- United States

- /

- Biotech

- /

- NasdaqGM:ORKA

How Investors Are Reacting To Oruka Therapeutics (ORKA) Once-Yearly Psoriasis Treatment Breakthrough

Reviewed by Sasha Jovanovic

- Oruka Therapeutics recently announced that its investigational drug ORKA-001 showed a half-life of approximately 100 days in phase 1 trials, indicating the potential for once-yearly dosing in psoriasis treatment and complete, sustained inhibition of STAT3 signaling with favorable safety outcomes.

- This milestone, which is being further evaluated in the ongoing phase 2 EVERLAST-A trial for maintaining remission with minimal dosing, could mark a significant shift in the standard of care for psoriasis.

- We’ll explore how ORKA-001’s potential for annual dosing could reshape Oruka Therapeutics’ investment narrative and market position.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Oruka Therapeutics' Investment Narrative?

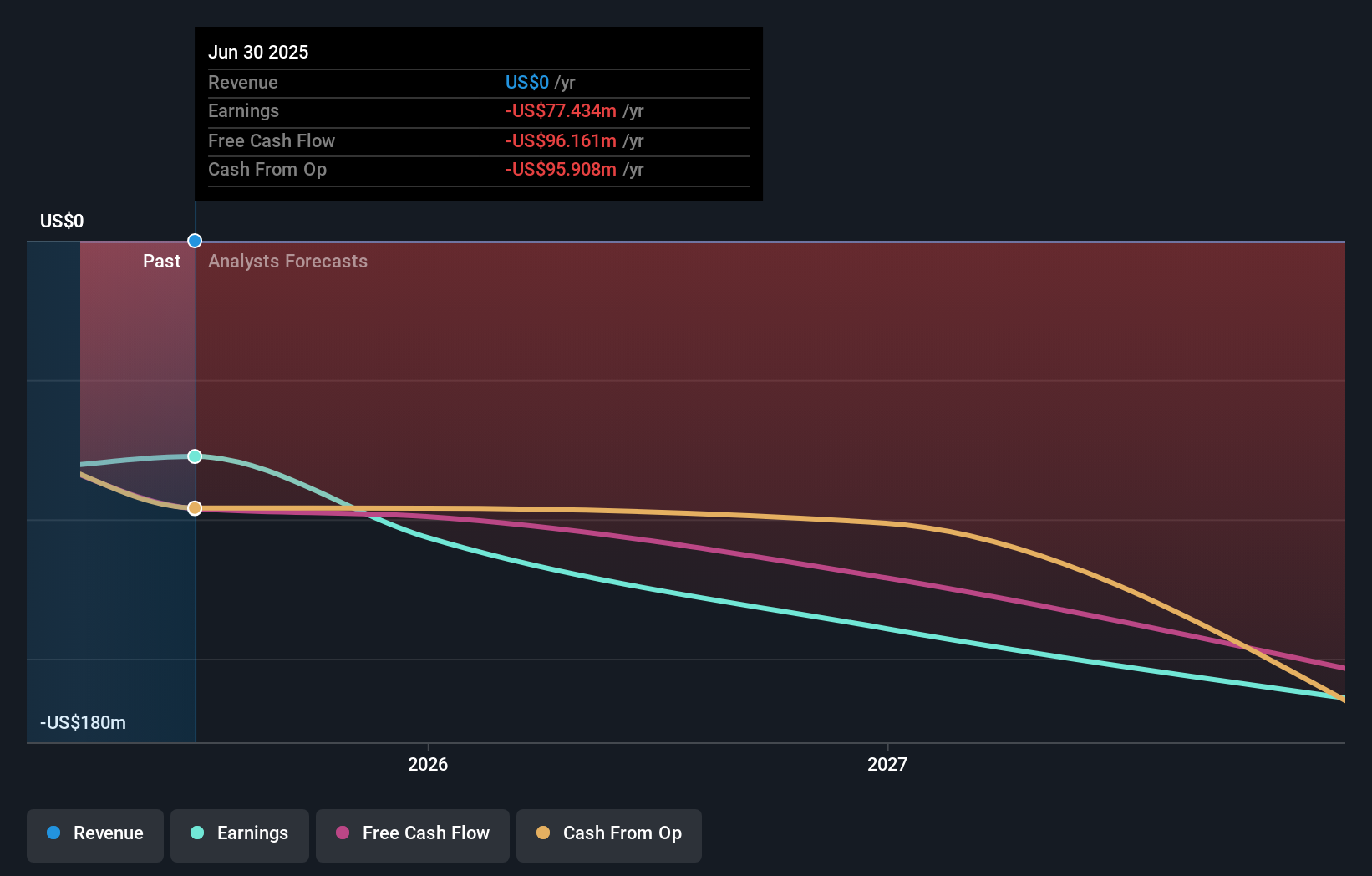

For an investor to have conviction in Oruka Therapeutics today, the big picture centers on the potential for ORKA-001 to set a new standard in psoriasis care, shifting the competitive landscape if annual dosing becomes feasible. The recent announcement of ORKA-001’s long half-life and strong early safety profile in phase 1 adds momentum to near-term catalysts, particularly the ongoing EVERLAST-A phase 2 trial that may provide key proof-of-concept results. This data readout could now be a more crucial inflection point than previously assumed, potentially impacting market expectations and Oruka’s ability to secure further financing or partnership if positive. On the risk side, unprofitability, limited operating history, substantial shareholder dilution, and lack of revenue remain front and center, but the latest news helps counterbalance pipeline uncertainty in the short term, even as medium-term commercialization hurdles persist.

But risks related to shareholder dilution and future capital needs are still important for investors to understand. According our valuation report, there's an indication that Oruka Therapeutics' share price might be on the expensive side.Exploring Other Perspectives

Explore 2 other fair value estimates on Oruka Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Oruka Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oruka Therapeutics research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Oruka Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oruka Therapeutics' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ORKA

Oruka Therapeutics

A clinical-stage biopharmaceutical company, focuses on developing novel monoclonal antibody therapeutics for psoriasis (PsO), and other inflammatory and immunology (I&I) indications.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.