- United States

- /

- Pharma

- /

- NasdaqGS:PHAT

Why We're Not Concerned Yet About Phathom Pharmaceuticals, Inc.'s (NASDAQ:PHAT) 27% Share Price Plunge

Unfortunately for some shareholders, the Phathom Pharmaceuticals, Inc. (NASDAQ:PHAT) share price has dived 27% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 57% share price decline.

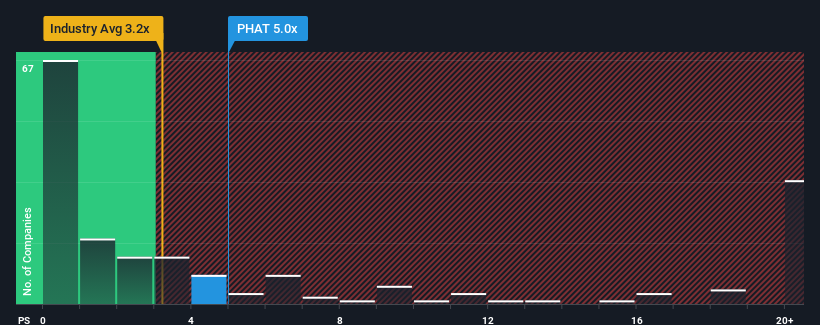

Even after such a large drop in price, Phathom Pharmaceuticals' price-to-sales (or "P/S") ratio of 5x might still make it look like a sell right now compared to the wider Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios below 3.2x and even P/S below 1x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Phathom Pharmaceuticals

How Has Phathom Pharmaceuticals Performed Recently?

With revenue growth that's superior to most other companies of late, Phathom Pharmaceuticals has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Phathom Pharmaceuticals will help you uncover what's on the horizon.How Is Phathom Pharmaceuticals' Revenue Growth Trending?

Phathom Pharmaceuticals' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Although, its longer-term performance hasn't been anywhere near as strong with three-year revenue growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 120% per year as estimated by the eight analysts watching the company. That's shaping up to be materially higher than the 20% per year growth forecast for the broader industry.

In light of this, it's understandable that Phathom Pharmaceuticals' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Phathom Pharmaceuticals' P/S?

There's still some elevation in Phathom Pharmaceuticals' P/S, even if the same can't be said for its share price recently. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Phathom Pharmaceuticals maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Pharmaceuticals industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Phathom Pharmaceuticals (at least 1 which is concerning), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PHAT

Phathom Pharmaceuticals

A biopharmaceutical company, focuses on developing and commercializing treatments for gastrointestinal diseases.

Undervalued with high growth potential.

Market Insights

Community Narratives