- United States

- /

- Pharma

- /

- NasdaqGS:PHVS

Why Pharvaris (PHVS) Is Down 11.3% After Equity Offering Raises $175M and What's Next

Reviewed by Simply Wall St

- Pharvaris recently completed a follow-on equity offering, raising approximately US$175 million through the sale of 8,250,000 ordinary shares and 500,000 pre-funded warrants, with Oppenheimer & Co. Inc. joining as co-lead underwriter.

- This significant injection of capital could enhance the company’s ability to fund research, development, and potential future commercialization efforts.

- We’ll explore how this expanded financial flexibility from the equity raise may shift Pharvaris’s overall investment narrative.

What Is Pharvaris' Investment Narrative?

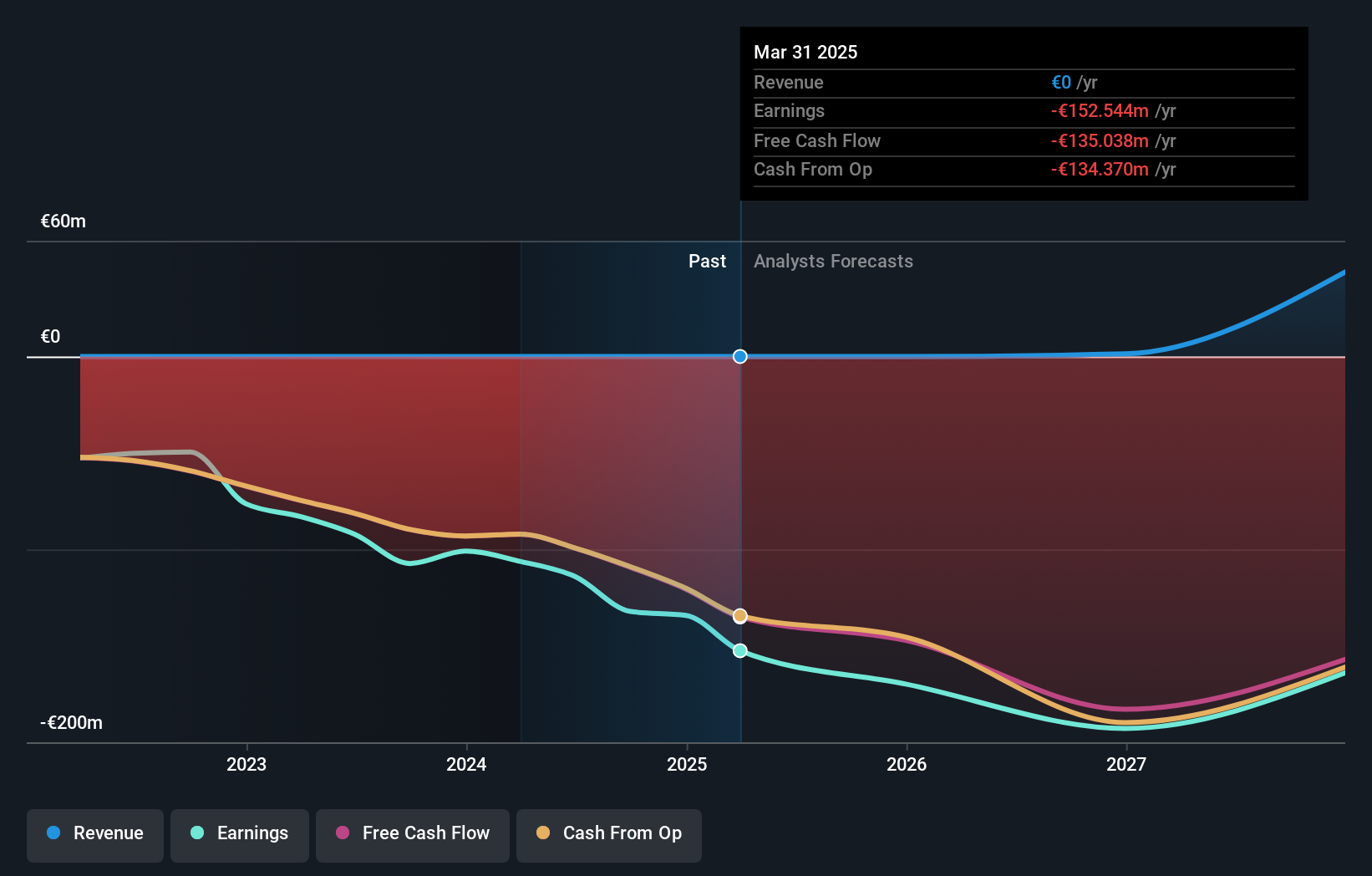

Investing in Pharvaris starts with believing in the promise of its lead oral therapy, deucrictibant, which targets Hereditary Angioedema (HAE) and the ability of the company to push through late-stage clinical milestones and regulatory submissions. The recent US$175 million equity raise is a meaningful event for shareholders, as it extends the company’s cash runway and cuts immediate liquidity concerns, supporting ongoing clinical trials and potential progress toward commercialisation. For near-term catalysts, eyes are on key Phase 3 readouts and the timeline for a new drug application, both crucial for future revenue prospects. However, the dual impact of consistent losses and past shareholder dilution remains a stark risk, while high forecast revenue growth has yet to be realised given zero current sales. While the share price briefly moved higher after the raise, it suggests the event was anticipated and its impact on short-term stock drivers may be balanced rather than transformative. On the other hand, the history of shareholder dilution is still important for investors to keep in mind.

Pharvaris' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Pharvaris - why the stock might be worth just $33.63!

Build Your Own Pharvaris Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pharvaris research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Pharvaris research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pharvaris' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PHVS

Pharvaris

A late-stage biopharmaceutical company, focuses on the development and commercialization of therapies for rare diseases with unmet needs covering angioedema and other bradykinin-mediated diseases.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives