- United States

- /

- Biotech

- /

- NYSEAM:PLX

3 Compelling Penny Stocks With Market Caps Under $600M

Reviewed by Simply Wall St

As the United States stock market reaches record highs, driven by a tame inflation report and expectations of an interest rate cut, investors are exploring diverse opportunities across various sectors. Penny stocks, often associated with smaller or newer companies, continue to capture attention for their potential to offer growth at lower price points. Despite being considered a somewhat outdated term, penny stocks remain relevant as they can still present valuable investment opportunities when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.89 | $405.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.78 | $643.76M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.50 | $260.1M | ✅ 4 ⚠️ 2 View Analysis > |

| WM Technology (MAPS) | $1.18 | $203.51M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.335 | $1.41B | ✅ 3 ⚠️ 1 View Analysis > |

| Global Self Storage (SELF) | $5.00 | $56.69M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $2.03 | $25.24M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.95 | $6.9M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.45 | $76.58M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 355 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Organogenesis Holdings (ORGO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Organogenesis Holdings Inc. is a regenerative medicine company that develops, manufactures, and commercializes products for advanced wound care and surgical and sports medicine markets in the United States, with a market cap of $540.41 million.

Operations: The company generates its revenue primarily from the regenerative medicine segment, totaling $429.53 million.

Market Cap: $540.41M

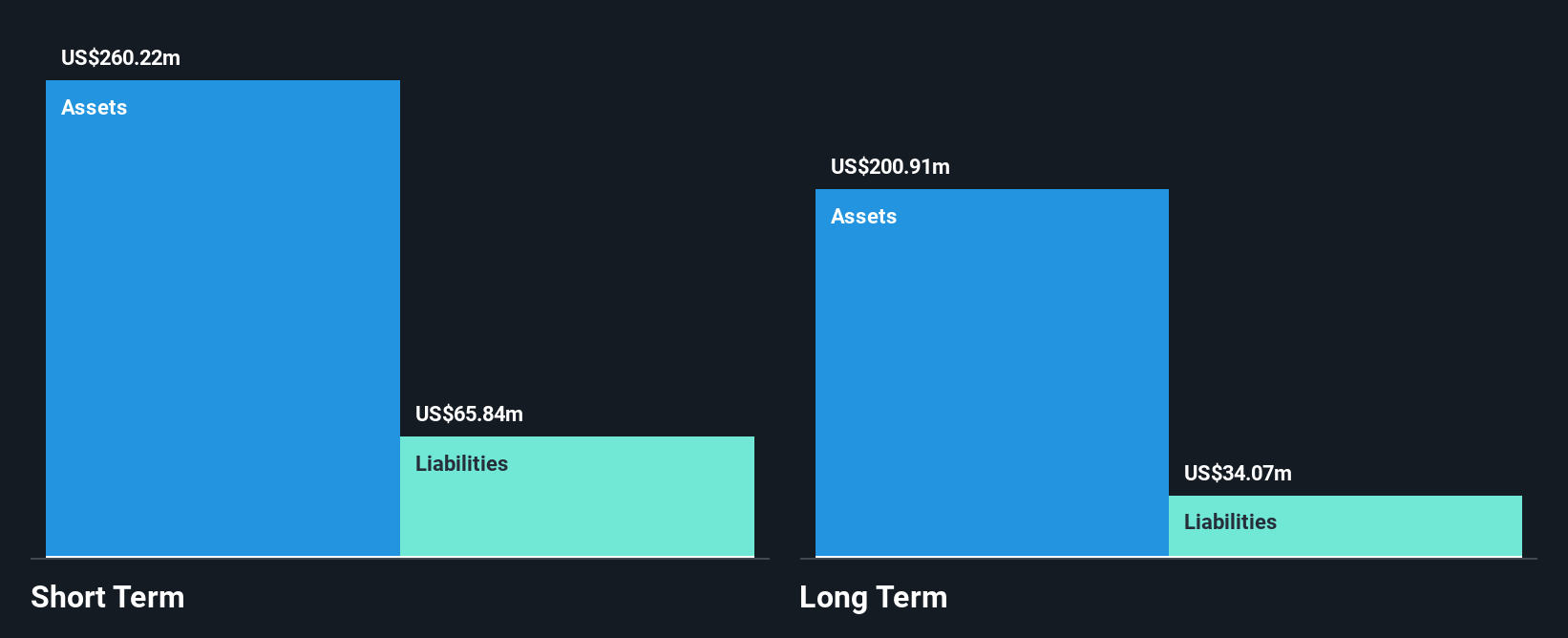

Organogenesis Holdings Inc., with a market cap of US$540.41 million, is navigating challenges typical for companies in the regenerative medicine sector. Despite recent setbacks in Phase 3 trials for ReNu, the product maintains a favorable safety profile and holds Regenerative Medicine Advanced Therapy designation from the FDA. Financially, Organogenesis remains unprofitable but has improved its net loss compared to previous years and forecasts revenue growth up to US$510 million by year-end 2025. The company benefits from strong short-term asset coverage over liabilities and operates debt-free, though it faces cash runway constraints if free cash flow grows at historical rates.

- Take a closer look at Organogenesis Holdings' potential here in our financial health report.

- Examine Organogenesis Holdings' earnings growth report to understand how analysts expect it to perform.

Prelude Therapeutics (PRLD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Prelude Therapeutics Incorporated is a clinical-stage precision oncology company dedicated to discovering and developing novel cancer medicines for underserved patients, with a market cap of $123.33 million.

Operations: Prelude Therapeutics Incorporated does not currently report any revenue segments.

