- United States

- /

- Biotech

- /

- NasdaqCM:ORTX

Reflecting on Orchard Therapeutics' (NASDAQ:ORTX) Share Price Returns Over The Last Year

The nature of investing is that you win some, and you lose some. Anyone who held Orchard Therapeutics plc (NASDAQ:ORTX) over the last year knows what a loser feels like. To wit the share price is down 62% in that time. We wouldn't rush to judgement on Orchard Therapeutics because we don't have a long term history to look at. Shareholders have had an even rougher run lately, with the share price down 17% in the last 90 days.

See our latest analysis for Orchard Therapeutics

Orchard Therapeutics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Orchard Therapeutics increased its revenue by 22%. We think that is pretty nice growth. Unfortunately it seems investors wanted more, because the share price is down 62% in that time. It is of course possible that the business will still deliver strong growth, it will just take longer than expected to do it. For us it's important to consider when you think a company will become profitable, if you're basing your valuation on revenue.

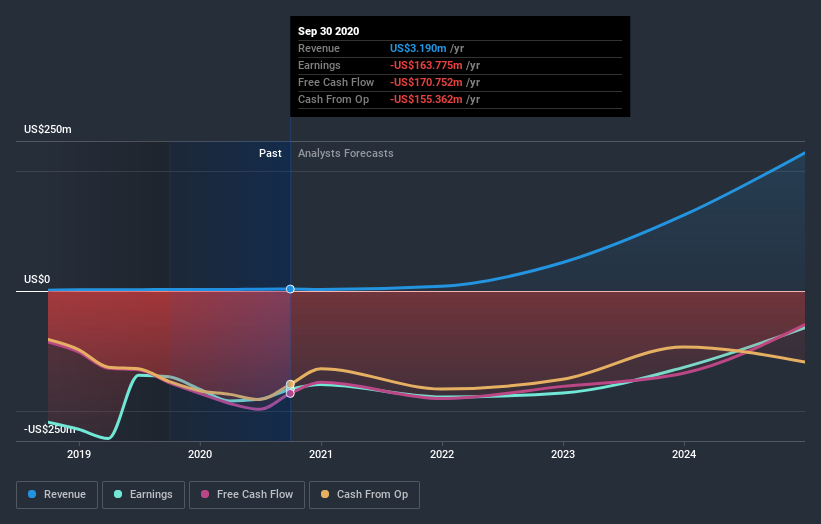

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on Orchard Therapeutics

A Different Perspective

While Orchard Therapeutics shareholders are down 62% for the year, the market itself is up 24%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 17%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Orchard Therapeutics you should know about.

But note: Orchard Therapeutics may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Orchard Therapeutics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqCM:ORTX

Orchard Therapeutics

Orchard Therapeutics plc, a gene therapy company, research, develops, and commercialize hematopoietic stem cell and gene therapies in the United Kingdom, Italy, France, and Germany.

Adequate balance sheet with limited growth.

Market Insights

Community Narratives