- United States

- /

- Pharma

- /

- NasdaqGS:PCRX

How Investors Are Reacting To Pacira BioSciences (PCRX) Spine Pain Trial Win And New FDA Clearance

Reviewed by Sasha Jovanovic

- In early December 2025, Pacira BioSciences reported 12‑month results from a 30‑patient randomized pilot study showing its iovera° cryoneurolysis treatment produced lower pain scores, better function, and fewer follow‑on spine injections than radiofrequency ablation for chronic low back pain, with no treatment‑related adverse events, alongside FDA clearance of a deeper‑reaching lumbar SmartTip device.

- This combination of positive clinical data and new device clearance adds weight to Pacira’s efforts to expand iovera° across spine‑related pain pathways, potentially broadening its footprint beyond perioperative pain into chronic spine care.

- Next, we’ll examine how iovera°’s favorable comparison with radiofrequency ablation could influence Pacira’s investment narrative around non‑opioid spine pain expansion.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Pacira BioSciences Investment Narrative Recap

To own Pacira, you need to believe it can turn its non opioid pain portfolio into durable, profitable growth while gradually reducing its dependence on EXPAREL. The new iovera° spine data and deeper lumbar SmartTip look helpful for the non opioid spine pain story, but they do not change the near term focus on EXPAREL’s exclusivity risk and the company’s ability to re accelerate top line growth after lowered 2025 guidance.

Among recent developments, the Paragraph IV notice from WhiteOak Group challenging EXPAREL patents is particularly relevant here, because it highlights how important pipeline assets like iovera° and PCRX 201 could become if generic pressure eventually materializes. Positive spine data for iovera° supports the longer term diversification effort, but the timing and outcome of EXPAREL intellectual property litigation remain key swing factors for Pacira’s earnings trajectory and valuation.

Yet investors should also be aware that Pacira’s heavy reliance on EXPAREL in the face of patent challenges could...

Read the full narrative on Pacira BioSciences (it's free!)

Pacira BioSciences' narrative projects $908.9 million revenue and $112.0 million earnings by 2028.

Uncover how Pacira BioSciences' forecasts yield a $29.00 fair value, a 21% upside to its current price.

Exploring Other Perspectives

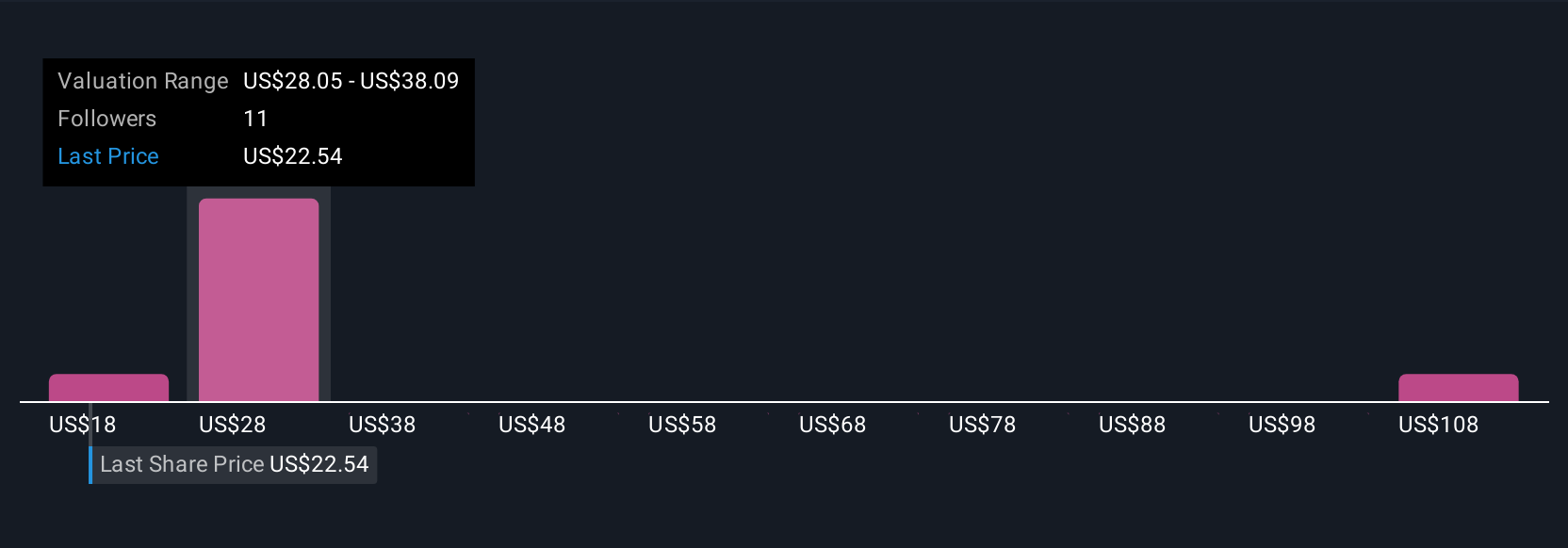

Four members of the Simply Wall St Community currently see Pacira’s fair value anywhere between US$18 and about US$104, reflecting very different expectations. Set those views against Pacira’s core risk that any adverse EXPAREL patent or pricing outcome could quickly affect the earnings base and consider how differently the next few years could play out.

Explore 4 other fair value estimates on Pacira BioSciences - why the stock might be worth 25% less than the current price!

Build Your Own Pacira BioSciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pacira BioSciences research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pacira BioSciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pacira BioSciences' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCRX

Pacira BioSciences

Engages in the development, manufacture, marketing, distribution, and sale of non-opioid pain management and regenerative health solutions to healthcare practitioners in the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026