potential, or perhaps there is something these numbers are missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Praxis Precision Medicines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Praxis Precision Medicines Narrative

If you want to dig into the details yourself or have a different perspective, you can easily shape your own narrative from the ground up in just a few minutes. Do it your way

A great starting point for your Praxis Precision Medicines research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye out for fresh opportunities. Don’t miss your chance to discover stocks beyond the obvious, using tools designed for finding real winners.

- Power up your search for future tech standouts with these 24 AI penny stocks, paving the way in artificial intelligence and automation breakthroughs.

- Uncover under-the-radar value by checking out these 875 undervalued stocks based on cash flows, which the market hasn’t fully appreciated yet.

- Catch the next wave of digital finance transformation with these 79 cryptocurrency and blockchain stocks, unlocking new frontiers in blockchain and cryptocurrency innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRAX

Praxis Precision Medicines

A clinical-stage biopharmaceutical company, engages in the development of therapies for central nervous system (CNS) disorders characterized by neuronal excitation-inhibition imbalance.

Flawless balance sheet and fair value.

Market Insights

Community Narratives