Market Cap: $123.33M

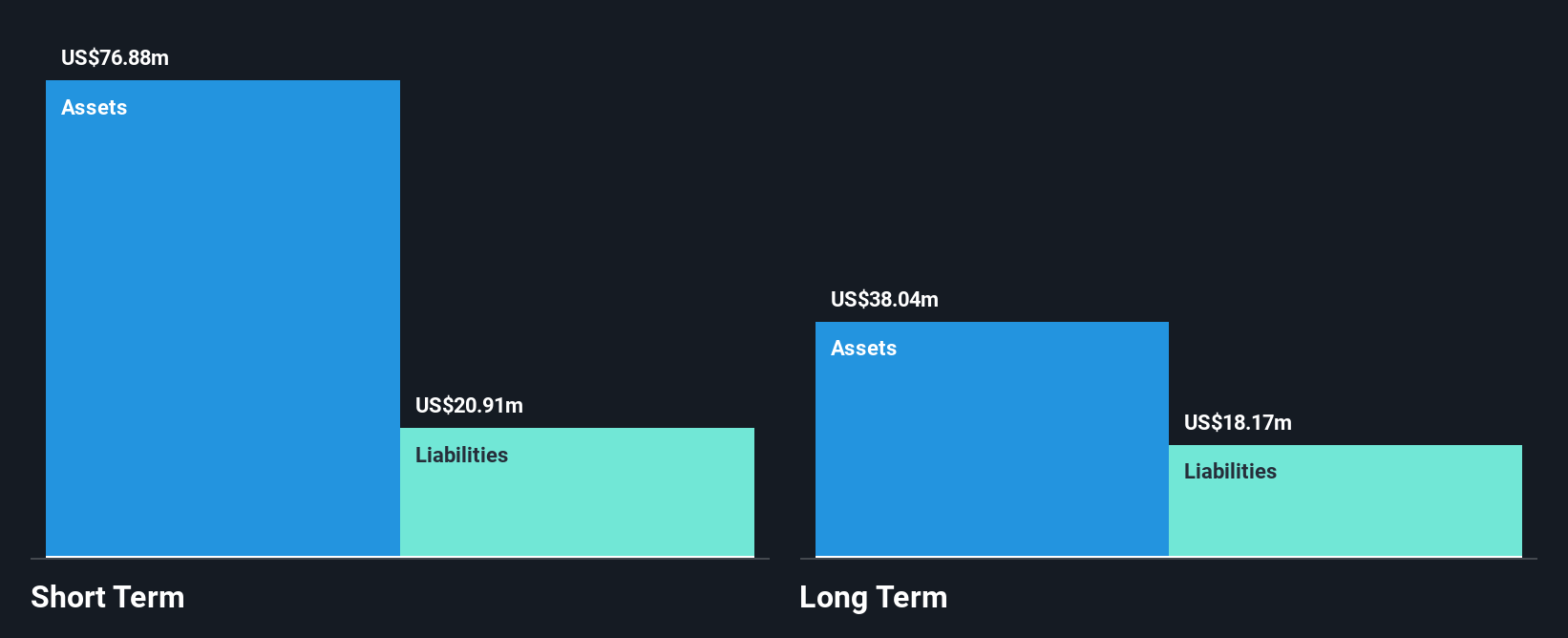

Prelude Therapeutics, a clinical-stage oncology company with a market cap of US$123.33 million, operates pre-revenue and remains unprofitable. Despite this, it is debt-free and has sufficient short-term assets to cover its liabilities. However, Prelude's cash runway is limited to less than a year if current cash flow trends persist. Recent leadership changes include the appointment of Katina Dorton to the board, bringing extensive industry expertise which may bolster strategic direction. The company's share price has been highly volatile recently, reflecting broader challenges in achieving profitability amid declining earnings forecasts for the next three years.

- Click to explore a detailed breakdown of our findings in Prelude Therapeutics' financial health report.

- Assess Prelude Therapeutics' future earnings estimates with our detailed growth reports.

Protalix BioTherapeutics (PLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Protalix BioTherapeutics, Inc. is a biopharmaceutical company focused on developing, producing, and commercializing recombinant therapeutic proteins using its ProCellEx plant cell-based protein expression system, with a market cap of $188.17 million.

Operations: Protalix BioTherapeutics generates revenue primarily from its biotechnology startup segment, which reported $61.95 million.

Market Cap: $188.17M

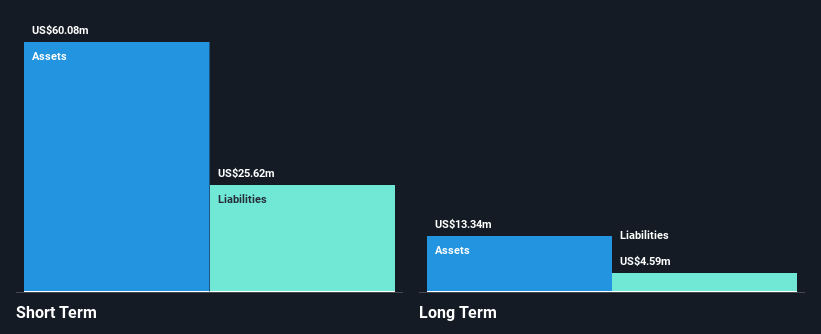

Protalix BioTherapeutics, with a market cap of US$188.17 million, has transitioned to profitability, reporting a net income of US$0.164 million in Q2 2025 compared to a loss the previous year. Revenue for the quarter increased to US$15.66 million from US$13.47 million year-over-year, highlighting growth potential within its biotechnology segment. The company is debt-free with sufficient short-term assets covering liabilities and boasts an experienced management team averaging 3.2 years of tenure. Despite high share price volatility and low return on equity (12.6%), recent index inclusion may enhance investor visibility and confidence in its strategic direction.

- Navigate through the intricacies of Protalix BioTherapeutics with our comprehensive balance sheet health report here.

- Evaluate Protalix BioTherapeutics' prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Take a closer look at our US Penny Stocks list of 355 companies by clicking here.

- Ready For A Different Approach? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:PLX

Protalix BioTherapeutics

A biopharmaceutical company, engages in the development, production, and commercialization of recombinant therapeutic proteins based on the ProCellEx plant cell-based protein expression system.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives