- United States

- /

- Biotech

- /

- NasdaqCM:PIRS

Pieris Pharmaceuticals, Inc. (NASDAQ:PIRS) Not Doing Enough For Some Investors As Its Shares Slump 27%

Unfortunately for some shareholders, the Pieris Pharmaceuticals, Inc. (NASDAQ:PIRS) share price has dived 27% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 83% loss during that time.

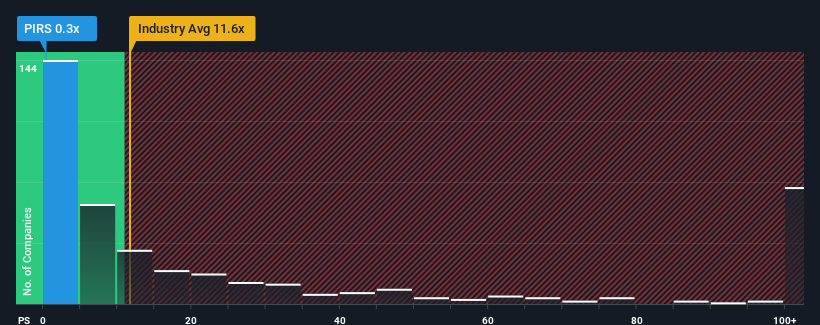

Following the heavy fall in price, Pieris Pharmaceuticals may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.6x and even P/S higher than 49x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Pieris Pharmaceuticals

How Pieris Pharmaceuticals Has Been Performing

With revenue growth that's superior to most other companies of late, Pieris Pharmaceuticals has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Pieris Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.How Is Pieris Pharmaceuticals' Revenue Growth Trending?

In order to justify its P/S ratio, Pieris Pharmaceuticals would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 66%. Revenue has also lifted 5.9% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue growth is heading into negative territory, declining 100% each year over the next three years. With the industry predicted to deliver 221% growth each year, that's a disappointing outcome.

With this information, we are not surprised that Pieris Pharmaceuticals is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Having almost fallen off a cliff, Pieris Pharmaceuticals' share price has pulled its P/S way down as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that Pieris Pharmaceuticals maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Pieris Pharmaceuticals' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Pieris Pharmaceuticals (1 can't be ignored!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PIRS

Pieris Pharmaceuticals

A biotechnology company, discovers and develops biotechnological applications.

Adequate balance sheet slight.

Market Insights

Community Narratives