- United States

- /

- Biotech

- /

- NasdaqGS:PGEN

Precigen (NASDAQ:PGEN shareholders incur further losses as stock declines 13% this week, taking five-year losses to 89%

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. Spare a thought for those who held Precigen, Inc. (NASDAQ:PGEN) for five whole years - as the share price tanked 89%. And it's not just long term holders hurting, because the stock is down 32% in the last year. Shareholders have had an even rougher run lately, with the share price down 31% in the last 90 days. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Precigen

Precigen wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Precigen reduced its trailing twelve month revenue by 22% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 14% per year in the same time period. We don't think this is a particularly promising picture. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

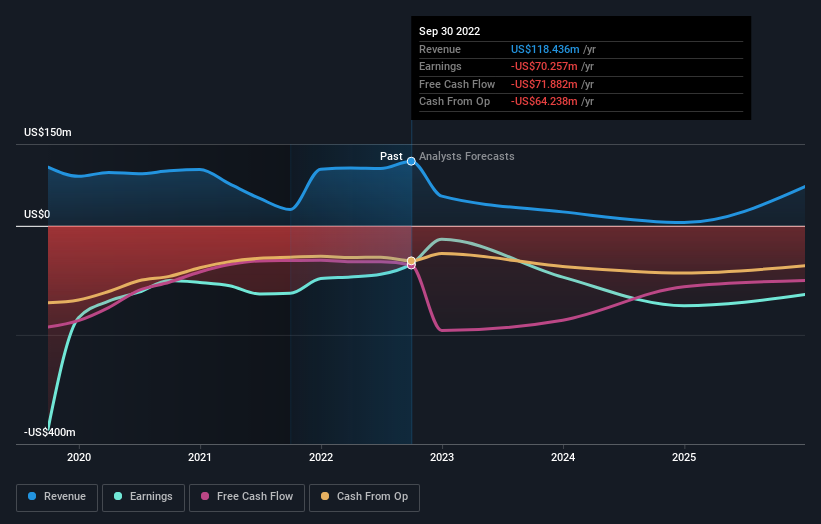

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. If you are thinking of buying or selling Precigen stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We regret to report that Precigen shareholders are down 32% for the year. Unfortunately, that's worse than the broader market decline of 6.6%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. However, the loss over the last year isn't as bad as the 14% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Precigen (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PGEN

Precigen

A discovery and clinical-stage biopharmaceutical company, develops gene and cell therapies using precision technology to target diseases in areas of immuno-oncology, autoimmune disorders, and infectious diseases.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives