- United States

- /

- Life Sciences

- /

- NasdaqGS:PACB

Even With A 37% Surge, Cautious Investors Are Not Rewarding Pacific Biosciences of California, Inc.'s (NASDAQ:PACB) Performance Completely

The Pacific Biosciences of California, Inc. (NASDAQ:PACB) share price has done very well over the last month, posting an excellent gain of 37%. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 77% share price drop in the last twelve months.

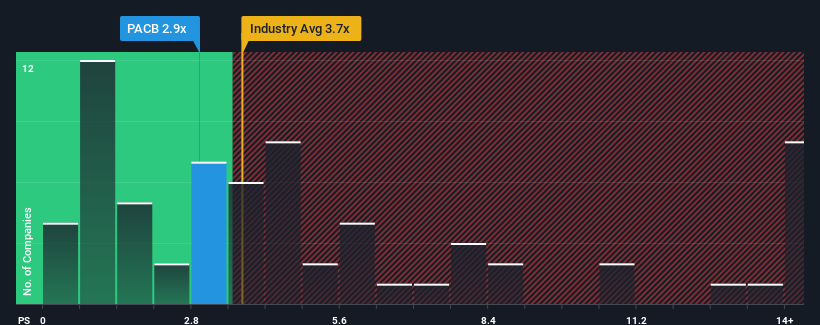

In spite of the firm bounce in price, Pacific Biosciences of California may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.9x, since almost half of all companies in the Life Sciences industry in the United States have P/S ratios greater than 3.7x and even P/S higher than 6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Pacific Biosciences of California

How Has Pacific Biosciences of California Performed Recently?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Pacific Biosciences of California has been doing quite well of late. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. Those who are bullish on Pacific Biosciences of California will be hoping that this isn't the case and the company continues to beat out the industry.

Want the full picture on analyst estimates for the company? Then our free report on Pacific Biosciences of California will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Pacific Biosciences of California's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 29%. The latest three year period has also seen an excellent 78% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 19% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 7.3% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Pacific Biosciences of California's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Pacific Biosciences of California's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Pacific Biosciences of California currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Plus, you should also learn about these 4 warning signs we've spotted with Pacific Biosciences of California (including 1 which is concerning).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PACB

Pacific Biosciences of California

Designs, develops, and manufactures sequencing solution to resolve genetically complex problems.

Undervalued low.

Similar Companies

Market Insights

Community Narratives